Featured News Headlines

US Fed Pumps Billions, But Bitcoin Remains Weak

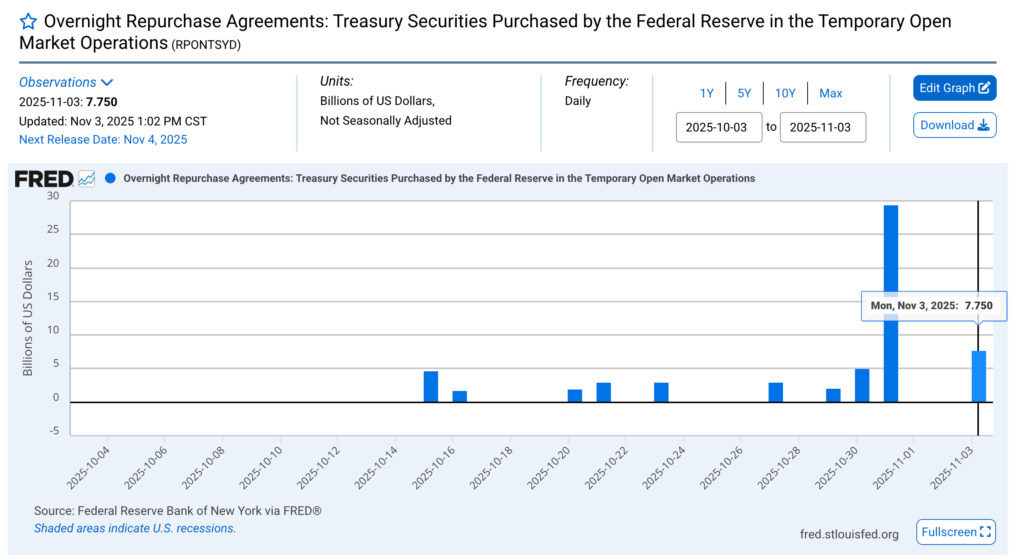

On November 3, the Federal Reserve carried out an additional $7.75 billion in repo operations, following a $29.4 billion injection into the banking system on the previous Friday. According to reports, this marked the largest single-day liquidity boost since the dot-com era, with total liquidity injections reaching approximately $37 billion.

Alex Mason commented, “This is the biggest money printing event of the last 5 years. The crypto market is about to go parabolic.”

Alongside Treasuries, the Fed added $14.25 billion in liquidity via repo operations backed by mortgage-backed securities on the same day. In theory, these moves should support asset prices by increasing cash circulation, allowing banks and institutions to deploy more capital into risk assets like stocks and cryptocurrencies.

Markets Show Unexpected Weakness

Despite the substantial liquidity injections, crypto markets have not responded positively. The Crypto Fear and Greed Index fell sharply to 21, signaling “Extreme Fear”, the lowest level since April 2025. Just a week earlier, the index was neutral at 50.

Bitcoin (BTC) has declined nearly 5% in November so far, while Ethereum (ETH) dropped by almost 9% over the same period, reflecting heightened market caution despite the Fed’s actions.

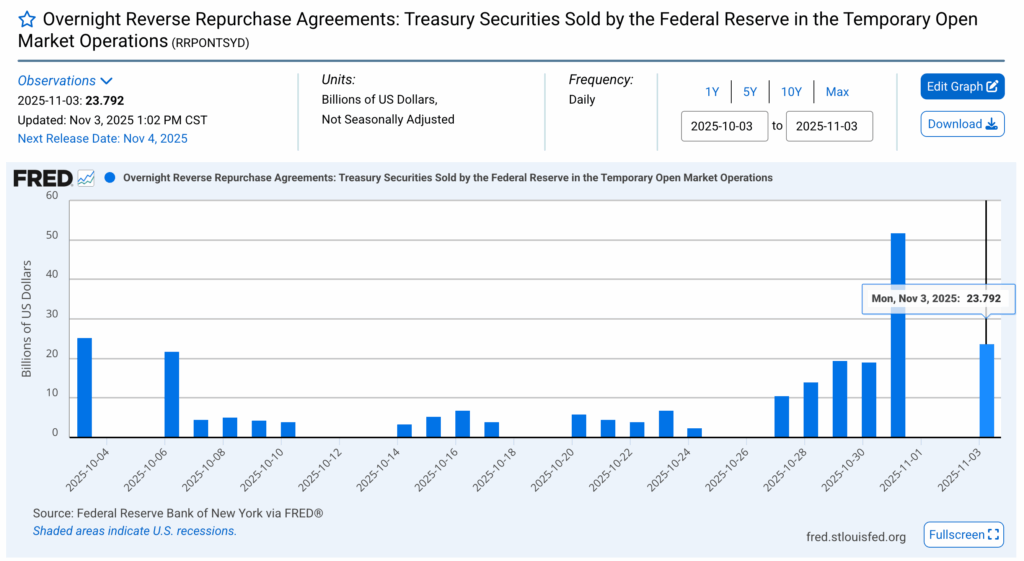

Reverse Repos Create Mixed Signals

The disconnect between liquidity injections and market behavior may be linked to the Fed’s reverse repo operations. Data shows that over $75 billion in reverse repos were conducted since last Friday, including nearly $24 billion on November 3 alone. Unlike regular repos, which add liquidity, reverse repos drain cash by borrowing money from banks and money-market funds in exchange for Treasuries as collateral.

This indicates that financial institutions are seeking safety, parking excess cash with the Fed instead of deploying it into the market. The combination of liquidity injections and simultaneous absorption highlights ongoing uncertainty in financial conditions.

Implications for Risk Assets

For risk assets such as cryptocurrencies, this push-and-pull dynamic explains persistent volatility. Fresh liquidity inflows are offset by tight short-term funding conditions, keeping investor sentiment cautious. The situation underscores how macroeconomic mechanisms, including repo and reverse repo operations, continue to influence market behavior in complex ways.

Comments are closed.