Featured News Headlines

ETH Market Balance: Staking and MVRV Insights

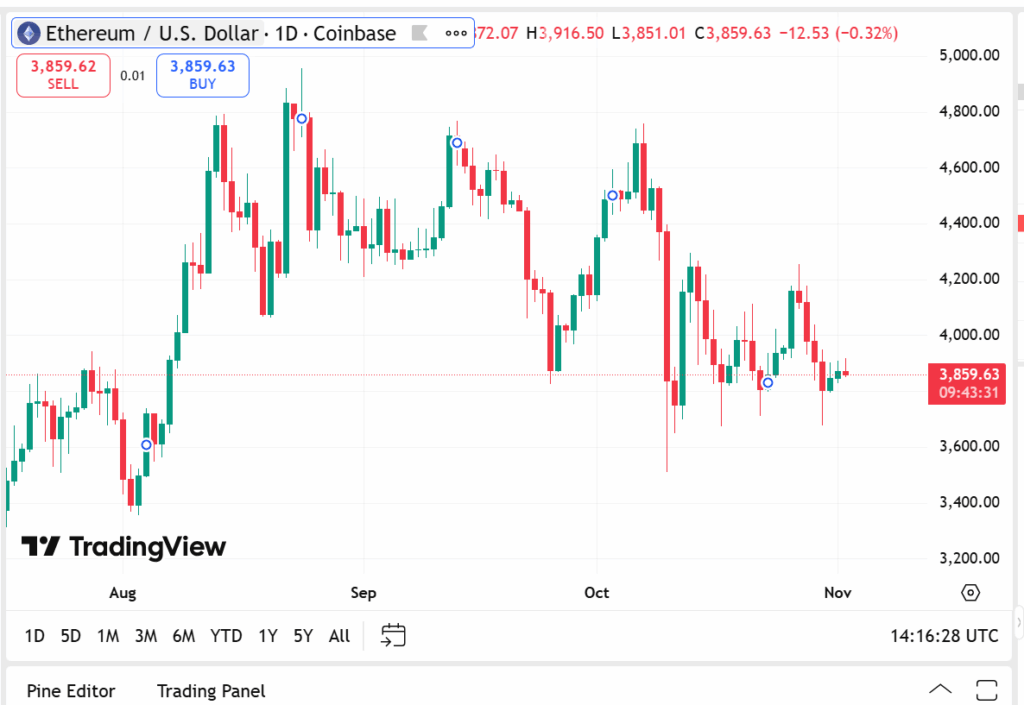

The Ethereum (ETH) ecosystem finds itself at a pivotal moment, with its Market Value to Realized Value (MVRV) ratio hovering around 1.50. This figure may appear modest, but it carries meaningful implications for the crypto space, particularly for Web3 startups and traders focused on strategic timing and liquidity decisions.

Understanding the MVRV Metric

The MVRV ratio compares an asset’s total market cap to its realized cap — the aggregate cost basis of all coins when last moved. A ratio of 1.0 implies that, on average, holders are breaking even. A figure above 1.0 indicates unrealized profit across the holder base, while below 1.0 signals unrealized losses. With ETH currently standing at roughly 1.50, the market appears balanced — not deeply profitable, yet not in loss territory either.

Price Landscape: Neither Euphoria nor Despair

ETH’s price zone—between approximately $2,560 and $5,760—suggests a market resisting extremes. On one side, inflated valuations generate caution; on the other, cheap desperation invites distrust. The MVRV of staked ETH, reportedly around 1.7, offers additional context:

“The notable uptick for staked ETH indicates that long‑term pessimism is giving way to conviction.”

This differential between circulating supply and staked supply could signal that a portion of investors are more committed now than in past cycles.

Timing and Treasury Considerations

For Web3 projects, corporate treasuries, and liquidity managers, the 1.50 MVRV marker may serve as a strategic reference rather than a rigid rule. Projects could use it to calibrate when to convert fiat, allocate capital, or reassess runway assumptions. If holders, on average, have roughly 50% unrealized profits, the incentive to re‑evaluate risk or adjust exposure increases. This perspective emphasizes timing and planning rather than predicting specific price moves.

Staking and Market Sentiment

The gap between circulating ETH MVRV and staked ETH’s MVRV is particularly revealing. With approximately 36.1 million ETH staked out of a circulating 121.12 million, a significant portion of supply is locked in long-term. This acts as a stabilizing buffer, reducing the likelihood of panic selling during volatile periods. The strong commitment of stakers highlights growing confidence in Ethereum’s underlying structure.

Institutional participation has also been notable, with inflows and spot-market activity suggesting deeper engagement by larger market players. This convergence of staking conviction and institutional interest enhances Ethereum’s structural stability and offers insight into broader market dynamics.

Historical Context and Future Scenarios

Historically, when MVRV hovers around 1.0–1.5, the market often undergoes structural shifts. For Ethereum, there are two potential trajectories:

- Renewed accumulation and reduced liquidity could push the MVRV higher, potentially entering zones associated with heightened market enthusiasm.

- Conversely, if inflows weaken or macroeconomic pressures increase, 1.50 may act as resistance, reflecting temporary stagnation rather than momentum.

For Web3 startups, this underscores the importance of strategic planning. Treasury management, token-release schedules, and liquidity timing can benefit from careful consideration of MVRV trends and on-chain metrics.

In Brief

With Ethereum’s MVRV ratio near 1.50 and staked supply showing strong commitment, the ecosystem appears neither overheated nor deeply distressed. The market may be quietly setting the stage for a meaningful structural move. Monitoring on-chain metrics can provide valuable insights for strategic planning, helping projects navigate complex market dynamics, optimize resource allocation, and prepare for potential shifts in market behavior. This moment highlights the intersection of investor confidence, staking behavior, and market structure — offering a nuanced perspective on Ethereum’s current and future trajectory.

Comments are closed.