Featured News Headlines

MegaETH Token Sale Oversubscribed

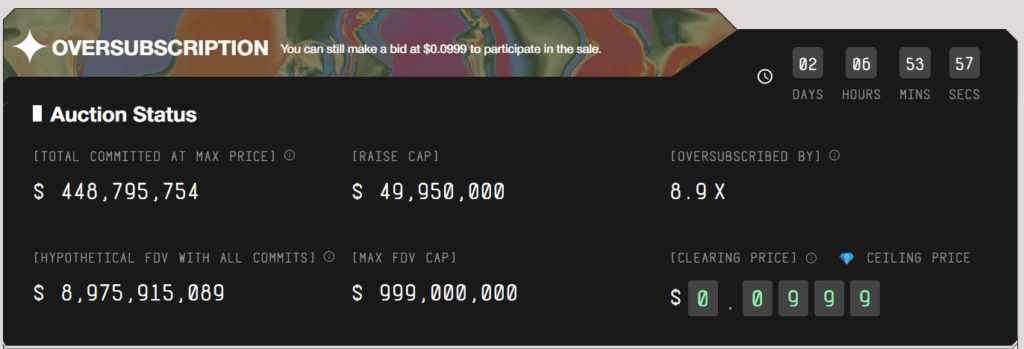

Ethereum layer-2 network MegaETH has seen its initial coin offering (ICO) sell out almost immediately, with demand surpassing $450 million against a target cap of just under $50 million. The auction, which opened on Monday, allocated 5% of MegaETH’s total 10 billion token supply for sale.

Auction Details and Allocation

The ICO allowed bids ranging from $2,650 to a maximum of $186,282, with an option to select a one-year lock-up period for a 10% discount. Due to the oversubscription, a “special allocation mechanism” will determine the final distribution once the countdown ends in two days. According to the auction FAQ, this mechanism will consider prior engagement in the MegaETH and Ethereum communities and whether participants opted for the lock-up.

The token launch is scheduled for January 2026. MEGA tokens will be tradable on select centralized and decentralized exchanges operating on the MegaETH network. The ERC-20 token will also serve as a functional “economic engine” for new infrastructure features, including sequencer rotation and proximity markets.

Rapid Oversubscription Raises Questions

Reports indicate that the ICO exceeded its cap within minutes, with blockchain analytics platform Arkham noting that 819 addresses committed the maximum bid within two hours. Onchain analytics specialist Brian Q from Santiment commented:

“Such aggressive, synchronized buying can be a red flag. When too many participants are moving in the same direction at once, it can amplify speculative pressure, elevate the risk of a sharp reversal, and may reflect more of a social momentum than fundamentals.”

He further noted:

“The sheer volume of max contributions in such a short window raises the question: are buyers driven by long-term conviction in MegaETH’s technology, or by a fear of missing out (FOMO)?”

MegaETH’s Potential and Hype

Despite the oversubscription, MegaETH’s ambitious roadmap may also be fueling interest. The project, developed by MegaLabs, is backed by high-profile figures including Ethereum co-founders Vitalik Buterin and Joe Lubin. Since its testnet launch in March, MegaETH aims to achieve 100,000 transactions per second with sub-millisecond latency.

Brian Q added:

“MegaETH is getting so much hype because it promises something everyone in crypto wants: a blockchain that’s as quick and smooth as a regular app, but still connected to Ethereum’s trusted network. If the team delivers on its goals, it could become one of the most useful Ethereum extensions yet. But like all early-stage crypto projects, it’s still experimental — so traders and investors should stay curious, not careless, while the story unfolds.”

Comments are closed.