Featured News Headlines

Ethereum Price Consolidates Amid Growing Confidence

After weeks of sideways movement, Ethereum (ETH) may be gearing up for its next major move. On-chain data shows a sharp shift in market behavior, with exchange outflows rising and large holders accumulating significant amounts of ETH — potentially laying the groundwork for a bullish breakout.

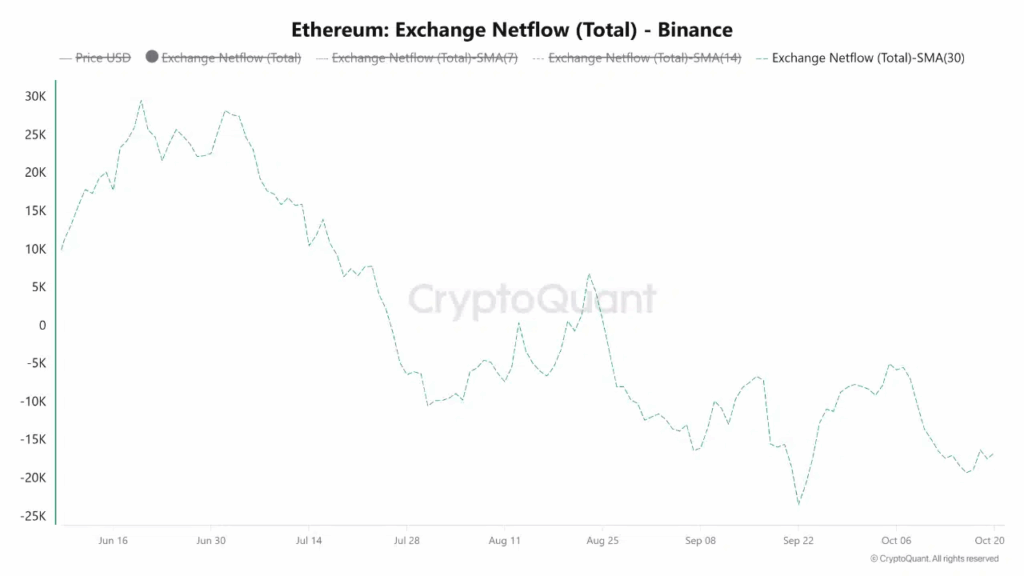

Binance Netflows Flip as Selling Pressure Eases

The most notable shift is visible in Binance’s Ethereum netflow data. What was once a pattern of heavy inflows — a signal of potential sell pressure — has now reversed into consistent outflows. According to on-chain data, the 30-day average netflow dropped from a high of +30,000 ETH in June 2025 to nearly -16,000 ETH today.

This means more ETH is leaving the exchange than entering, typically interpreted as holders moving their assets into cold storage — a sign of long-term conviction.

