Featured News Headlines

CME vs Binance: Who’s Winning the Futures Battle?

The flow of speculative capital in crypto markets is signaling a notable shift. Institutional platforms like the Chicago Mercantile Exchange (CME) are beginning to edge out traditionally dominant retail exchanges such as Binance—at least in one key metric.

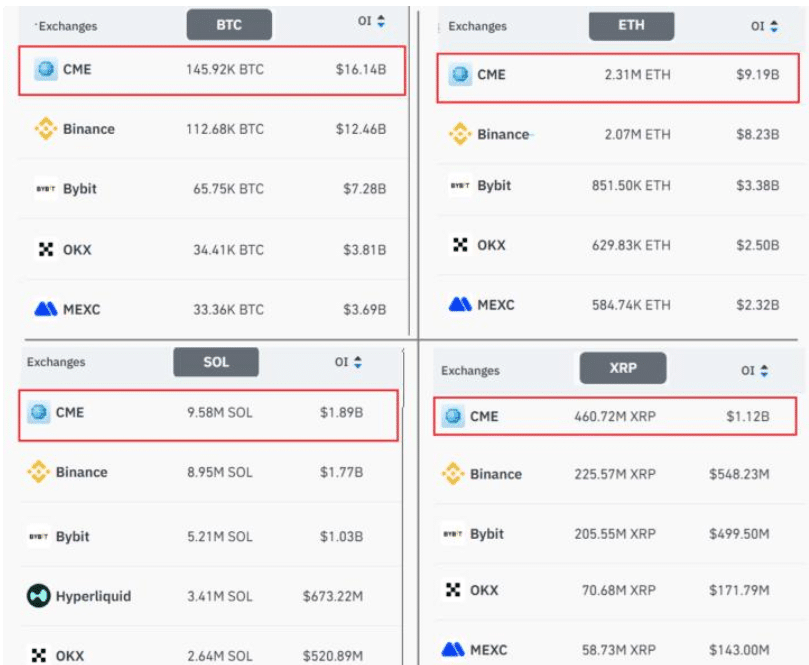

Institutional Interest Surges: CME Leads in Open Interest

In a significant development, CME has surpassed Binance in Futures Open Interest (OI) for major cryptocurrencies. According to recent data, Bitcoin [BTC] Futures OI on CME reached $16.67 billion—approximately 1.34× higher than Binance’s figure.

But this isn’t just about Bitcoin. When including Ethereum [ETH], Solana [SOL], and Ripple [XRP], CME’s aggregate OI reached $28.3 billion, overtaking Binance’s $23 billion and Bybit’s $12.2 billion.

This surge suggests that institutional players are increasingly favoring CME’s regulated infrastructure to gain speculative exposure to crypto markets.

Flash Crash Offers CME a Unique Advantage

The transition didn’t happen in a vacuum.

On October 10, a sharp crypto flash crash triggered total liquidations of $19.2 billion, the highest ever recorded. Yet while most exchanges reeled from the fallout, CME remained relatively insulated.

As a regulated derivatives exchange, CME halts trading at 4:00 p.m. CT on Fridays and resumes on Sundays, leaving it largely immune to weekend volatility. This timing quirk helped the exchange avoid the worst of the October crash, enabling it to retain stronger Open Interest figures compared to peers.

“CME Futures were the only major venue unaffected by the weekend flash crash,” noted analysts reviewing post-crash data.

Binance’s Bitcoin Futures OI dropped 22%, while CME’s fell only 11%, highlighting the exchange’s relative stability during market stress.

Volume Tells a Different Story

Despite CME’s growing dominance in Open Interest, it’s not yet the top player in terms of trading volume—a critical metric for liquidity and market depth.

Binance continues to dominate daily trading activity, with BTC/USD Futures alone generating $56 million in volume. When combined, Binance, OKX, and Bybit process more than $100 billion per day across BTC, ETH, SOL, and XRP Futures.

In comparison, CME’s daily average stands at $14 billion, underscoring that while institutional interest is rising, the bulk of speculative action still occurs on less regulated platforms.

24/7 Trading May Reshape the Landscape

CME’s growing market share in Open Interest could mark the beginning of a broader realignment. The exchange has already announced plans to launch 24-hour futures and options trading by early 2026—a move that could significantly boost its competitiveness.

If successfully implemented, this expansion could attract even more institutional capital and begin to erode the dominance of unregulated exchanges.

Comments are closed.