Negative Correlation Between Longs and Price Signals Trouble for Crypto Bulls

Crypto Long Positions Surge – In the aftermath of the October 11 market crash, retail traders have been quick to bet on a rebound. However, recent data suggests that this wave of bullish sentiment could be on shaky ground.

According to a new report by Hyblock Capital, short-term traders are still aggressively backing long positions across major cryptocurrencies. The long ratio — indicating the proportion of long to short positions — is notably high: 68% to 79% across Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and HYPE.

Supporting this view, data from Coinglass reveals elevated Long/Short Account Ratios on Binance:

- BTC: 2.1

- ETH: 2.6

- SOL: 3.7

- HYPE: 2.0

These ratios imply that traders widely expect a V-shaped recovery. But this optimism may be misaligned with market realities.

Correlation Data Suggests Trouble Ahead

What’s concerning is the negative correlation between long ratios and price movements. Hyblock’s data highlights a sharp inverse relationship:

- BTC: -0.93

- ETH: -0.86

- SOL: -0.87

In simple terms, as more traders go long, prices tend to fall — a dynamic already reflected in the market.

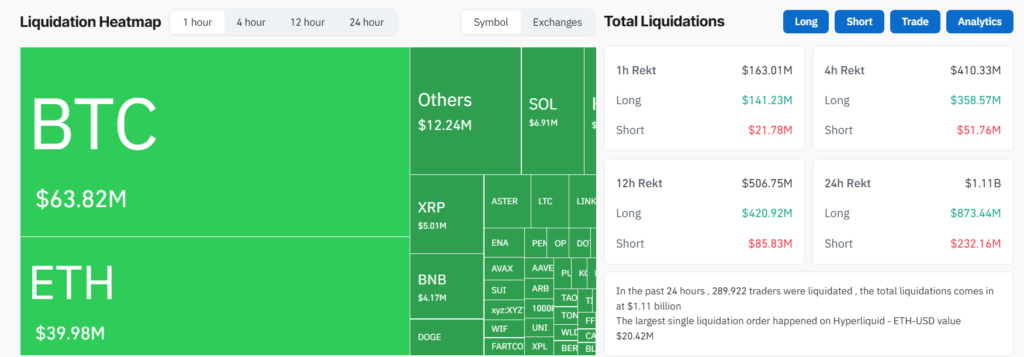

Over $1.1 Billion in Liquidations Signal Caution

The risk is no longer theoretical. Coinglass reports that over 289,000 traders were liquidated in the last 24 hours, with total liquidations hitting $1.11 billion — of which $873 million came from long positions.

As the crypto market capitalization dips below $3.6 trillion, further forced liquidations could follow. With capital drained, many retail traders may lack the funds to re-enter at lower prices, making a quick rebound increasingly unlikely.

In the face of continued sell pressure, the market may remain volatile and range-bound, testing the resilience of even the most optimistic traders.

Comments are closed.