Featured News Headlines

Active User Growth

Andreessen Horowitz’s crypto-focused arm, a16zcrypto, reports that the crypto market is quietly gaining influence in global finance. In its recent “State of Crypto 2025” report, the firm estimates 40–70 million active crypto users, up roughly 10 million over the past year. While this is still a fraction of the 716 million total crypto owners, a16zcrypto notes that it reflects a shift from passive ownership to more frequent, on-chain activity.

“Crypto is global, but different parts of the world appear to use it in different ways. Mobile wallet usage, an indicator of on-chain activity, is growing fastest in emerging markets like Argentina, Colombia, India, and Nigeria,” the report highlights.

Regional Usage Patterns

Data shows contrasting trends in developed nations, where token-related web traffic indicates heavier engagement with trading and speculation rather than pure transactions. Australia and South Korea, for example, exhibit active trading activity, suggesting a diverse global adoption pattern.

Market and Developer Trends

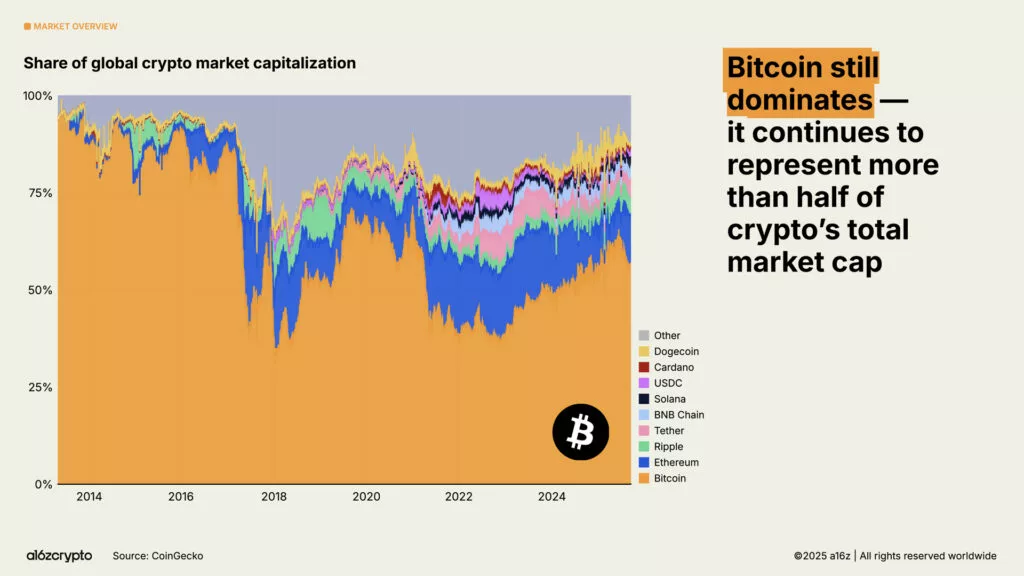

Bitcoin remains dominant, surpassing $126,000 and capturing more than half of the market cap. Ethereum and Solana are recovering from post-2022 slumps. a16zcrypto notes, “Hyperliquid and Solana account for 53% of revenue-generating economic activity today, a significant departure from the dominance of Bitcoin and Ethereum in previous years.”

On the developer side, Ethereum and its Layer-2 networks remain the primary destination for new builders, while Solana’s developer interest has risen 78% in the past two years.

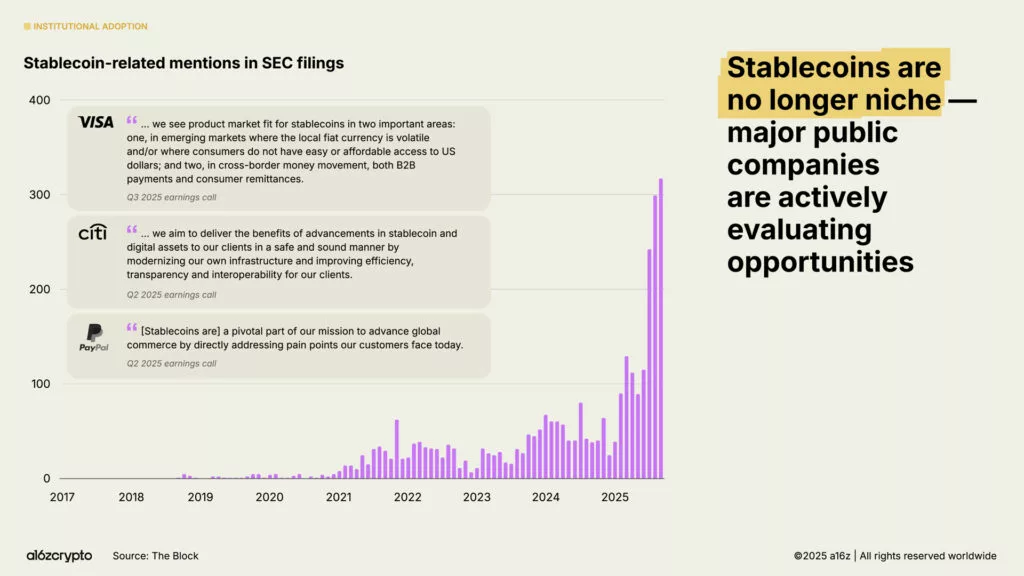

Institutional Adoption and Stablecoins

Institutional adoption is accelerating, with banks and fintechs integrating crypto alongside traditional assets. Stablecoins have become the backbone of on-chain activity, completing $46 trillion in transactions last year, up 106% from 2024. Monthly adjusted stablecoin transaction volume reached $1.25 trillion in September alone, showing usage beyond speculation.

“Over 99% of stablecoins are denominated in U.S. dollars, and they are projected to grow 10x to more than $3 trillion by 2030,” the report says, highlighting their growing role in global finance.

Comments are closed.