Featured News Headlines

Crypto ETFs Diverge: Bitcoin and Ether Face Major Outflows, Solana Gains Momentum

Spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs) continued to bleed capital on Tuesday, marking their fifth consecutive day of outflows, while Solana (SOL) funds extended their winning streak to six days of inflows.

Bitcoin and Ether ETFs Face Major Withdrawals

According to Farside Investors data, spot Bitcoin ETFs recorded $578 million in net outflows on Tuesday — the largest single-day decline since mid-October. Leading the withdrawals were BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC, both facing substantial redemptions as institutional sentiment cooled.

Meanwhile, spot Ether ETFs faced similar selling pressure, with $219 million in net redemptions. Products from Fidelity (FETH) and BlackRock (ETHA) bore the brunt, extending a five-day streak that has wiped out nearly $1 billion from Ether-linked ETFs since late October.

Solana ETFs Attract Capital Amid Broader Selloff

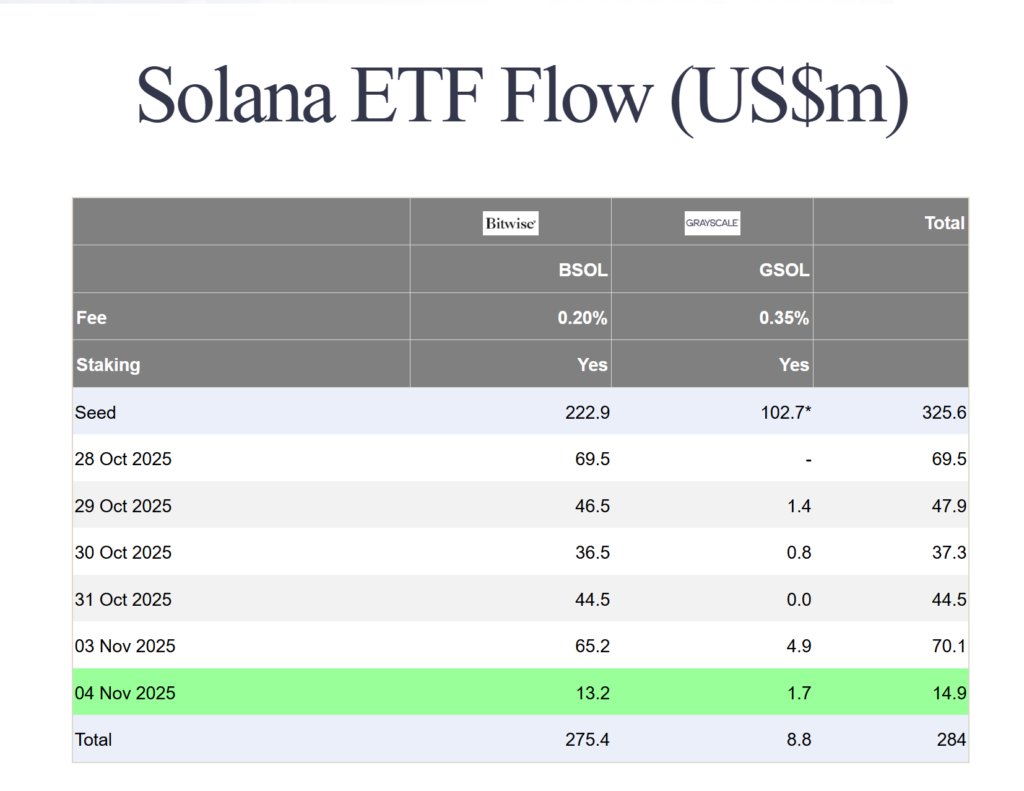

In sharp contrast, Solana ETFs have continued to attract inflows. The products saw $14.83 million in net inflows on Tuesday, marking six consecutive days of gains. Both Bitwise’s BSOL and Grayscale’s GSOL contributed to the upward trend, as institutional investors rotate capital into the newer, yield-bearing Solana product.

Institutions Trim Risk as Macro Jitters Intensify

Vincent Liu, Chief Investment Officer at Kronos Research, told Cointelegraph that the persistent outflows reflect a broader macro-driven risk reduction rather than fading faith in crypto itself.

“Straight days of redemptions show institutions are trimming risk as leverage unwinds and macro jitters rise,” Liu said. “Until liquidity conditions stabilize, capital rotation will keep the ETF bleed alive.”

Liu attributed the withdrawals to tightening liquidity and a strengthening U.S. dollar, emphasizing that the trend mirrors a risk-off environment, not a collapse in conviction toward digital assets.

Solana: ‘Fresh Flow Meets Fresh Story’

Liu also highlighted Solana’s resilience, describing its ETF momentum as “fresh flow meets fresh story.” He noted that Solana’s speed, staking rewards, and compelling narrative are drawing institutional curiosity despite broader market caution.

“It’s a narrative-driven move by early adopters chasing yield and growth,” Liu explained. “The broader market is still in risk-off mode, but Solana’s story is keeping momentum tilted upward.”

As Bitcoin and Ether ETFs face sustained redemptions amid macro uncertainty, Solana’s steady inflows underscore a shifting dynamic in the institutional crypto landscape — one where yield appeal and fresh narratives are increasingly capturing investor attention.

Comments are closed.