Featured News Headlines

Dogecoin and SHIB Plunge Amid Market Crash

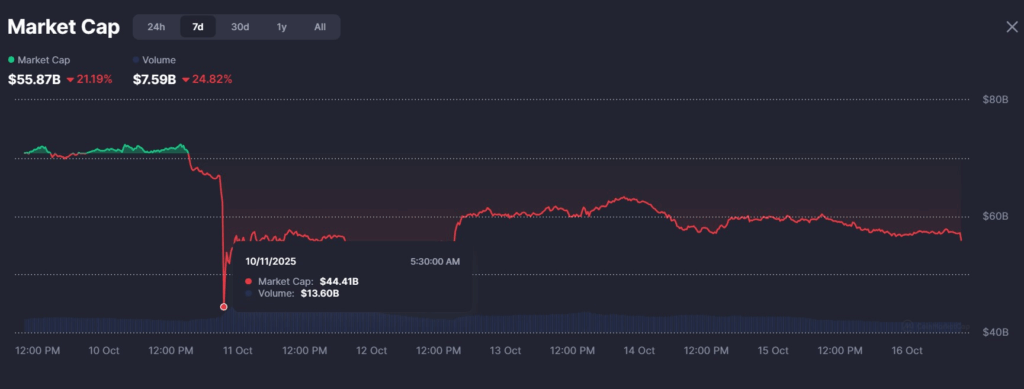

The memecoin sector has suffered a major setback, with total market capitalization plunging to levels not seen since July. This sharp correction follows a broader cryptocurrency sell-off that hit riskier digital assets particularly hard.

According to CoinMarketCap, the memecoin market dropped to $44 billion on Saturday, marking a steep 40% decline from $72 billion just a day earlier. Although it rebounded slightly to $53 billion on Sunday, the overall trend indicates a clear loss of momentum in what had been one of the most speculative corners of crypto.

Summer Gains Erased as Momentum Fades

Over the past four months, the memecoin sector had consistently held above $60 billion in market cap, buoyed by strong retail enthusiasm and meme-driven trading activity, particularly across the Solana and BNB Chain ecosystems. A flurry of new Solana-based memecoins helped ignite a rally in late summer, but recent events have reversed those gains.

At the time of writing, the sector is hovering around $57 billion, still significantly below its recent highs.

Top Memecoins Struggle to Recover

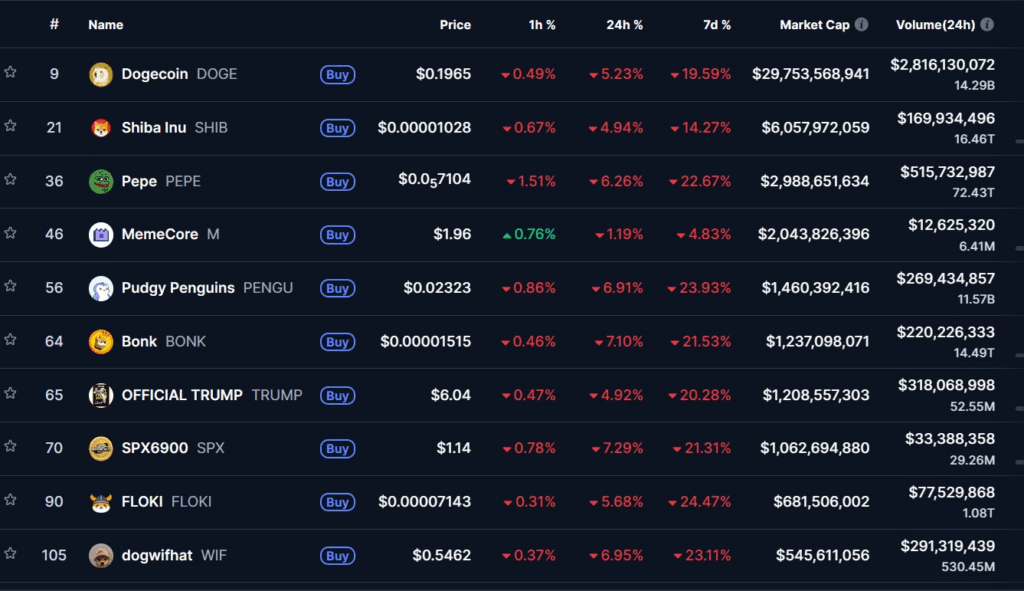

Data from CoinMarketCap reveals that the top 10 memecoins represent over $47 billion, or roughly 82% of the entire memecoin market. All of these tokens are currently in the red, posting losses over both the 24-hour and 7-day charts.

Key tokens such as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) reported weekly losses ranging from 13% to 22%. Other notable names like Bonk (BONK) and Floki (FLOKI) declined by more than 20% over the same period.

Even politically themed tokens were not spared. A memecoin associated with U.S. President Donald Trump fell 20%this week, tracking the wider downturn in meme-based assets.

NFTs and ETFs Rebound as Memecoins Lag

While memecoins remain in recovery mode, other sectors of the digital asset market have shown signs of stabilization. NFTs, which lost around $1.2 billion in value—a 20% drop—during the crash, rebounded quickly, recovering 10% just one day later.

Meanwhile, crypto investment products have begun attracting capital again. Spot Bitcoin ETFs recorded $102 million in net inflows on Tuesday, while Ether ETFs saw $236 million flow in, indicating renewed investor confidence.

Bitcoin and Ether Show Signs of Strength

Despite the broader market correction, major cryptocurrencies have shown resilience. Bitcoin (BTC), which dropped to $102,000, has since recovered to trade above $111,000, according to CoinGecko. Ether (ETH), which briefly dipped below $3,700, is once again trading above $4,000.

The contrast between established digital assets and memecoins highlights the differing levels of volatility and investor confidence across crypto subsectors.

Comments are closed.