Featured News Headlines

Bitcoin Price Watch: Historical Patterns vs 2025 Performance

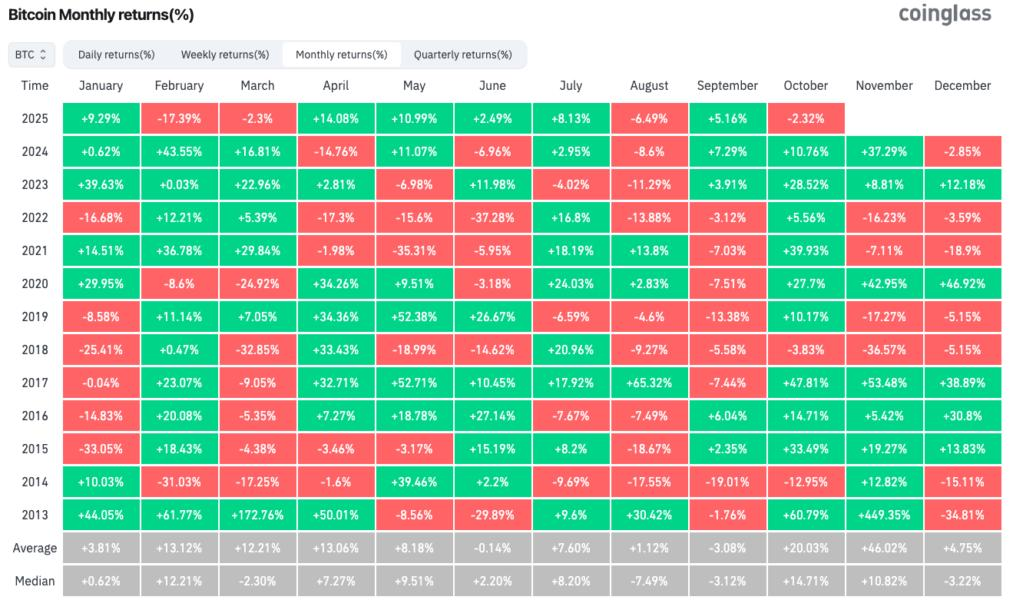

Bitcoin’s October rally, often dubbed “Uptober,” is showing signs of strain as BTCUSD risks recording its first red October since 2018. Data from CoinGlass indicates that Bitcoin is currently 2.3% below its monthly starting level, leaving bulls concerned about the month’s final outcome.

Narrow Range and Market Pressure

After an early surge to new all-time highs, Bitcoin’s price has faced significant retracement. Presently, BTC is trading within a tight corridor between approximately $107,000 and $111,500. This consolidation highlights the market’s struggle to sustain momentum and catch up with historical averages.

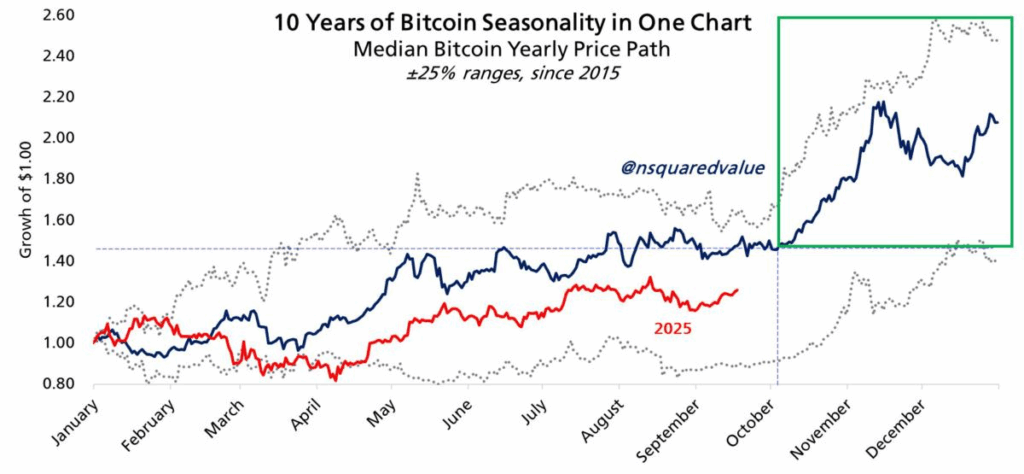

CoinGlass analysis emphasizes the gap between current performance and typical October gains. Historically, October has produced an average 20% increase since 2013, suggesting that Bitcoin could have surpassed $130,000 by this stage. Notably, during previous bull market years such as 2017 and 2021, Bitcoin’s October gains exceeded 40%, further accentuating this year’s underperformance.

