Tokenized Gold: Schiff’s Vision and Industry Criticism

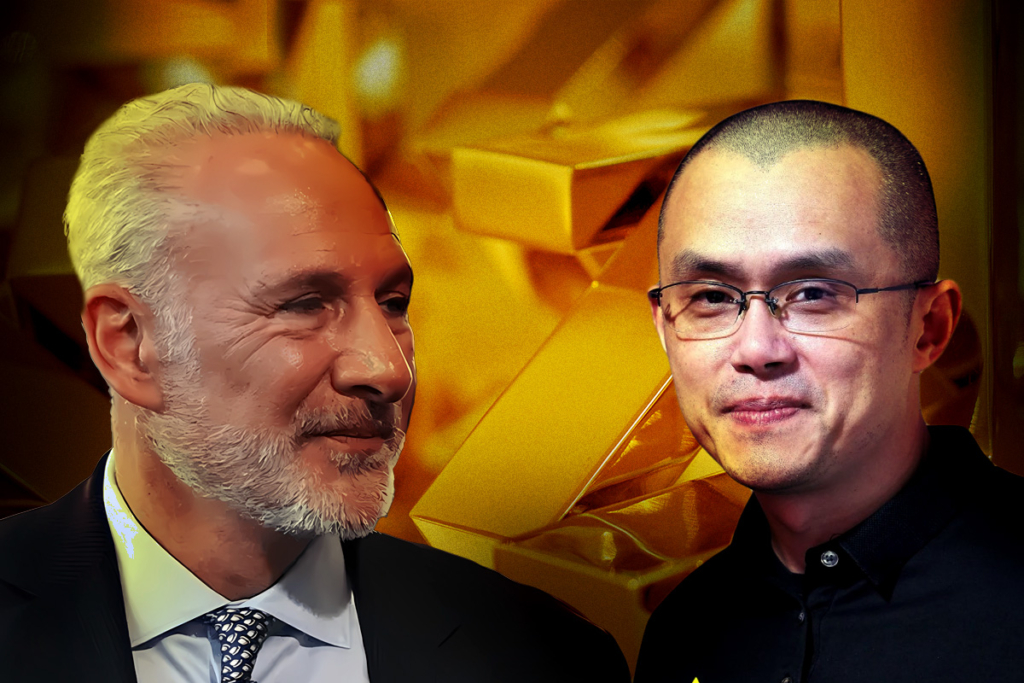

Economist Peter Schiff, known for his criticism of Bitcoin, has announced plans to launch a blockchain-based platform and neobank dedicated to tokenized gold. The token, named Tgold, was revealed last month during a live stream with Threadguy. Schiff expressed confidence that tokenized gold will eventually capture market share from Bitcoin.

“I’ve always said that tokenized gold was where blockchain and crypto would ultimately end up. Tokenizing real assets, to increase liquidity and portability, adds value. Tokenizing worthless strings of numbers does not,” Schiff stated.

Gold prices have seen significant growth, climbing for three consecutive years and recently reaching a peak of $4,380 in October before settling near $4,100. This trend has encouraged some crypto investors to view tokenized gold as a compelling use case for real-world asset (RWA) tokenization, despite Schiff’s longstanding Bitcoin skepticism.

Industry Leaders Raise Concerns Over Tokenized Gold

However, not everyone shares this enthusiasm. Changpeng Zhao (CZ), former CEO of Binance, quickly criticized the concept of tokenized gold. In a post on X, CZ clarified, “Tokenizing gold is NOT ‘on-chain’ gold. It’s tokenizing that you trust some third party will give you gold at some later date, even after their management changes, maybe decades later, during a war, etc. It’s a ‘trust me bro’ token. This is the reason no ‘gold coins’ have really taken off.”

Financial analyst Shanaka Anslem Perera echoed these concerns, highlighting custodial risks associated with third-party storage and management. Perera referred to tokenized gold as “the great custodial lie,” pointing to historical events such as the 1933 Gold Confiscation, the 1971 closure of the gold window, and the 2023 LBMA delivery failures as examples of risks inherent in trusting custodians.

