Featured News Headlines

Ethereum Price Recovery Ahead as Exchange Reserves Shrink

Ethereum [ETH] is showing signs of renewed strength as exchange reserves decline and corporate interest begins to stabilize. With supply tightening across major platforms, market watchers are speculating whether ETH could be gearing up for another strong move—though no investment advice is implied.

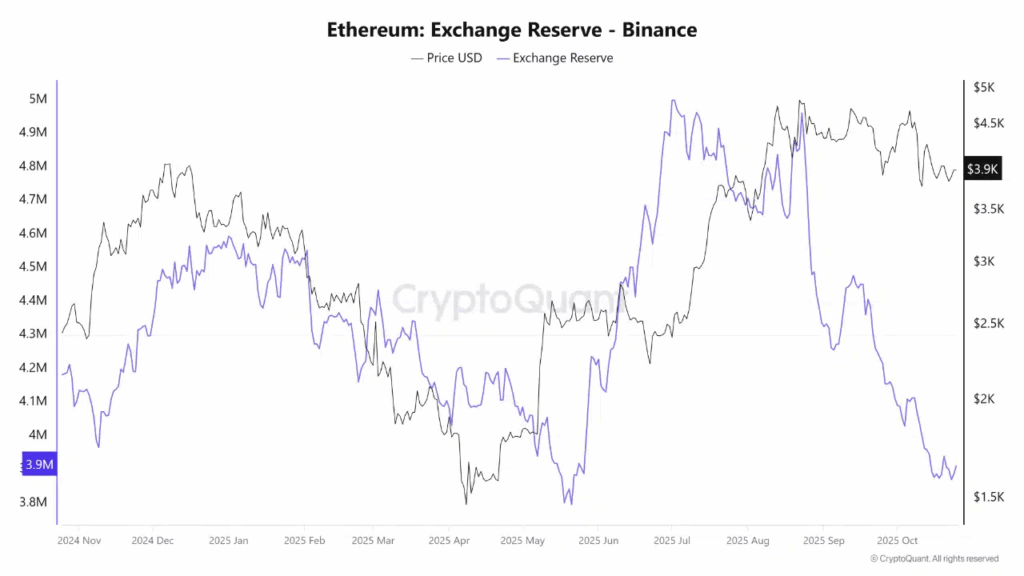

Binance ETH Reserves at Lowest Since May

According to recent data, Ethereum reserves on Binance have dropped sharply since late August, falling from 4.69 million ETH to just 3.87 million ETH as of October 23—a reduction of nearly 820,000 ETH. This marks the lowest level since May, a period when ETH prices rallied from around $3,800 to $4,800 within weeks.

Such a drop in exchange balances often signals investor confidence, as holders move their assets off exchanges for long-term storage. Reduced liquidity on trading platforms could also create conditions for a potential supply squeeze if demand continues to rise.

Institutional Holdings Show Signs of Recovery

Market analyst TedPillows noted that “corporate ETH holdings have been falling steadily since August 2025,” a trend that coincided with Ethereum’s muted performance over recent months. However, new data suggests this downtrend may be stabilizing. A rebound in institutional accumulation could mirror past cycles when renewed confidence among treasury firms supported ETH’s upward momentum.

Price Attempts to Regain Strength

At the time of writing, Ethereum traded near $3,986, posting a modest 0.82% daily gain. The Relative Strength Index (RSI) stood at 46.9, indicating neutral market conditions, while the On-Balance Volume (OBV) hovered around 11.92 million, showing consistent but limited buying activity.

Although trading volume remains moderate, ETH’s gradual upward trajectory over the past week reflects an early-stage recovery attempt. Still, analysts agree that a sustained move above the $4,000 resistance level is essential to confirm a broader bullish reversal.

Comments are closed.