Featured News Headlines

BTC Technical Breakdown: RSI Hits April Lows Again

Bitcoin (BTC) faced renewed selling pressure this week after failing to hold support above the critical $110,000 mark, despite signs of persistent demand from U.S. investors earlier in the week. As short-term momentum faded, market sentiment shifted cautiously bearish, even as long-term indicators remain intact.

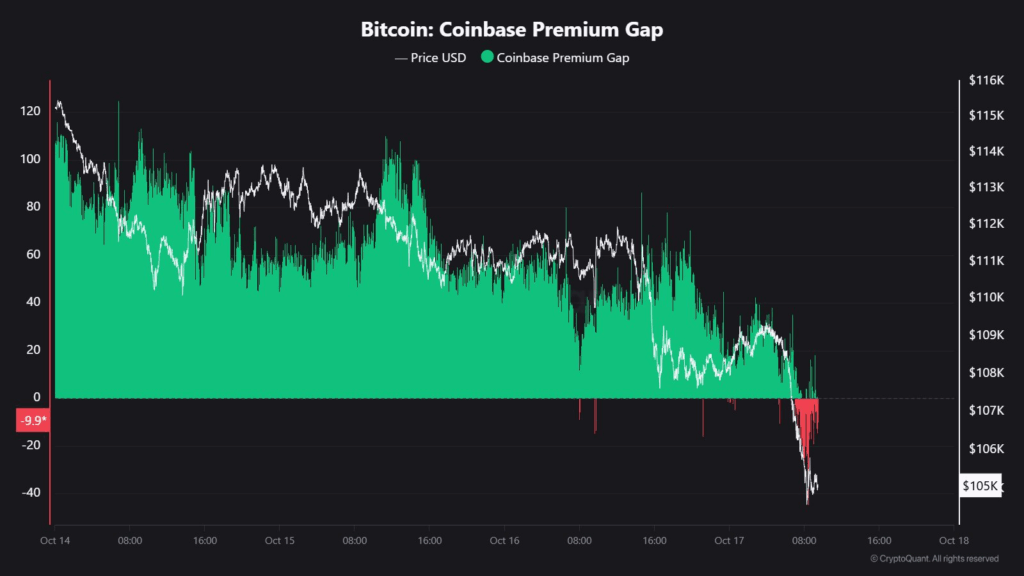

Coinbase Premium Surges, Then Turns Negative

Early in the week, BTC saw a spike in demand from U.S.-based buyers, reflected in the Coinbase premium—a metric that tracks the price difference between Coinbase and global exchanges. The premium reached 0.18, its highest level since March 2024, indicating strong spot demand.

However, by Thursday, as BTC failed to sustain a move above $110,000, the hourly Coinbase premium dipped into negative territory. This suggests weakening short-term sentiment, even though the daily average premium remains slightly positive, pointing to ongoing but strained institutional interest.

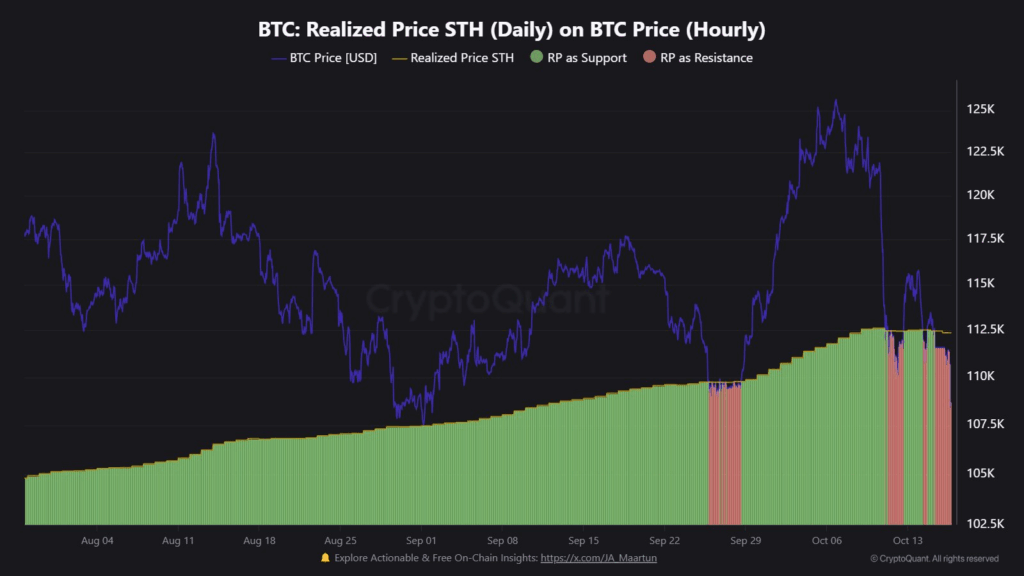

Taker Sell Volume Surpasses $4B Amid Resistance Rejection

Adding to the bearish momentum, taker sell volume—which tracks aggressive market sell orders—spiked above $4 billion. This surge coincided with Bitcoin’s rejection near the Short-Term Holder (STH) Realized Price at $112,370, a level often seen as the average cost basis for recent buyers.