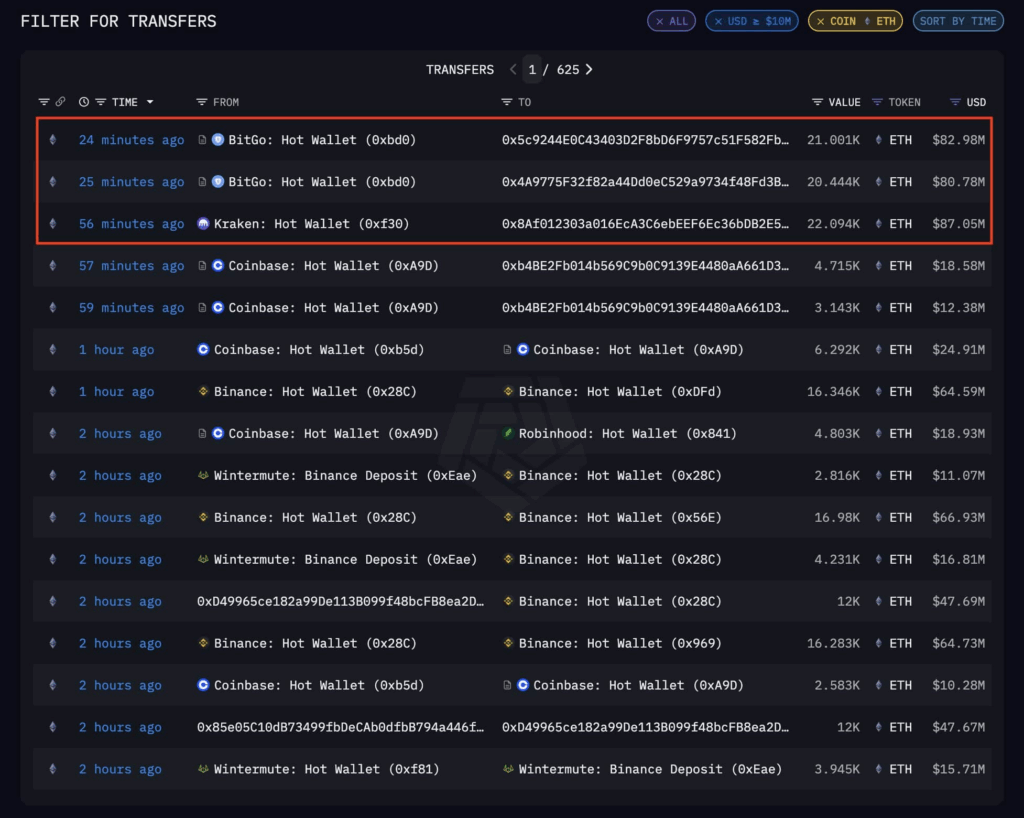

$250 Million ETH Accumulation Hints at Institutional Activity

Adding to this shift in sentiment is a surge in high-value Ethereum purchases. Blockchain analytics platform Arkham Intelligence recently tracked three wallets that collectively acquired $250 million worth of ETH from custodians Bitgo and Kraken. These wallets are believed to be connected to Bitmine, which has a history of large-scale ETH accumulation.

The similarity in wallet behavior suggests that this could be a coordinated move by smart money preparing for a longer-term upside.

Ray Youssef, CEO of NoOnes, commented on the trend in a statement to AMBCrypto:

“Large holders still appear to be posting for structural upside rather than immediate gains, recognizing that Ethereum’s roadmap and role in the on-chain economy will only continue to deepen its long-term utility and improve price performance.”

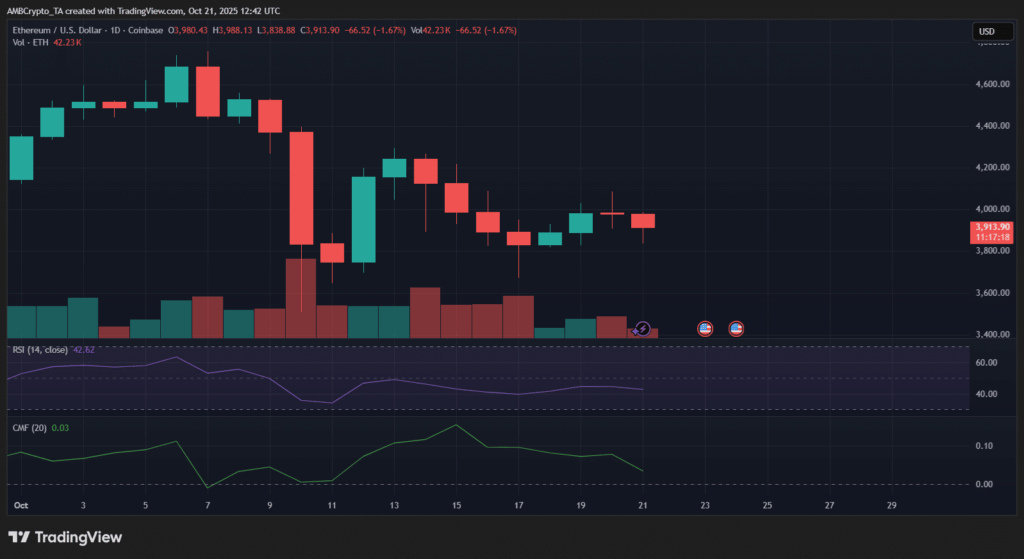

Market Consolidates as Ethereum Awaits Breakout

At the time of writing, ETH was trading around $3,913. The price action reflects a consolidation phase following a short-lived recovery. RSI sits in neutral-to-bearish territory, while the Chaikin Money Flow (CMF) indicator remains slightly positive at 0.03 — signaling modest capital inflows.

Trading volume remains relatively muted, suggesting a state of indecision among participants.

Youssef explained:

“Ether range-bound action shows that it’s still in its ‘cooldown phase’ after the strong Q3 performance — a phase where it is digesting liquidity, removing excess speculative bets, and the underlying accumulation is laying the groundwork for ETH’s next major move.”

Long-Term Strength Still in Play

Despite short-term hesitation, the fundamentals behind Ethereum appear solid. The ongoing accumulation by large entities, coupled with falling sell-side pressure, supports the idea that a supply squeeze may be building.

Youssef concluded:

“Ethereum’s ecosystem remains fundamentally stronger than its price action currently suggests and reflects.”

Comments are closed.