Featured News Headlines

Can DOGE Hold $0.18 Support Amid Growing Bearish Pressure?

A significant Dogecoin [DOGE] transaction has sparked renewed market attention after 132 million DOGE tokens, valued at approximately $27 million, were transferred from an unidentified wallet to Robinhood.

Such whale activity has historically preceded short-term pullbacks, as large holders often shift tokens to exchanges prior to selling. The timing of this transfer, coupled with fading retail participation, suggests whales are exerting greater influence over DOGE’s price movements.

“With liquidity thinning across exchanges, any large sell order could significantly impact price volatility,” analysts noted.

Interestingly, Dogecoin prices did not immediately plunge after the transfer — signaling caution among traders rather than outright panic.

Bulls Defend Key Support Amid Bearish Sentiment

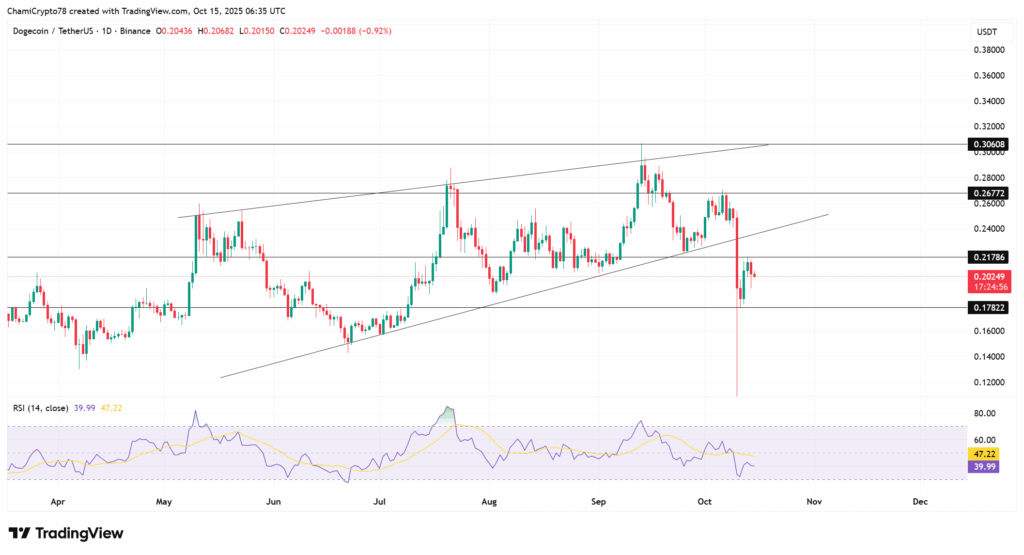

Dogecoin continues to trade within an ascending price channel, though the $0.22 resistance level has repeatedly capped upward momentum. As of publication, the price hovers near the $0.18–$0.20 demand zone, an area that has previously attracted bullish defense.

The Relative Strength Index (RSI) stands at 39.99, indicating weak buying momentum and a slight bearish bias in the short term.

Still, holding above $0.18 preserves the broader structure for a potential rebound. A confirmed breakout above $0.22 could invalidate the current bearish outlook and pave the way for a short-term relief rally.

