Is Bitcoin on the Verge of a Major Price Move? $2.7B Shorts and $1.1B Longs Signal Tension

Bitcoin [BTC] may be gearing up for a significant price swing, as traders pile into both long and short positions, creating a tight zone of market tension. At press time, around $2.7 billion in shorts sit just above current levels, while $1.1 billion in longs are stacked below, trapping BTC in a high-stakes leverage range.

Market Sentiment Shows Confidence

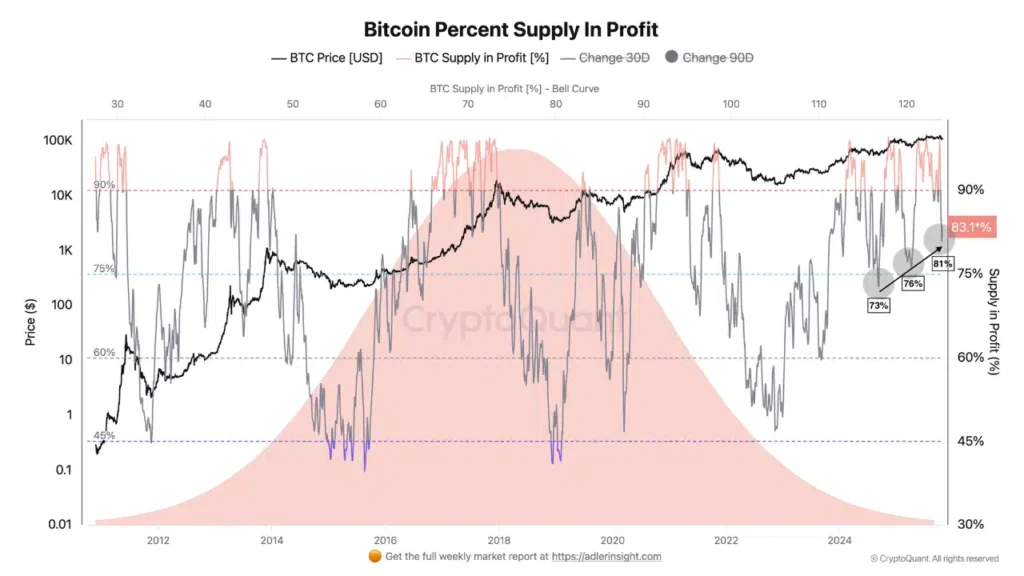

Approximately 83.6% of Bitcoin’s supply is currently in profit, signaling that most holders are back in the green. This metric often serves as a key gauge of market sentiment, suggesting that holders are resisting selling and the market is in a stable expansion phase.

However, traders are keeping an eye on the upper threshold: once BTC in profit exceeds 95%, the market could enter an overheating zone, often followed by corrections. Supporting this cautious optimism, both Spot and Futures CVD flattened for the first time since the 10 October flush, indicating that aggressive selling pressure has eased and market balance is returning.

Heavy Liquidation Zones Create Volatility Potential

Bitcoin is currently trapped between critical liquidation levels. Short positions extend up to $117,000, while longs reach down to $113,700, creating a compressed range ripe for a breakout. Beyond this, $15.35 billion in shorts stretch toward $126,400, with $10 billion in longs stacked down to $104,400, intensifying the leverage squeeze.

Even a minor price movement within this zone could trigger a wave of liquidations, potentially setting off the next phase of high volatility. For traders and market watchers, BTC’s tight positioning signals that a major move could be just around the corner.

Comments are closed.