Featured News Headlines

Are Bitcoin Treasury Companies Entering a Bubble? Experts Weigh In

Investor enthusiasm for Bitcoin treasury companies, often known as Bitcoin-stacking firms, is showing signs of fading as the market becomes more discerning. Currently, there are 205 publicly listed Bitcoin treasury companies worldwide, but many have experienced significant declines in their market net asset values (mNAVs) over recent months.

Market Sophistication Drives Demand for Differentiation

David Bailey, CEO of KindlyMD and leader of its Bitcoin accumulation strategy, explained in a CNBC interview that “the market’s getting more sophisticated, it’s learning how to assess what makes treasury companies different.”

Bailey emphasized that to justify launching a Bitcoin treasury company today, a firm must have a unique “edge” or strategic advantage. “It’s kind of like, what’s the edge? Why are you needed?” he said.

Strategies for Standing Out in a Crowded Market

The CEO outlined various ways treasury companies can distinguish themselves, including targeting untapped international markets, focusing on niche asset categories such as credit markets (a strategy used by Michael Saylor), or acquiring operating businesses that generate steady income.

KindlyMD’s Bitcoin Treasury Journey

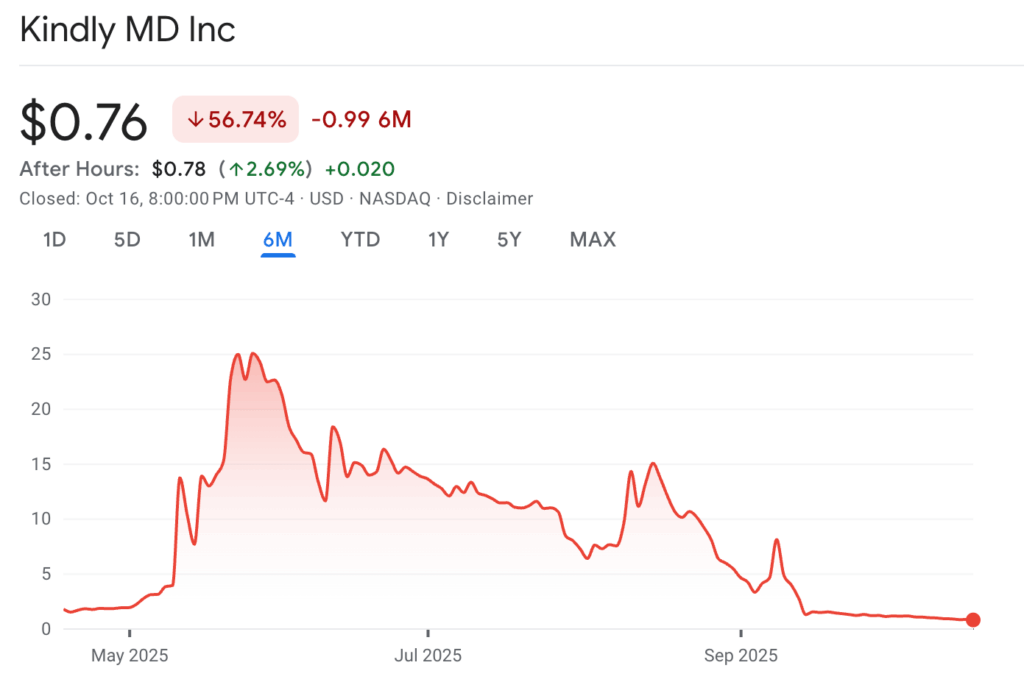

KindlyMD recently merged with Nakamoto Holdings to create a publicly traded Bitcoin treasury company, aiming to accumulate 1 million BTC. The company’s shares have been volatile, with a sharp 55% drop in one day on September 15, following Bailey’s warning about potential short-term price swings.

“We expect share price volatility may increase for a period of time,” Bailey noted in a shareholder letter. At the time of writing, KindlyMD’s stock was trading at $0.76.

Is the Bitcoin Treasury Sector Entering a Bubble?

Industry opinions are mixed on whether Bitcoin treasuries are in a bubble. Bailey believes the strongest firms will progress to “the next stage,” fostering a “healthy space” for the industry.

Public Bitcoin treasuries collectively hold $113.8 billion, according to BitcoinTreasuries.NET, but several companies have seen steep drops in their mNAVs recently.

Standard Chartered highlighted market saturation as a key factor behind declining mNAVs, warning smaller firms face heightened risks.

VC firm Breed cautioned that only a few Bitcoin treasury companies will survive the intense “death spiral” affecting companies trading near their mNAV. Glassnode analyst James Check expressed skepticism about the strategy’s longevity, stating on July 4, “my instinct is the Bitcoin treasury strategy has a far shorter lifespan than most expect.”

Comments are closed.