Featured News Headlines

Jito (JTO) Under Pressure: Buyers Dominate Futures Market

Jito’s native token (JTO) is facing intense downward pressure after falling 12% in the past 24 hours, nearing its all-time low. While this decline has dented investor confidence, several on-chain indicators suggest that large holders may still see value in the token’s current price levels.

Whales Buy the Dip as Prices Slide

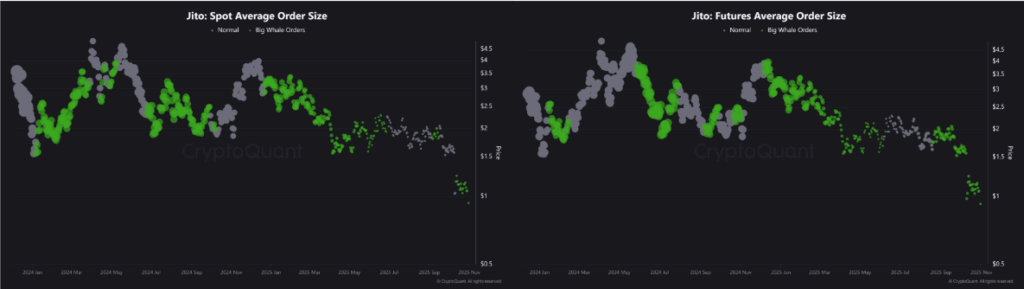

According to recent Average Order Size data, large investors — often referred to as whales — have been steadily accumulating JTO across both spot and futures markets.

This consistent accumulation hints that institutional or high-capital traders view the token’s lower prices as a long-term entry opportunity. Historically, similar phases of quiet whale activity have preceded short-term rebounds or at least helped stabilize falling markets.

In Jito’s case, this pattern could mark the early stages of a potential recovery phase if accumulation continues.

Futures Market Turns Bullish on JTO

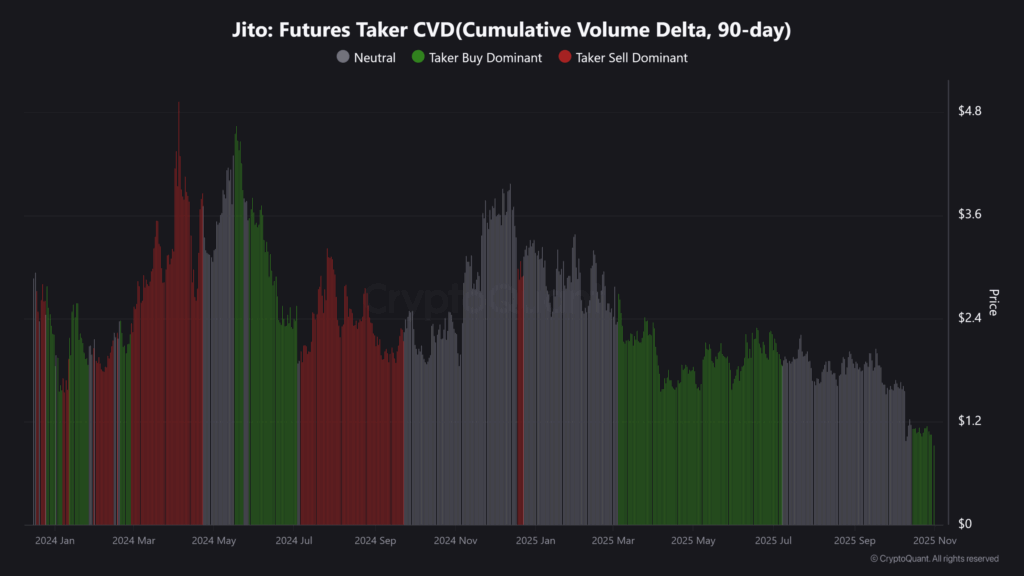

Complementing this on-chain activity, buyers currently dominate Jito’s Futures market, according to CryptoQuantdata.

The report shows a notable rise in long positions over the past few days, indicating that traders expect either a price recovery or a technical correction after the recent crash.

“When whale accumulation aligns with bullish futures sentiment, a price rebound often follows,” analysts noted. Interestingly, this shift in sentiment is emerging just as seller momentum appears to be fading.

Technical Indicators Hint at a Possible Reversal

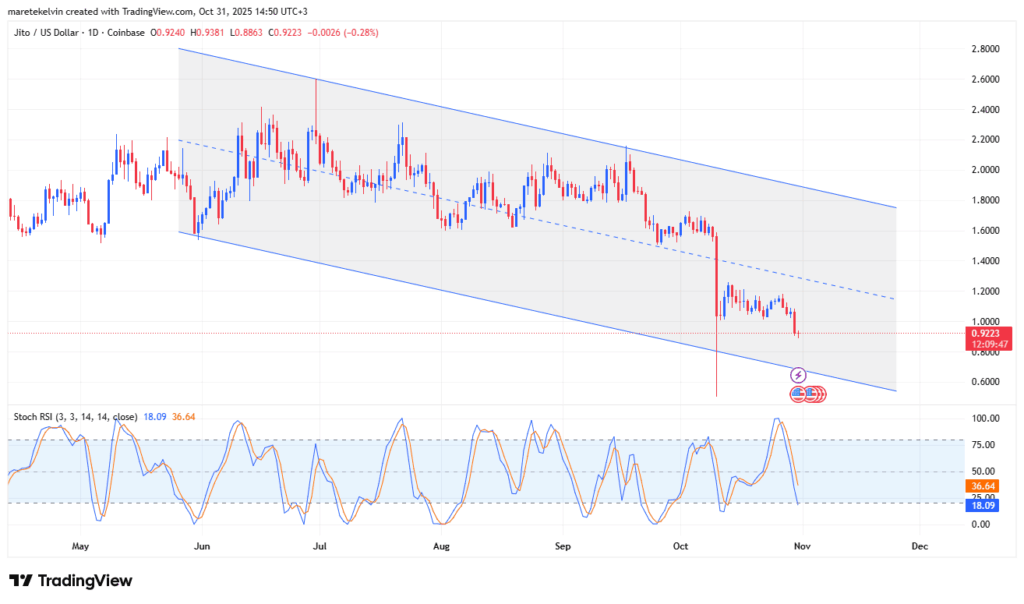

On the daily chart, JTO’s Stochastic RSI is approaching the oversold region, signaling that selling pressure may be nearing exhaustion.

Meanwhile, the token remains within a bullish flag pattern, a setup that often precedes upward breakouts — provided that buying volume increases.

However, analysts caution that the strength of any rebound will depend on how aggressively bullish investors respond, as JTO is currently trading in a consolidation phase with limited volatility.

Could Jito Avoid a Full Breakdown?

Despite its recent drop, on-chain metrics and technical data point to a possible turning point for JTO.

If whale accumulation continues and long positions remain dominant in the derivatives market, the token could potentially avoid a deeper collapse and stabilize in the short term.

For now, Jito’s next move will depend on whether these emerging bullish factors can outweigh the prevailing market uncertainty.

Comments are closed.