Featured News Headlines

Crypto Market Crash: $1 Trillion Wiped Out as Bitcoin and Ethereum Hit Multi-Month Lows

Crypto Crash 2025 – The cryptocurrency market has erased over $1 trillion in value since October 6, wiping out all the gains accumulated throughout 2025 and sparking fears of a new prolonged crypto bear market.

Crypto Market Erases 2025 Gains

After reaching a record valuation of over $4 trillion in October, the digital asset market has entered a steep downturn. Major cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH), have plunged to multi-month lows, signaling a sharp deterioration in investor sentiment.

“Bitcoin’s first red October in seven years has certainly caught attention, but I see it more as a healthy reset than a structural reversal,” said Rachel Lin, CEO of SynFutures, in an interview with BeInCrypto. “After a strong run through most of 2025, markets needed to digest gains—and we’re now seeing that play out.”

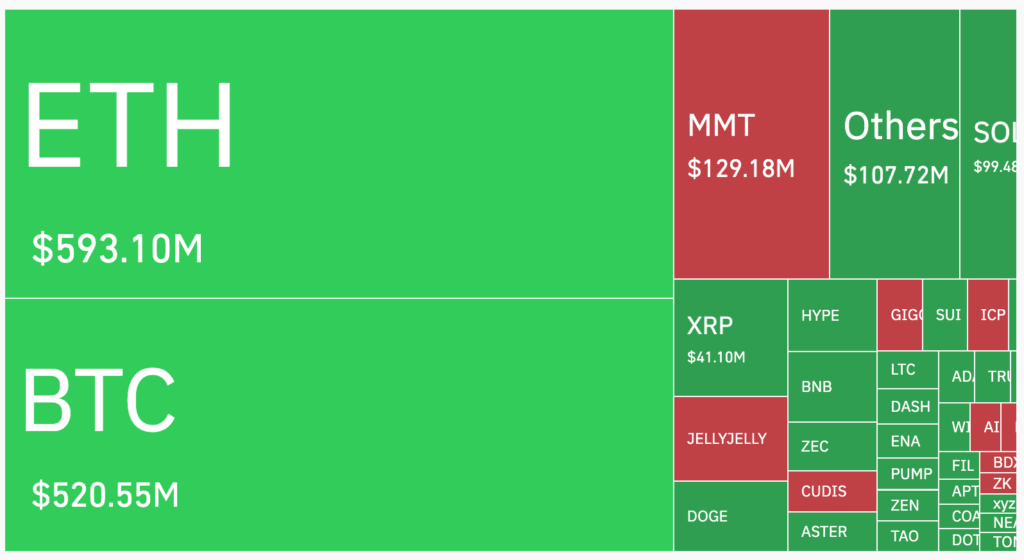

According to The Kobeissi Letter, crypto markets have now officially erased over $1 trillion in market cap since early October. The report attributes the magnitude of the decline to record leverage levels amplifying the downside as uncertainty and weak momentum weigh on traders.

Recent data from Coinglass further illustrates the turmoil: in just 24 hours, $1.8 billion in liquidations occurred, affecting over 441,000 traders. The largest single liquidation, worth $26 million, took place on Hyperliquid.

Experts Split: Correction or Full Bear Market?

Market watchers remain divided on whether the recent selloff marks the beginning of a full-fledged bear market. Some analysts warn that Bitcoin may have already entered bearish territory, while others see the downturn as a natural correction.

Economist Peter Schiff predicted “staggering” losses for crypto investors, warning that the collapse could rival or even surpass the dot-com bubble of the early 2000s. Meanwhile, on-chain analyst CredibleCrypto cautioned that new holders lacking prior bear market experience could accelerate volatility, calling this “potentially the most devastating downturn in Bitcoin history.”

Can the Market Bounce Back?

Not all analysts share the doom and gloom. Michaël van de Poppe and Ran Neuner argue that the current pullback mirrors 2024’s sharp but short-lived crash—after which Bitcoin surged over 60%, Ethereum rose 75%, and altcoins delivered 5x–10x returns within weeks.

With the U.S. Federal Reserve expected to cut interest rates and end quantitative tightening in December, macro conditions could soon turn favorable again.

As November 2025 unfolds, the crypto market stands at a crossroads—between fear and resilience, capitulation and opportunity. Whether this moment defines the start of a new bear cycle or just a temporary correction may depend on the global economy, liquidity trends, and investor psychology in the months ahead.

Comments are closed.