Featured News Headlines

COIN and ETH Move in Sync: The Hidden Indicator for the Next Rally

Ethereum (ETH) is no longer just another blockchain project—it’s evolving into something much bigger. As one analyst put it, “ETH isn’t just a blockchain anymore, it’s basically a reserve currency.” Recent data shows Ethereum’s ecosystem now rivals the foreign exchange reserves of major global economies, positioning it as a potential cornerstone of digital finance.

Ethereum’s Expanding Reserve Power

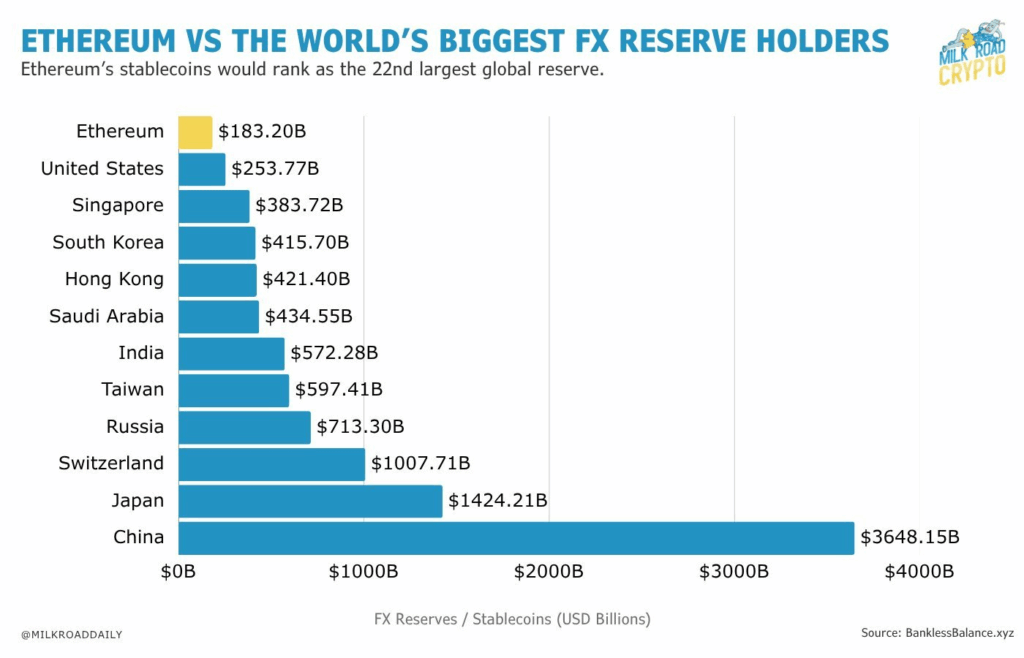

Ethereum’s stablecoin ecosystem has reached a staggering $183 billion, ranking it as the 22nd largest reserve globally. To put this in perspective, that’s larger than the foreign currency reserves of nations like Singapore, South Korea, Hong Kong, India, and Saudi Arabia.

Only major financial heavyweights such as China ($3.6T), Japan ($1.4T), and Switzerland ($1T) sit far ahead. This scale is transforming Ethereum’s role—from a “tech sector asset” to a global settlement layer with tangible monetary weight.

If ETH now functions as a de facto reserve denominator, any sustained price breakout could carry macro-level implications far beyond the crypto market.

