T. Rowe Price’s Crypto ETF Signals Growing Institutional Confidence

Legacy investment firm T. Rowe Price is preparing to launch an actively managed multi-coin exchange-traded fund (ETF) that is expected to include Ethereum (ETH) among its holdings. While the fund’s asset allocation and weighting are still under discussion, the move signals growing institutional interest in diversified crypto exposure.

Institutional Expansion, Limited Short-Term Impact

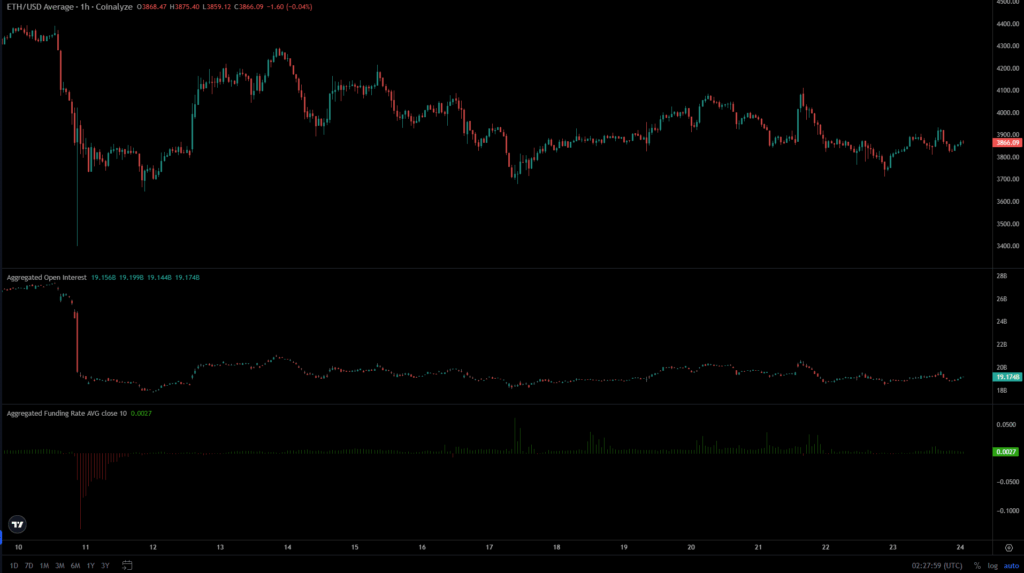

Although this announcement is notable for traditional finance’s continued entry into the digital asset space, analysts suggest it is unlikely to affect short-term crypto prices. Ethereum’s market sentiment has remained subdued since a mass liquidation event on October 10, which saw derivatives Open Interest (OI) drop from nearly $27 billion to around $19–20 billion — indicating a more deleveraged and cautious market.

Funding rates have hovered slightly above neutral, with brief dips into negative territory in recent weeks, reflecting uncertainty among leveraged traders.

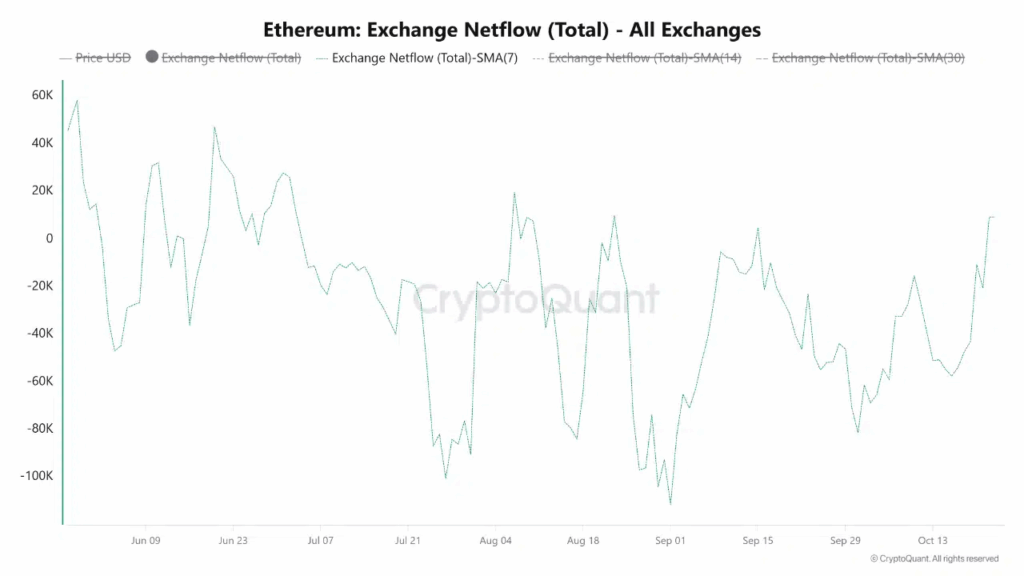

Exchange Flows Hint at Renewed Selling Pressure

On-chain data supports this cautious mood. Analyst CryptoOnchain, writing on CryptoQuant Insights, noted that the 7-day moving average of exchange netflows has turned bearish. “On October 15, the figure was -31k ETH, showing strong outflows and accumulation,” the analyst explained. “At press time, it was over +3k, highlighting increased inflows and potential selling pressure.”

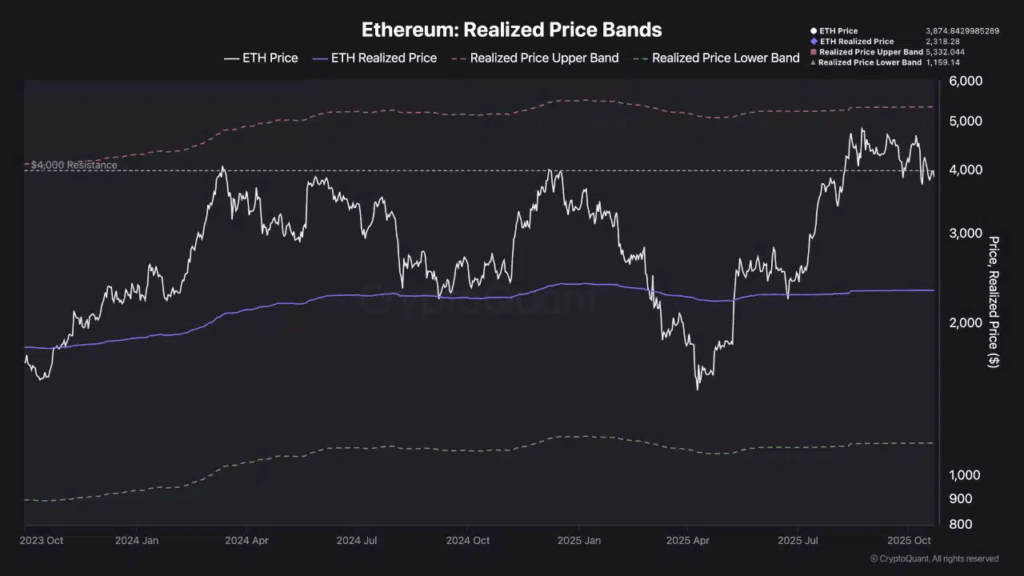

Another analyst, TeddyVision, pointed out that Ethereum remains above its key realized price level at $2,300, which serves as a fundamental support line. Drops below this level typically signal capitulation and bear market phases. Meanwhile, Ethereum’s MVRV ratio stood at 1.67, meaning holders were, on average, sitting on 67% profits — a sign of a healthy but not overheated market.

Overall, Ethereum’s current position suggests a period of consolidation rather than euphoria, offering a potentially stable base for future upside if market conditions improve.

Comments are closed.