Featured News Headlines

Gold Surges, Bitcoin Stumbles – Safe Haven Debate Reignites

Amid growing concerns over inflation, rising debt levels, and uncertainty around the Federal Reserve’s independence, gold has surged to record highs, climbing above $4,000 per ounce in October. The precious metal has gained over 60% year-to-date, significantly outperforming most major asset classes.

Analysts attribute this momentum to what JPMorgan has called the “debasement trade” — a strategy where investors seek protection from fiat currency erosion by pivoting toward hard assets like gold and Bitcoin.

Bitcoin and Gold: Same Trade, Different Paths

Despite both assets being central to the debasement narrative, their recent price actions have diverged sharply. Bitcoin dropped 8% over the past week, trading at $111,207, while gold gained nearly 6% during the same period.

“Gold buying has accelerated this year, but global dollar-denominated debt is over $50 trillion. The world hasn’t weaned itself off the dollar yet, and that could disrupt anti-dollar trades if the greenback rallies unexpectedly,” said Nic Puckrin, crypto analyst and co-founder of The Coin Bureau.

He further warned: “Gold and Bitcoin remain strong long-term bets, but any unexpected spike [in the dollar] could cause a lot of pain.”

Safe-Haven Status: Bitcoin Under Scrutiny

As tensions rise globally — from U.S. fiscal deficits to renewed trade friction with China — many investors are reevaluating Bitcoin’s role as a store of value. A $19 billion selloff in crypto has raised fresh doubts.

“Bitcoin follows other risk assets… it’s not a safe haven store of value the way gold is. The world is going off the dollar standard and back onto a gold standard,” said Peter Schiff, a well-known Bitcoin critic, during a recent podcast.

His comments reflect a growing skepticism, especially as some investors now see Bitcoin behaving more like a tech stock than an inflation hedge.

Is the Digital Gold Narrative Still Alive?

Despite the volatility, some market participants argue that Bitcoin’s role in the debasement trade remains relevant.

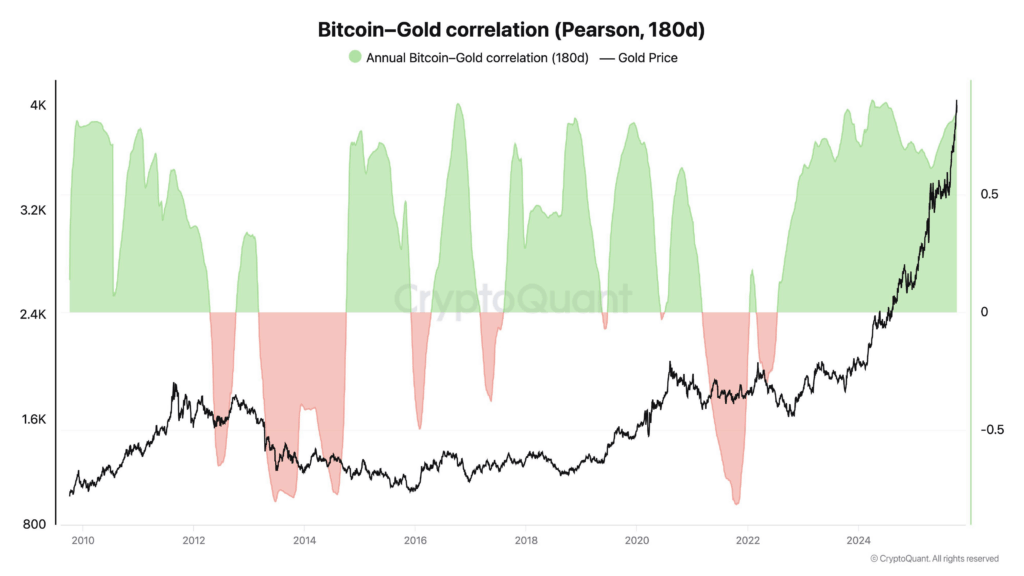

“Bitcoin and gold will outlast any other currency,” wrote Tether CEO Paolo Ardoino on X, emphasizing their potential as long-term stores of value. On-chain metrics also point to a rising correlation between Bitcoin and gold, hinting that institutional portfolios may still view them as complementary.

“BTC-Gold correlation is high; digital gold narrative still alive. Inflation hedge demand isn’t dead yet,” said Ki Young Ju, CEO of Cryptoquant.

ETF Flows and Institutional Shifts

Another area of concern is the flow of institutional capital. Some experts suggest that money flowing into Bitcoin ETFshas come at the expense of gold ETFs. If sentiment shifts again, it could reverse.

“The biggest risk for Bitcoin is all the money that has piled into Bitcoin ETFs that came out of gold ETFs. Many of those investors may go back to gold,” Schiff added.

He also noted that companies holding Bitcoin on their balance sheets could face pressure to sell during downturns, which may amplify market volatility.

Debasement Trade: Still in Play?

Despite short-term divergences and differing risk profiles, the demand for non-fiat assets continues to grow. Whether investors lean toward gold, Bitcoin, or both often depends on their time horizon and risk tolerance.

Gold brings centuries of monetary trust and global acceptance. Bitcoin, on the other hand, offers digital portability, fixed supply, and censorship resistance, but remains subject to market sentiment and regulatory shifts.

While the “debasement trade” remains a topic of debate, the underlying forces driving it — inflation, debt, and geopolitical uncertainty — show no signs of fading.

Comments are closed.