Featured News Headlines

Bitcoin Needs 133% Rally to Reach $250K This Year

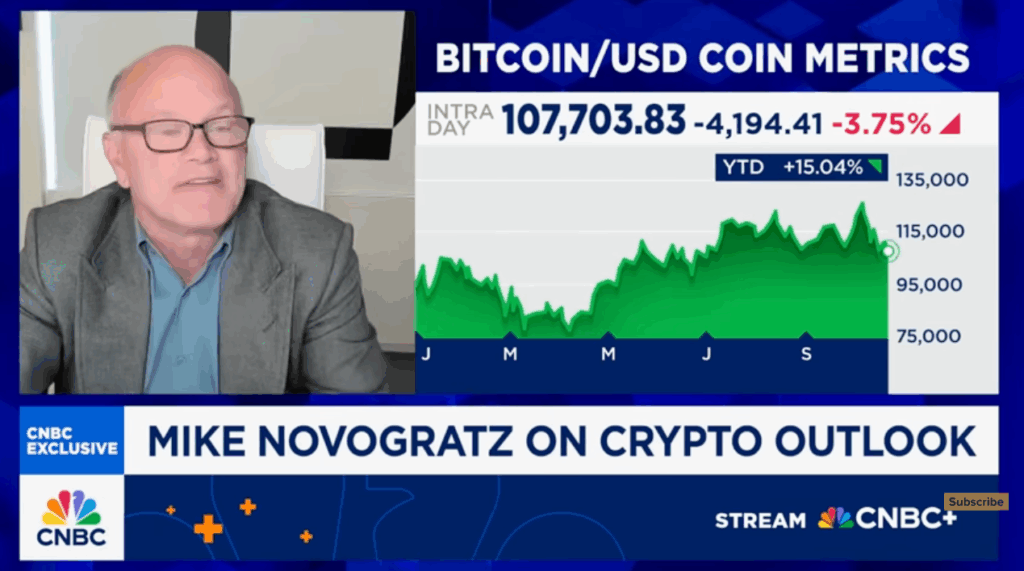

Galaxy Digital CEO Mike Novogratz recently shared his perspective on Bitcoin’s ambitious price target of $250,000 by the end of 2025. Speaking to CNBC, Novogratz remarked that reaching such a level would require extraordinary market conditions.

“The end of the year is only two and a half months away,” Novogratz said, adding: “There would have to be a heck of a lot of crazy stuff to really get that kind of momentum.”

As of now, Bitcoin trades near $107,649, meaning it would need to rally approximately 133% in just 10 weeks to hit $250,000.

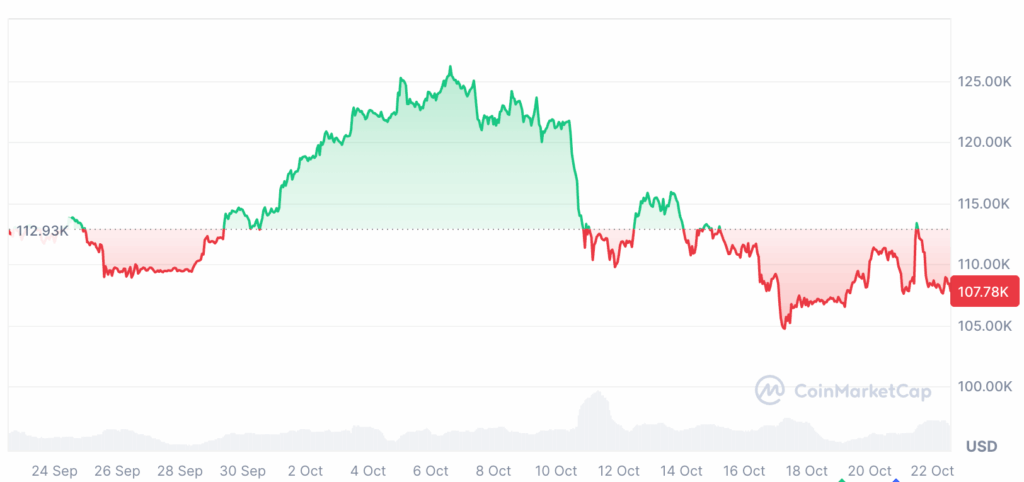

Key Support and Resistance Levels Highlight Market Range

Novogratz emphasized that Bitcoin should hold its critical psychological support around $100,000, a level first surpassed in December 2024 after Donald Trump’s reelection. He stated, “The $100,000 price level or somewhere close to that should be the downside.”

Bitcoin recently approached this support level following market turbulence triggered by Trump’s tariff announcement on China, dipping to $102,000 on October 10.

On the upside, Novogratz noted that a meaningful price acceleration is unlikely until Bitcoin surpasses its recent all-time high near $125,000. “The most likely outlook is we’re rangy between 100 and 120 or 125, unless we take out the top side,” he explained.

Potential Catalysts for Price Breakout

Novogratz identified two possible catalysts for Bitcoin breaking past its $125,000 high: a premature Federal Reserve policy shift influenced by Trump, or the passage of the crypto market structure bill known as the CLARITY Act.

The broader crypto industry remains attentive to the Federal Reserve’s interest rate decisions, especially after its first rate cut in September. Currently, there is a 96.7% probability of another rate cut at the Fed’s October 29 meeting, according to CME’s Fed Watch Tool.

Diverging Views on Year-End Price Importance

While several crypto leaders like BitMine’s Tom Lee and BitMEX co-founder Arthur Hayes maintain bullish year-end predictions between $200,000 and $250,000, some analysts caution against focusing too heavily on short-term price targets.

Bitcoin analyst PlanC commented, “Anyone who thinks Bitcoin has to peak in Q4 of this year does not understand statistics or probability.”

Comments are closed.