MSTR Shares Falter With Bitcoin Downtrend

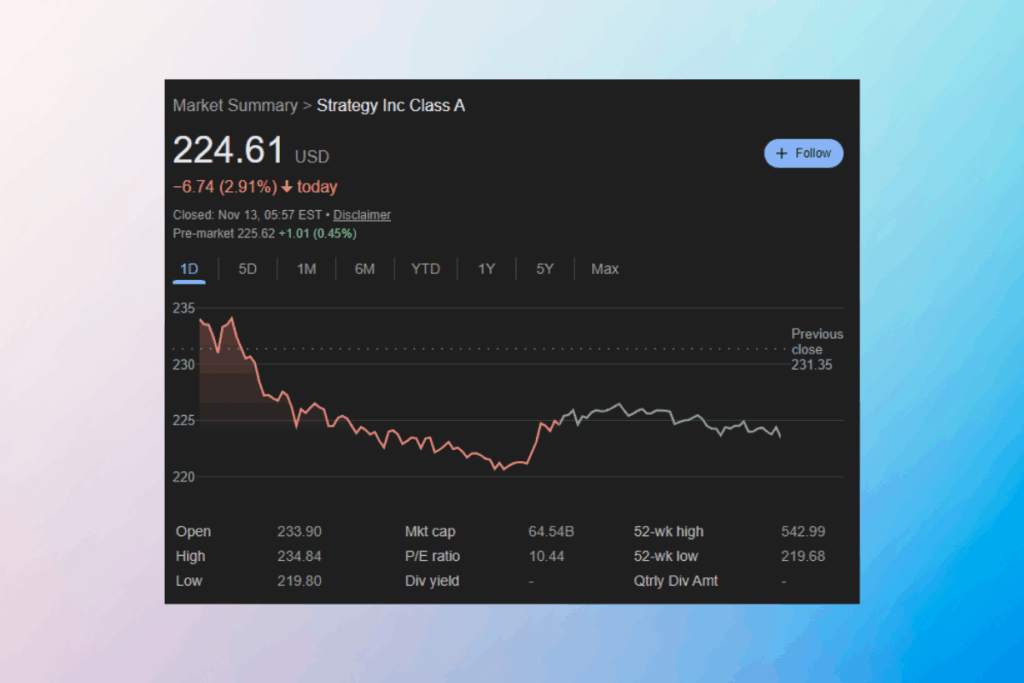

Shares of Strategy (MSTR) have fallen over 60% from their peak. The current price per share is close to $224.61. The company’s strong link with the top cryptocurrency is highlighted by the steep decrease, which closely resembles Bitcoin’s recent sell-off of more than 10%. MSTR has 641,692 Bitcoin, worth about $65 billion. Therefore, investors are keeping a careful eye on the company’s hedging tactics and net asset value.

Analysts Warn: MSTR Stock Mirrors Bitcoin Volatility

The company’s stock performance and changes in the price of Bitcoin are still closely related. Analysts note that any significant decline in Bitcoin often results in increased volatility in MSTR’s stock. This is due to the fact that the company is valued by the market as both a technology company and a vehicle for holding cryptocurrency. The market NAV (mNAV) of the Strategy is currently getting close to 1.0. In order to repurchase shares and stabilize the stock value, the corporation may be forced to liquidate Bitcoin at this crucial point.

MSTR Stock Faces Pressure Amid Potential Bitcoin Sale

According to financial analyst Andreas Steno Larsen, Strategy would have to liquidate some of its Bitcoin assets if mNAV falls below 1. The company’s stock and the larger cryptocurrency market might both be impacted by such a move. Therefore, investors are keeping an eye on important Bitcoin technical levels and corporate governance developments to assess possible liquidity measures. For MSTR stakeholders, maintaining shareholder wealth and preserving Bitcoin as a long-term asset is still a crucial balance.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.