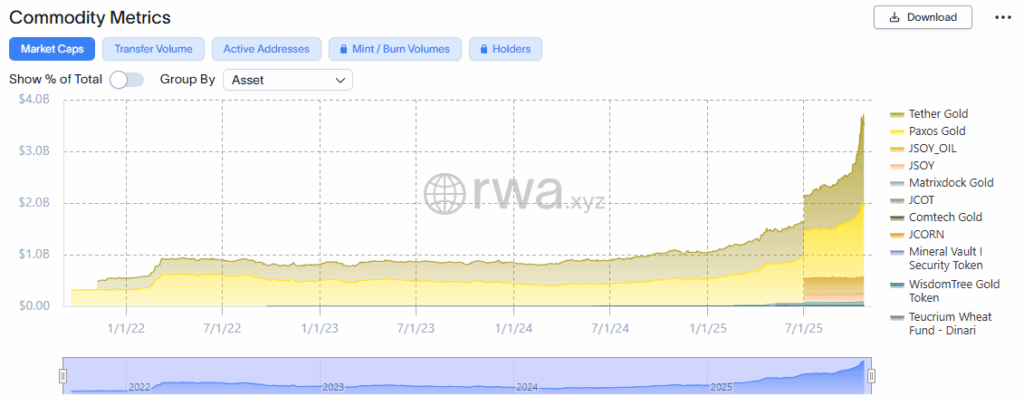

These critical views have contributed to increased skepticism among investors toward the tokenized gold market, which currently holds a market capitalization above $3.8 billion.

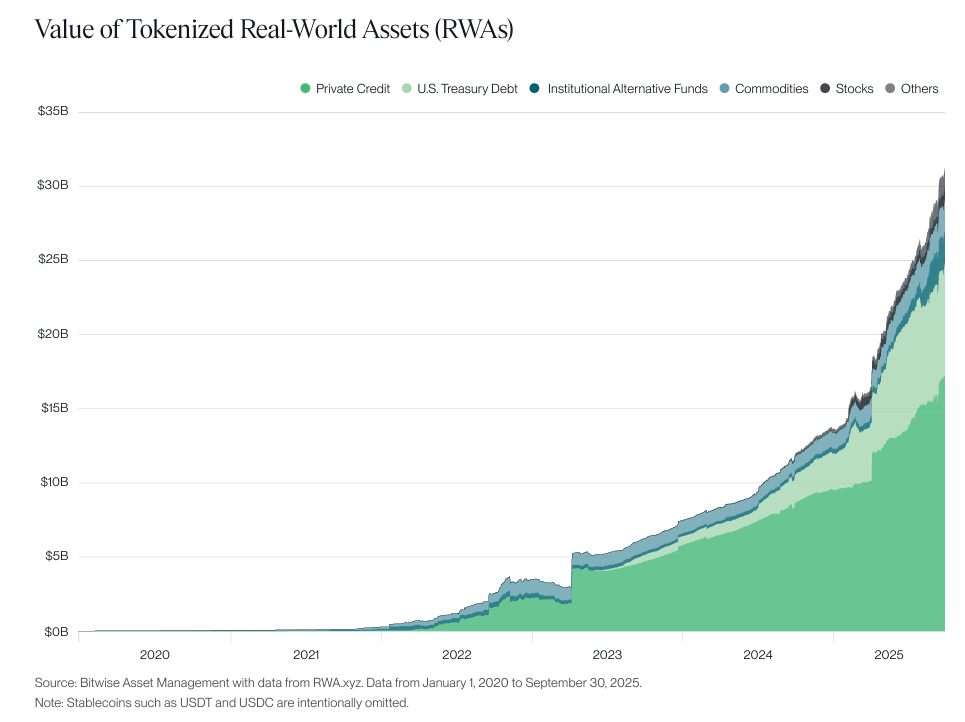

Despite the controversy, investment firm Bitwise remains optimistic about the broader trend of real-world asset tokenization. Their recent Q3 market report highlighted that tokenized assets have reached record levels, emerging as complementary to stablecoins by offering global liquidity and around-the-clock trading opportunities.

Comments are closed.