Zcash Hits Six-Month High, But a Pullback Looms

With gains of more than 10.42% in the last day and over 189.09% in the last month, Zcash (ZEC) is still outperforming a lackluster cryptocurrency market. The price of ZEC has continued to rise after verifying a flag breakout on October 24, despite pressure on the majority of altcoins. It has since reached each goal one after the other, most recently surpassing $438. With an extended projection aimed higher, $594 is currently the next major objective. Nevertheless, there are indications that bulls would soon be put to the test for the first time after such a dramatic increase.

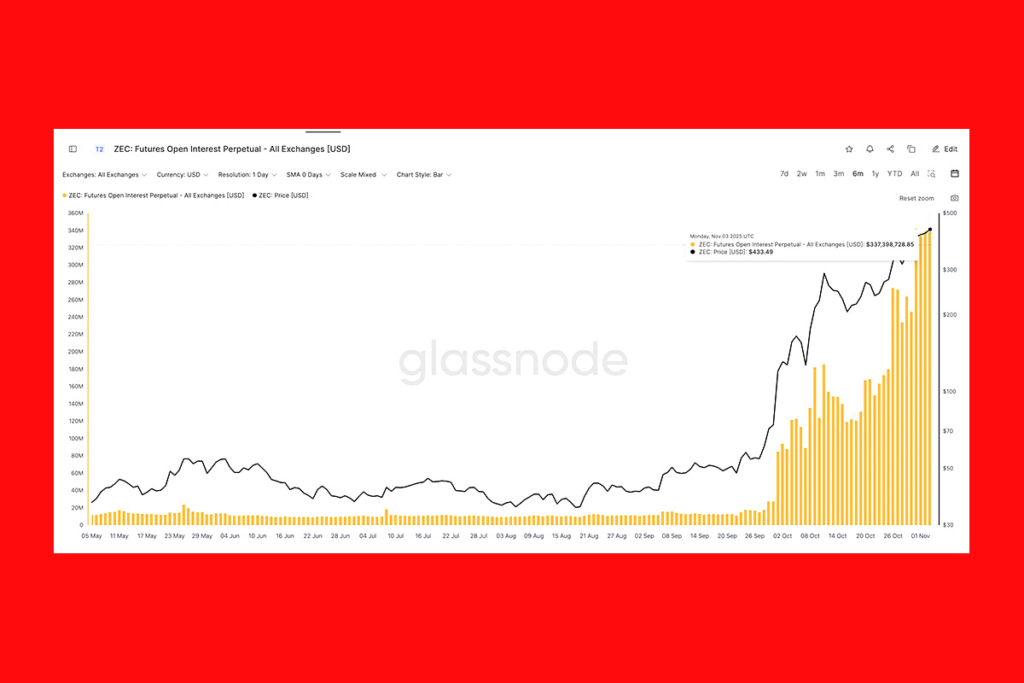

Zcash Rally Faces Pressure as Open Interest Reaches October Peak

The total number of outstanding derivative contracts, or open interest in Zcash futures, has risen to $337 million, the highest level in six months. This level is the same as the October peak. With traders mostly placing long bets, this demonstrates aggressive leverage rising across exchanges. Long liquidations currently total $30.27 million on Binance alone, over three times the amount of short liquidations ($12.43 million). This indicates that the market is significantly skewed toward long positions because the majority of short positions have already been cleaned away.

Such disparities may weaken the rally. A minor fall can lead to lengthy liquidations and a subsequent decline in the price of Zcash. There may be a brief correction if ZEC drops below $450. The seven-day period would see all of the lengthy liquidations if the price dropped below $342, which corresponds to a crucial Fibonacci level. Such a lengthy squeeze might ultimately harm the price of ZEC.

ZEC Price Rally Slows as RSI Signals Weakening Momentum

The price of ZEC has been rising since October 11, but the momentum-tracking Relative Strength Index (RSI) has been declining. Known as a bearish divergence, this frequently indicates that upward momentum is waning. This difference has been present for some time, despite the fact that prices have been rising. For this configuration to be cancelled, the RSI would have to increase over 86. At that level, though, the market is also overbought, and rallies tend to stall as traders take profits. Together with ZEC’s overheated derivative stance, this RSI situation indicates that bulls may ultimately capitulate, if only momentarily, in the event of the next decline. Following that, the market can get ready for the subsequent upward phase.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.