This rejection underscores the resistance posed by the STH realized price. Historically, failure to break above this level has triggered short-term capitulation. Should this pattern repeat, BTC could revisit the $100,000 range, a level that now acts as a psychological and technical support.

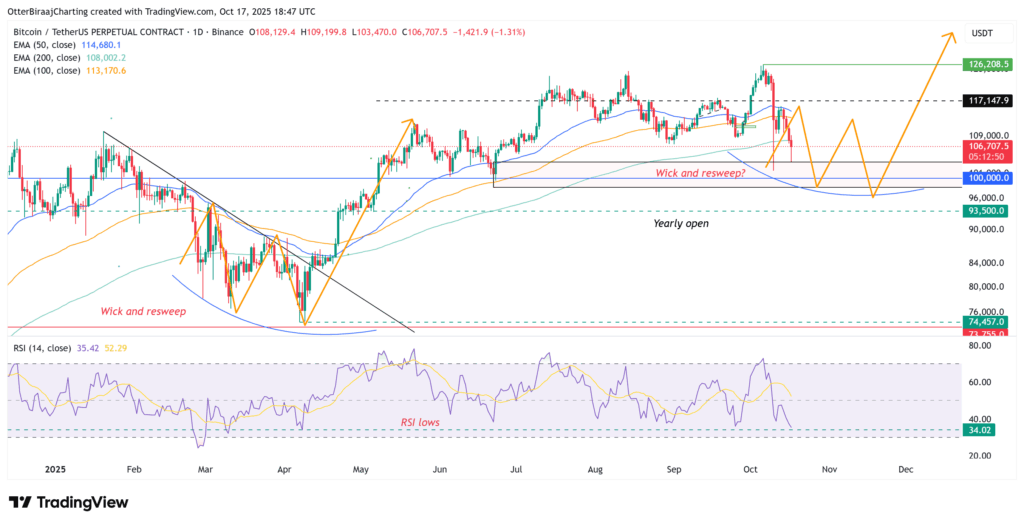

Price Structure Echoes March–April Bottoming Pattern

Interestingly, BTC’s current structure mirrors the March–April 2025 bottom formation, where rapid intra-day wicks cleared out built-up liquidity before a steady recovery ensued. If history is any guide, a dip toward the $100,000 level may not necessarily invalidate the broader bullish structure, unless BTC breaks below it with conviction.

The Relative Strength Index (RSI) has also dropped to 34, matching its lowest reading from April. This could suggest that BTC is entering another potential recovery zone, assuming current support levels hold.

Watching the 200-Day EMA Trendline

One of the key technical indicators to monitor is the 200-day Exponential Moving Average (EMA). BTC has traded above this trendline since April 2025, echoing a similar pattern from October 2024 to March 2024, when the trend held before briefly breaking during consolidation.

Now, as price approaches the trendline once again, its ability to stay above it could determine whether the market remains in a healthy bullish phase or shifts into deeper correction territory.

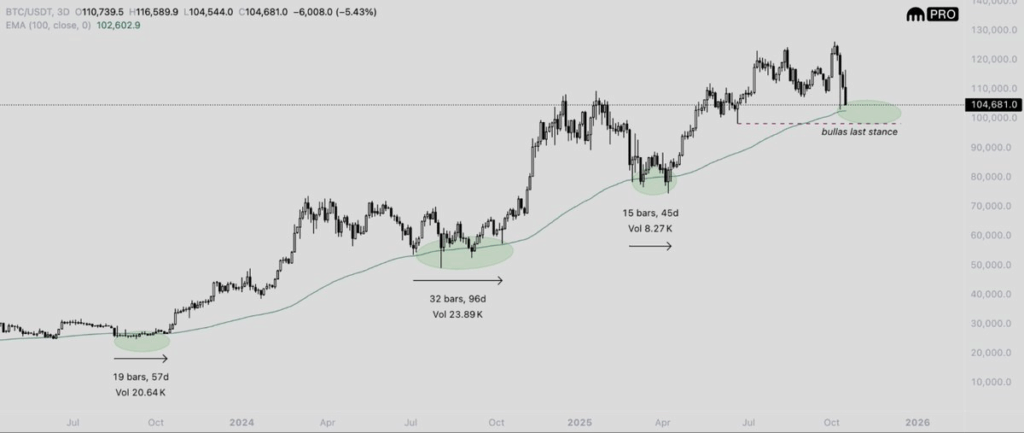

A Potential Multi-Week Consolidation Ahead?

If BTC follows its previous fractal pattern, it may enter a consolidation phase lasting several weeks. In the earlier cycle, the market took nearly 45–55 days to stabilize and form a bottom, which occurred in late April 2025.

Applying a similar timeline today suggests that a meaningful recovery could take shape by late November or early December 2025.

Crypto trader Dentoshi weighed in, stating:

“$BTC has consistently bottomed around the 3-day 100 EMA this bull run—but it’s taken 45–96 days to do so.”

Comments are closed.