WUUSD Filing Signals Western Union’s Move into Digital Assets

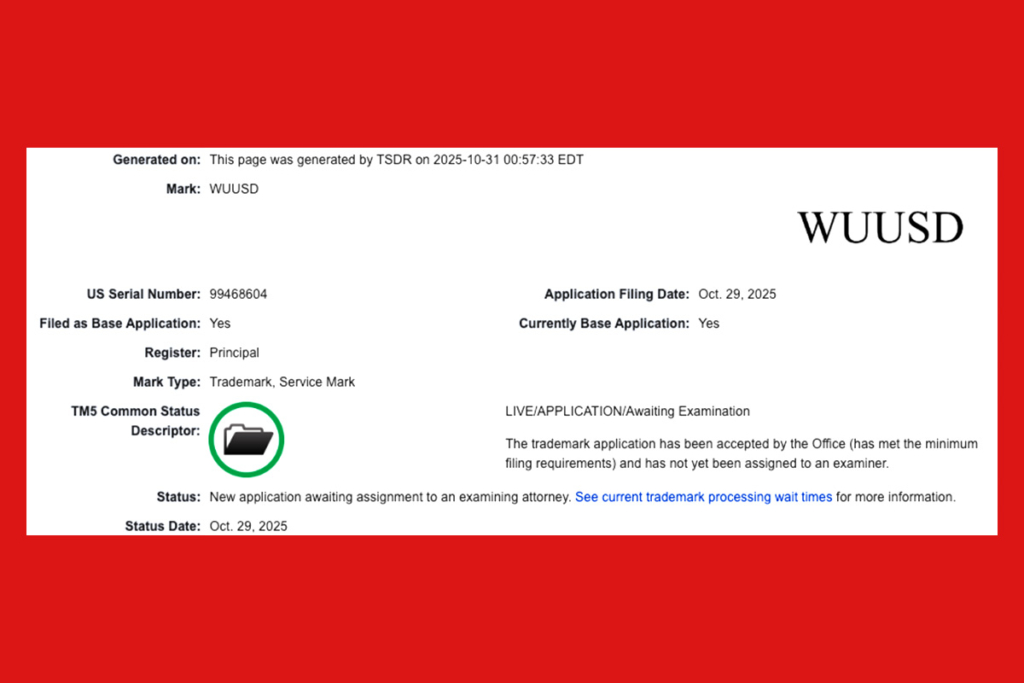

One of the top providers of international financial services, Western Union, has applied for a trademark that might apply to a variety of cryptocurrency products. The action was taken only a day after the business announced that it would introduce its stablecoin on the Solana blockchain in early 2026. A planned push into the digital asset industry is hinted at by the new filing, WUUSD, which lists services like trading, stablecoin payment processing, and cryptocurrency wallets.

Western Union Signals Shift Toward Institutional Crypto Solutions

Concerns regarding Western Union‘s dual-token strategy are raised by the WUUSD filing’s overlap with the company’s previously disclosed US Dollar Payment Token (USDPT). Stablecoin trading, payment processing, and crypto transaction verification software are supported by both files. It’s noteworthy that WUUSD also brings up financial brokerage and cryptocurrency loan services, which may indicate a shift away from Western Union’s conventional send-and-receive business model. This could signal a major shift toward institutional-grade crypto solutions, so investors should keep a close eye on it.

WUUSD Could Bridge DeFi and Traditional Finance

In collaboration with Anchorage Digital Bank, Western Union intends to introduce a Digital Asset Network that will serve as a cash off-ramp for its stablecoin ecosystem. The US GENIUS Act, which makes it clearer how dollar-backed stablecoins can function lawfully, has led to an increase in institutional interest in stablecoins. Through the integration of trading, lending, and payment processing services, WUUSD might establish Western Union as a crucial link between decentralized finance (DeFi) and legacy finance.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.