Derivatives Market Shows Bearish Dominance

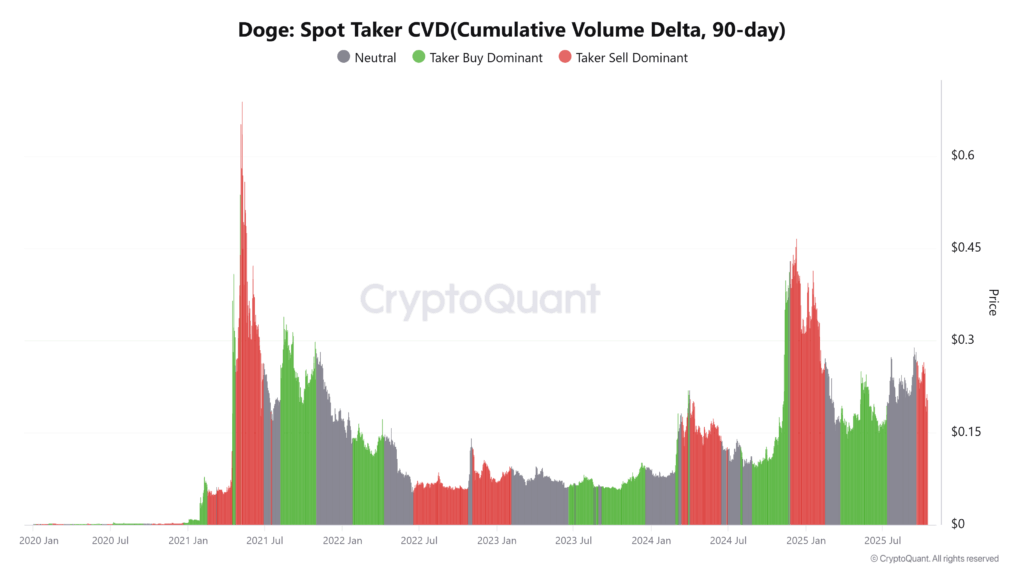

According to CryptoQuant’s Spot Taker CVD data, the derivatives market continues to favor sellers. “Sell-side dominance has persisted across the last 90 days,” the platform reported, highlighting reduced trader confidence.

This ongoing pressure has led many leveraged long positions to unwind, decreasing liquidity depth and raising the probability of volatile intraday swings.

Although a short squeeze could provide bulls with a temporary lift, current market dynamics suggest sell-side momentum remains in control.

Elevated NVT Ratio Flags Valuation Concerns

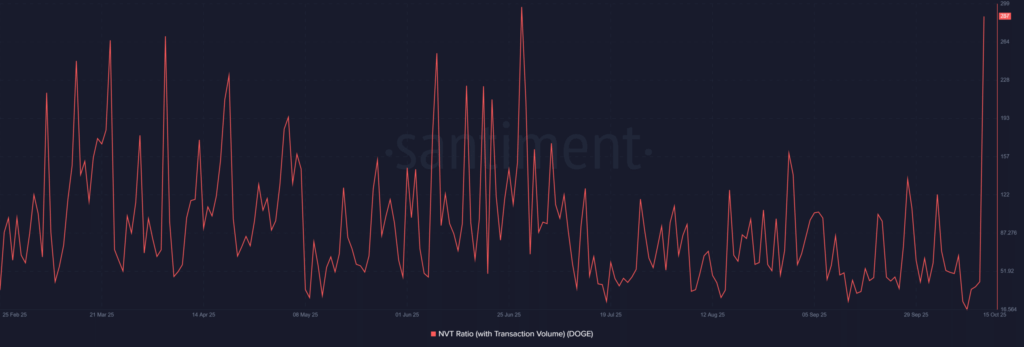

Data from Santiment reveals that Dogecoin’s Network Value to Transactions (NVT) Ratio has surged to 287 — a level that typically indicates an overvalued network.

Historically, similar spikes in the NVT ratio have signaled that speculative sentiment is outpacing real on-chain utility, often preceding price corrections.

“An increase in transaction volume would be needed to rebalance valuation metrics,” analysts suggest, “but until then, the elevated NVT remains a red flag.”

Can DOGE Avoid Another Breakdown?

Dogecoin’s short-term outlook remains fragile. The recent whale transfer to Robinhood, combined with persistent sell-side control in derivatives and weak on-chain activity, paints a cautious picture.

DOGE’s ability to hold above the $0.18 level may be crucial in defining its trajectory. A successful defense could revive buyer interest and target a return to $0.22. However, failure to maintain this support could open the door to further downside.

For now, market sentiment remains tilted bearish, with continued exchange inflows suggesting traders are preparing for potential additional volatility.

Comments are closed.