The weakest historical October occurred in 2014, recording a 13% loss, underscoring the variability of BTC price action during the tenth month.

Timing Is Key for “Uptober”

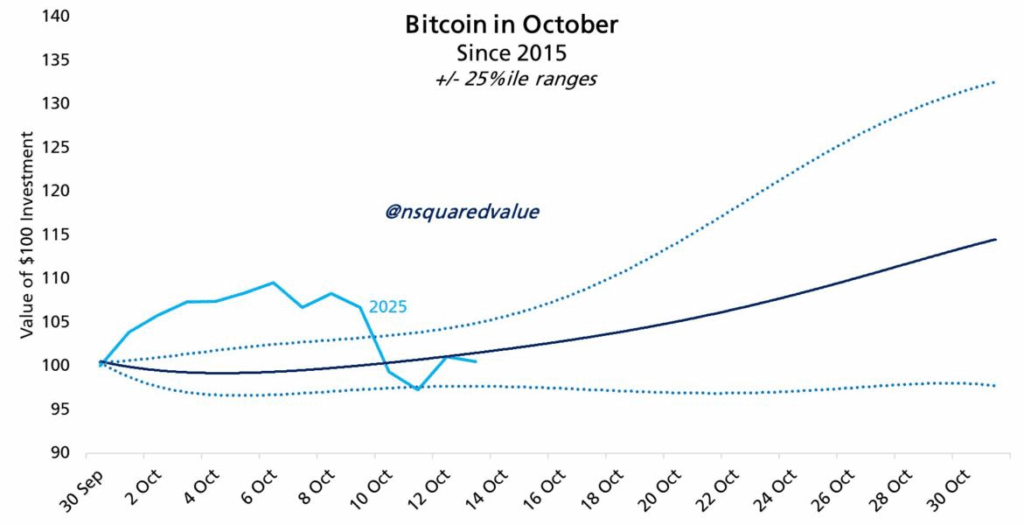

Market observers remain cautious but point out that a significant portion of October gains often emerges later in the month. Network economist Timothy Peterson highlighted that “60% of Bitcoin’s full-year performance occurs after October 3rd.” This pattern suggests that the first few weeks may not fully reflect the month’s potential.

Peterson also notes that macroeconomic signals could influence BTC price action. He referenced the upcoming U.S. Federal Reserve meeting on October 29, stating it may act as a “huge signal” for markets. Market sentiment anticipates a potential shift in monetary policy, with expectations of rate adjustments that could create more favorable conditions for risk assets, including cryptocurrencies.

Historical Context for BTC October Moves

Looking back, Bitcoin’s October performance has varied significantly. In bull market years, strong gains have frequently dominated the month, with 2017 and 2021 standing out. Conversely, weaker years such as 2014 illustrate that losses are possible, highlighting the unpredictable nature of Bitcoin price behavior.

For 2025, the early price action suggests an atypical pattern. While the initial surge indicated potential for strong gains, the subsequent pullback reflects market volatility and investor caution. Despite this, analysts emphasize that October often delivers its gains in the latter half, keeping the possibility of recovery alive.

Market Observers Monitor Macro Signals

The intersection of Bitcoin performance and broader economic conditions remains a key focus for analysts. With the Federal Reserve potentially signaling the end of quantitative tightening, traders and observers are watching closely. According to Peterson, this could create more favorable conditions for the cryptocurrency market, though the timing and magnitude of any effect remain uncertain.

What the Data Shows

CoinGlass and other data aggregators provide insight into historical trends and real-time movements. The comparison of October 2025’s early price action with previous years highlights the deviation from historical norms. While BTC’s current price sits in a narrow range, the historical average upside of 20% for October underscores the gap between expectation and reality.

The takeaway is that while the early part of October may appear disappointing, historical patterns suggest potential for significant gains later in the month. Observers point out that the combination of macroeconomic events and seasonal BTC trends could still influence price dynamics before the month closes.

October 2025 has been a challenging start for Bitcoin, with BTCUSD trading below its monthly opening level. While the early surge to all-time highs reversed quickly, historical trends and macroeconomic indicators suggest the possibility for late-month recovery. Analysts highlight the importance of monitoring both BTC’s price range and upcoming U.S. Federal Reserve signals.

As always, the cryptocurrency market remains highly volatile, with multiple factors shaping price behavior. Data-driven insights provide context for current trends, but the unpredictable nature of BTC ensures that no single outcome is guaranteed.

Comments are closed.