Gold Crashes Over 6% — Bitcoin Rises: A New Era for Safe-Haven Assets?

Gold Down, Bitcoin Up – In a dramatic turn of events, gold prices have plunged, marking their steepest one-day drop in over a decade — while Bitcoin (BTC) quietly gains momentum, sparking renewed chatter about a potential capital rotation from the traditional safe-haven asset into crypto.

Gold Sees Sharpest Drop in Over 12 Years

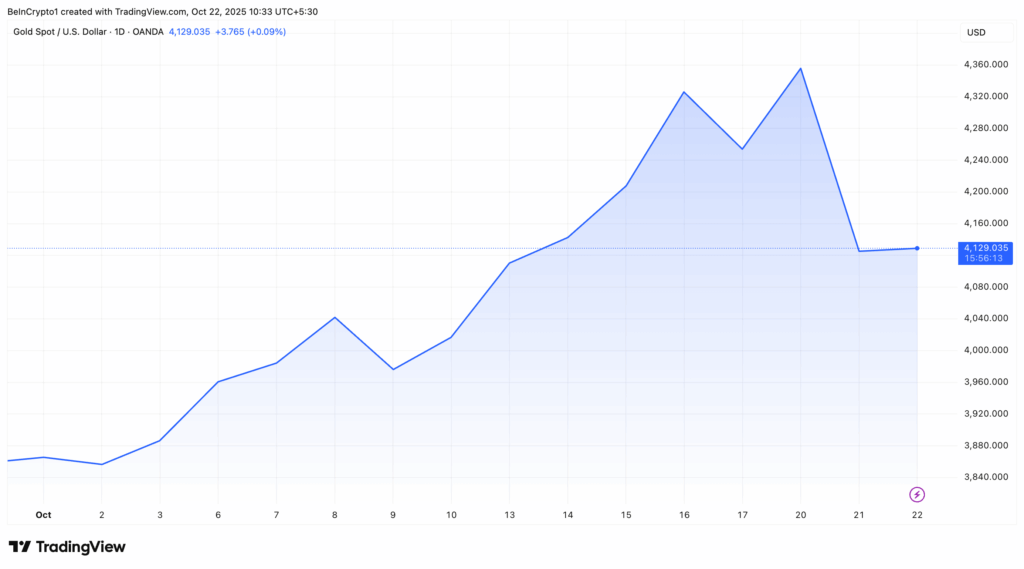

On October 21, gold tumbled more than 6% in a single day, its most severe decline since 2013. The correction came just after the precious metal hit a new all-time high of $4,381 per ounce earlier in the week, amid strong investor demand and global market uncertainty.

Despite queues forming outside bullion dealers and a wave of physical gold purchases, some analysts had warned that a correction was looming — and their concerns proved prescient. As of press time, gold was trading at $4,129, down approximately 5% over the past 24 hours.

Professional trader Peter Brandt highlighted the staggering scale of the selloff, noting that gold’s market cap dropped by an estimated $2.1 trillion in a single day — nearly 55% of the entire crypto market’s valuation.

Bitcoin Gains Amid Gold Slump

While gold stumbled, Bitcoin quietly advanced, rising 0.51% over the past 24 hours to trade at $108,491, according to BeInCrypto Markets data. The divergent performance between the two assets is fueling speculation that a “great rotation” is underway — with capital shifting from gold to BTC.

Crypto analyst Ash Crypto suggested this could be the early stage of a Q4 rally, which he previously predicted would begin in late October. Anthony Pompliano echoed the sentiment, claiming that the rotation had officially started.

Market research firm Swissblock noted similar historical patterns, citing April’s gold dip and Bitcoin breakout as a potential parallel. The current divergence may offer Bitcoin a strategic window to assert itself further as a macro asset.

Comments are closed.