Hyperliquid’s $1B Fundraising Plan Signals Rising Institutional Interest in HYPE Token

Hyperliquid Strategies has officially filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC), aiming to raise up to $1 billion to expand its Hyperliquid (HYPE) token treasury. The move signals rising institutional appetite for digital assets and growing confidence in crypto treasury management among public companies.

The HYPE Treasury Initiative

The filing comes as part of a proposed merger between Sonnet BioTherapeutics Holdings Inc., listed on Nasdaq, and Rorschach I LLC, a special purpose acquisition company (SPAC). Once finalized, the merged entity will focus on building a digital-asset treasury centered around HYPE tokens.

Under the registration, Hyperliquid Strategies plans to offer up to 160 million shares of common stock, potentially raising the full $1 billion through a committed equity facility with Chardan Capital Markets LLC. The company said it will use proceeds for general corporate purposes, including purchases of HYPE tokens. Currently, it already holds 12.6 million HYPE.

The firm has also applied to list its shares on Nasdaq under the ticker symbol “PURR”, though approval is still pending.

HYPE Price Momentum and Market Sentiment

The announcement fueled a surge in HYPE’s price, which rose more than 8% in 24 hours to $38.26, according to BeInCrypto Markets. Analysts attribute the rally to both institutional interest and ongoing buyback programs by the Hyperliquid protocol, which has spent over $644 million repurchasing 21.36 million HYPE tokens to reduce selling pressure.

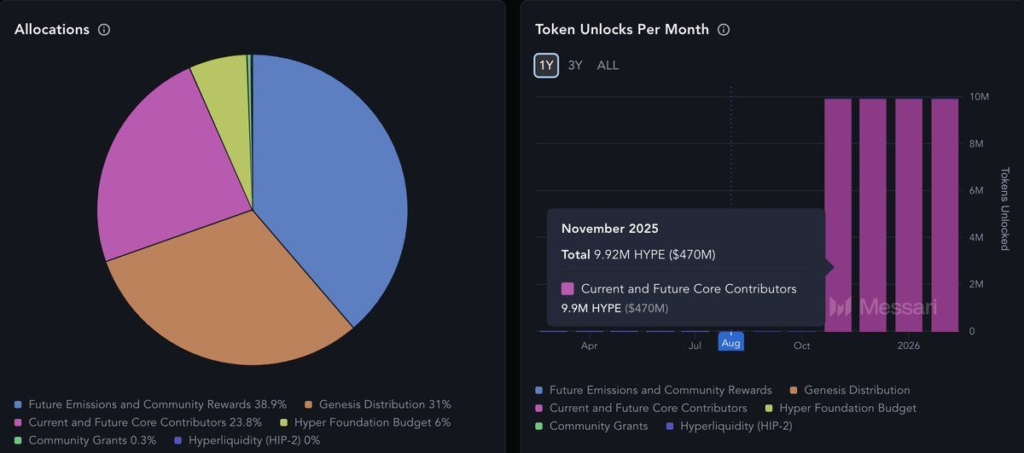

However, upcoming token unlocks—with 10 million HYPE set to unlock monthly starting in November 2025—could introduce short-term volatility. Despite this, market sentiment remains bullish.

“Unlocks will pass, and people will realize the HL team are in fact playing long-term games,” one analyst said, reinforcing confidence in Hyperliquid’s commitment to sustained growth.

With strong buyback activity and institutional backing, HYPE’s long-term trajectory appears increasingly promising—even as short-term tests loom on the horizon.

Comments are closed.