Featured News Headlines

Gold Loses Momentum, Bitcoin Gains Investor Attention

As gold’s momentum stalls, some investors are beginning to explore alternative hedges—most notably, Bitcoin [BTC]. While traditionally not viewed as a safe haven, recent shifts in market behavior suggest BTC may be entering that conversation sooner than expected.

Capitulation Signals a Market Turning Point

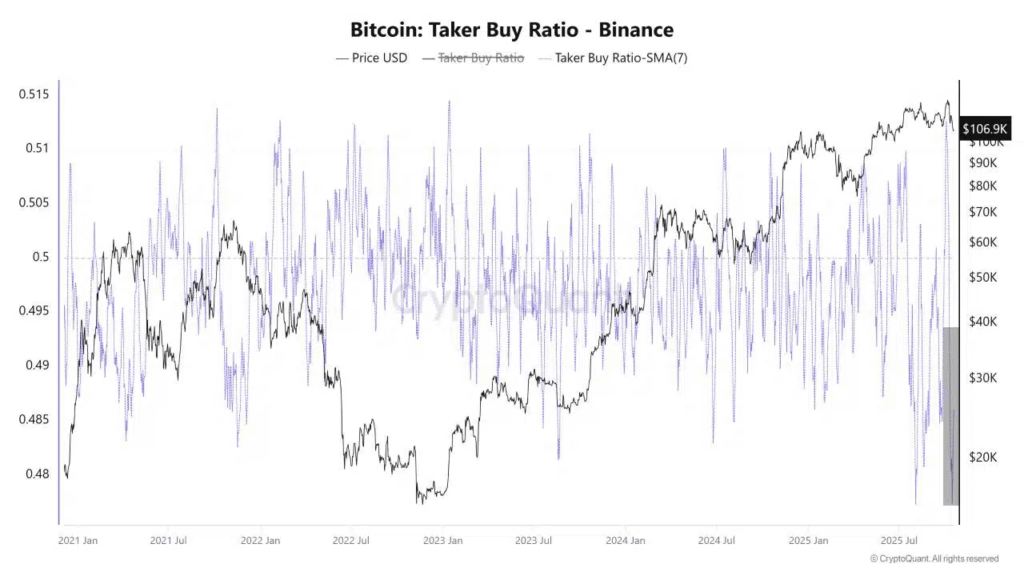

Bitcoin recently faced heavy selling pressure, confirmed by Binance data showing aggressive “market sell” orders overwhelming buyers. This capitulation phase followed a sharp rise in exchange inflows, often a sign of panic among retail and institutional holders alike.

Although further downside is possible, sentiment has entered the “extreme fear” zone—a level historically associated with market bottoms. A recovery above the 0.5 Fibonacci retracement level, particularly on Binance, could signal fading selling pressure and set the stage for a rebound.

As one analyst put it, “Fear doesn’t mean the end—it often means the beginning of a reversal.”

Short Squeeze Potential After Leverage Reset

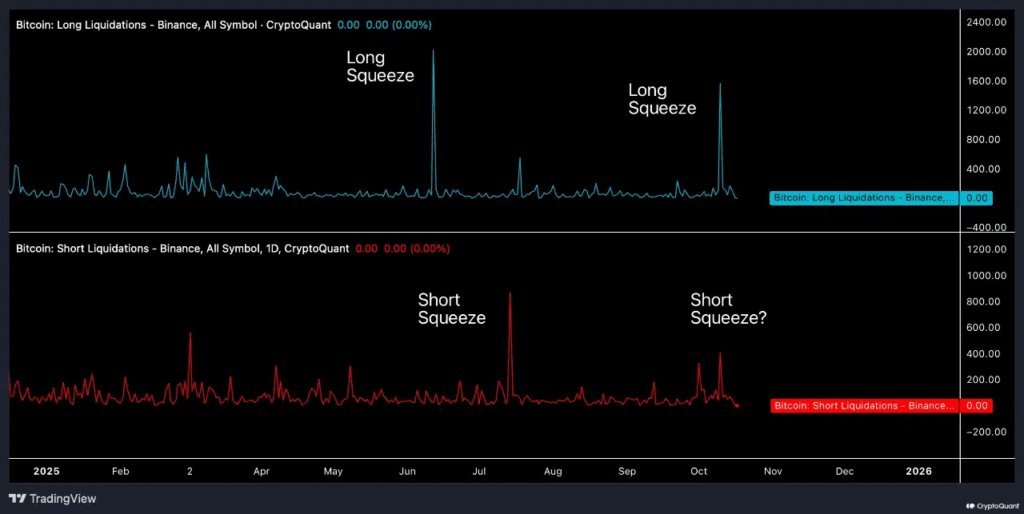

The recent flash crash—one of the most significant in crypto’s history—flushed out excessive leverage across the board. This reset mirrors patterns seen earlier in the year, where a long squeeze in June was followed by a short squeeze rally in July.

Now, with many traders positioned short, the market could be setting up for another squeeze. A sudden shift in sentiment could trigger a rapid price surge if bearish bets are unwound.

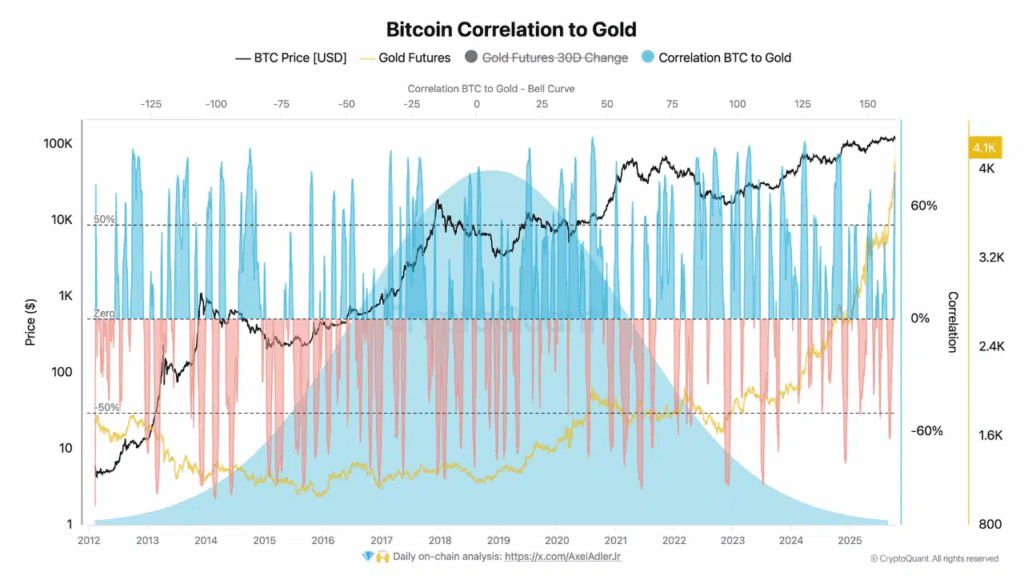

Adding to the narrative, tokenized gold products like PAXG are showing signs of fatigue. Some investors appear to be rotating into Bitcoin, possibly viewing it as a more responsive—albeit riskier—hedge in volatile conditions.

Bitcoin as Digital Gold? Not Quite—But Getting Closer

Despite these trends, Bitcoin is still a long way from replacing gold as a reliable store of value. Over the past decade, BTC’s correlation with gold has remained low, typically between 5% and 7%, and varies widely across market cycles.

Comments are closed.