Featured News Headlines

Bitcoin NAVs “Round-Trip” Wipes Out Billions — Is This the Next Entry Point?

Bitcoin Treasury NAVs Collapse – A steep decline in Net Asset Values (NAVs) across major Digital Asset Treasuries (DATs) has rattled markets, wiping out billions in shareholder value. But according to 10x Research, the collapse may offer a rare window for savvy investors eyeing pure Bitcoin exposure.

The End of Financial Alchemy

In a report shared with Cointelegraph on Friday, analysts at 10x Research declared, “The age of financial magic is ending for Bitcoin treasury companies.” For years, DATs allegedly created “billions in paper wealth” by issuing shares at hefty premiums over their actual Bitcoin (BTC) holdings.

This “magic trick,” as researchers described it, resulted in the transfer of capital from retail investors — who overpaid for shares — into real BTC held by companies. While executives accumulated actual digital assets, everyday shareholders were left holding the bag as NAVs normalized.

Case Study: Metaplanet and Strategy

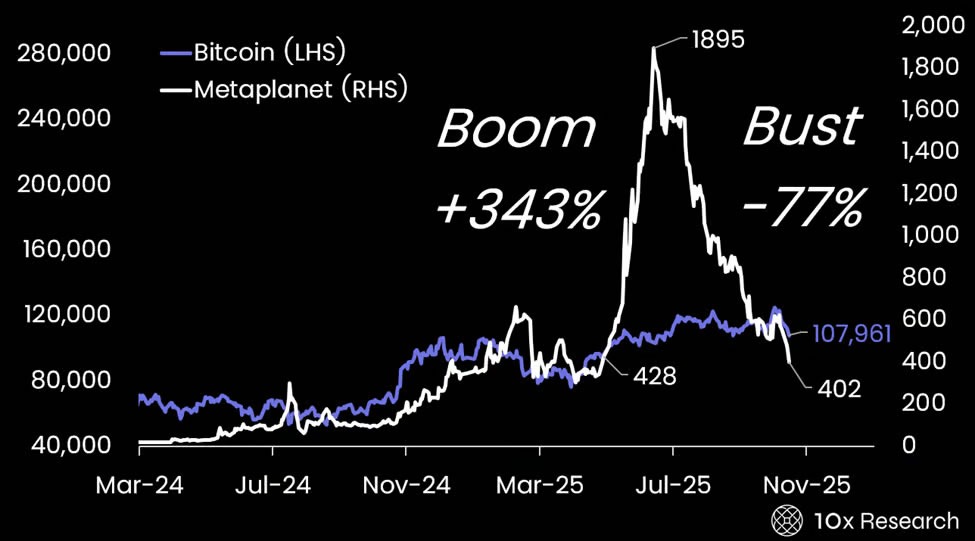

Japan-based Metaplanet, the fourth-largest Bitcoin treasury firm, saw its market cap drop from $8 billion to $3.1 billion, even as its Bitcoin holdings grew from $1 billion to $3.3 billion.

Michael Saylor’s Strategy (MSTR) followed a similar arc, with its stock falling 39% from its November 2024 all-time high of $473.83 to $289.87 on Friday.

Meanwhile, Metaplanet shares (MTPLF) plunged 6.5% on Thursday to 402 yen ($2.67), marking a massive 79% drop since their June peak.

A New Breed of Bitcoin Asset Managers

Despite the bloodbath, 10x Research sees a silver lining. With shares now trading at or below NAV, surviving DATs offer “pure Bitcoin exposure with optionality on future alpha.”

As weaker firms falter, well-capitalized, trading-savvy companies are emerging — poised to define the next bull market and establish a new category of Bitcoin asset managers.

“Bitcoin itself will continue to evolve,” the report concludes, pointing to a reshaped digital asset landscape that favors resilience and real performance over hype.

Comments are closed.