Featured News Headlines

Ethereum DAT Model Cracks While Bitcoin Holds Strong, Analysts Say

Ethereum’s [ETH] institutional momentum is waning, and growing fragility in its DAT model is positioning the altcoin as a potential tactical hedge for Bitcoin [BTC] investors, according to a recent 10x Strategy report.

Institutional ETH Narrative Shows Cracks

During the summer, Ethereum’s DAT model gained traction among institutional investors. BitMine Immersion [BMNR], holding over 3 million ETH in its treasury, became the flagship of this strategy—mirroring how “Strategy” once fueled Bitcoin accumulation. Yet, recent performance tells a different story: BMNR shares have fallen 10.17% this quarter, while traditional equities like Apple [AAPL] reach record highs around $277, signaling a rotation of risk capital toward the U.S. stock market.

The 10x Strategy report highlights that weaknesses in ETH’s DAT fundamentals—once a driver of institutional accumulation—are now dragging sentiment, with retail investors suffering significant losses.

BTC Resilience Outshines Altcoins

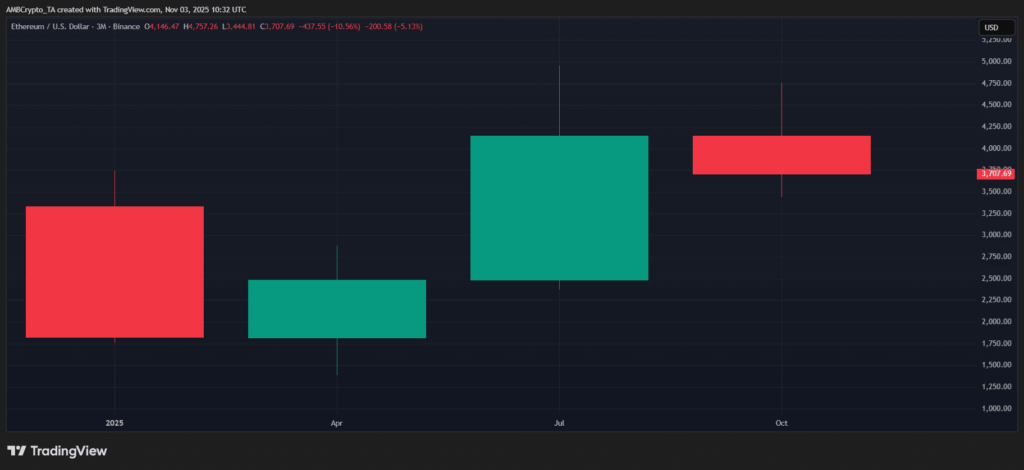

As the market enters a risk-off phase, Bitcoin’s structural resilience stands out. ETH has experienced deeper drawdowns than BTC, trading around 50% weaker despite ongoing institutional accumulation. Historically, altcoins were used to cushion market tops, but this cycle shows a divergence, with capital flowing toward Bitcoin and U.S. equities instead.

Shorting ETH as a Tactical BTC Hedge

With retail losing interest in Ethereum’s institutional narrative and altcoin flows drying up, the report suggests shorting ETH could serve as an effective hedge for BTC. The emerging ETH–BTC divergence may mark the second key divergence of this market cycle, following the earlier altcoin-Bitcoin run-up.

Investors monitoring structural Bitcoin strength vs. Ethereum risk may view this shift as a tactical opportunity, reflecting a broader cycle where BTC maintains dominance while ETH’s institutional momentum fades.

Comments are closed.