The Whale Who Keeps Winning

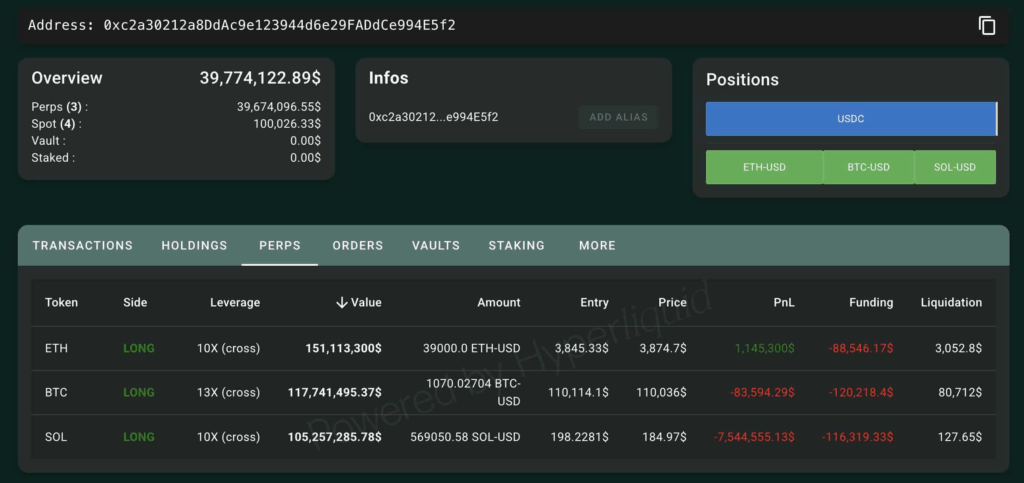

A major player, known as the wallet 0xc2a3, has been quietly accumulating massive positions. Despite cautious sentiment and negative funding rates, the trader recently opened a 39,000 ETH long position worth approximately $151 million at 10x leverage.

According to on-chain analyst Lookonchain, this trader has maintained a 100% win rate on major market swings. Alongside Ethereum, they’ve also built $118M in BTC longs and $105M in SOL longs.

However, their largest and most aggressive bet remains on ETH—a signal that could hint at growing institutional confidence in Ethereum’s next potential rally.

COIN as the Hidden Indicator

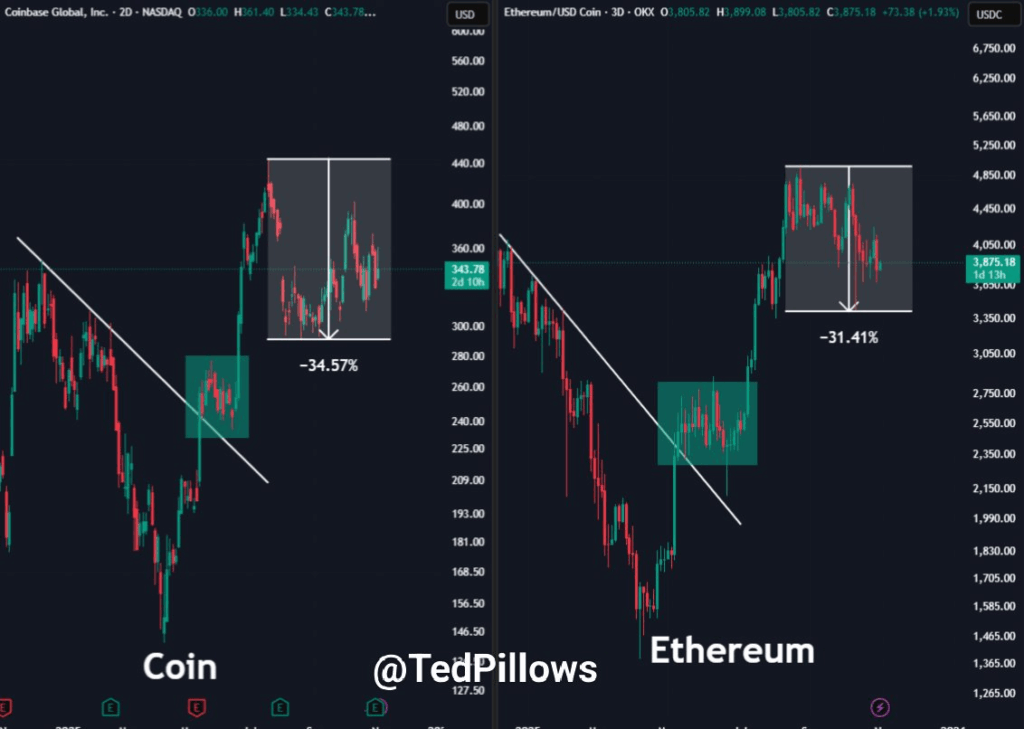

There’s another layer to this story that’s catching analysts’ attention. Market watcher TedPillows recently noted a striking correlation between Coinbase (COIN) and Ethereum price action.

“COIN led the last breakout, corrected 34%, and ETH followed with almost the same 31% structure,” he explained. Both assets are now trading within similar consolidation ranges. Historically, when COIN breaks to new highs, ETH tends to follow almost tick-for-tick.

While headlines focus on reserves, whale positioning, and market flows, this COIN-ETH pattern could be the most overlooked signal of all.

Comments are closed.