Featured News Headlines

Bitcoin and Ethereum ETF Assets Hit $153B Amid Fed Pivot Expectations

Bitcoin and Ethereum ETFs – U.S. spot Bitcoin and Ether ETFs staged a sharp comeback on Tuesday following comments from Federal Reserve Chair Jerome Powell, who hinted at a potential shift toward rate cuts before the end of the year.

ETF Inflows Surge Amid Dovish Fed Tone

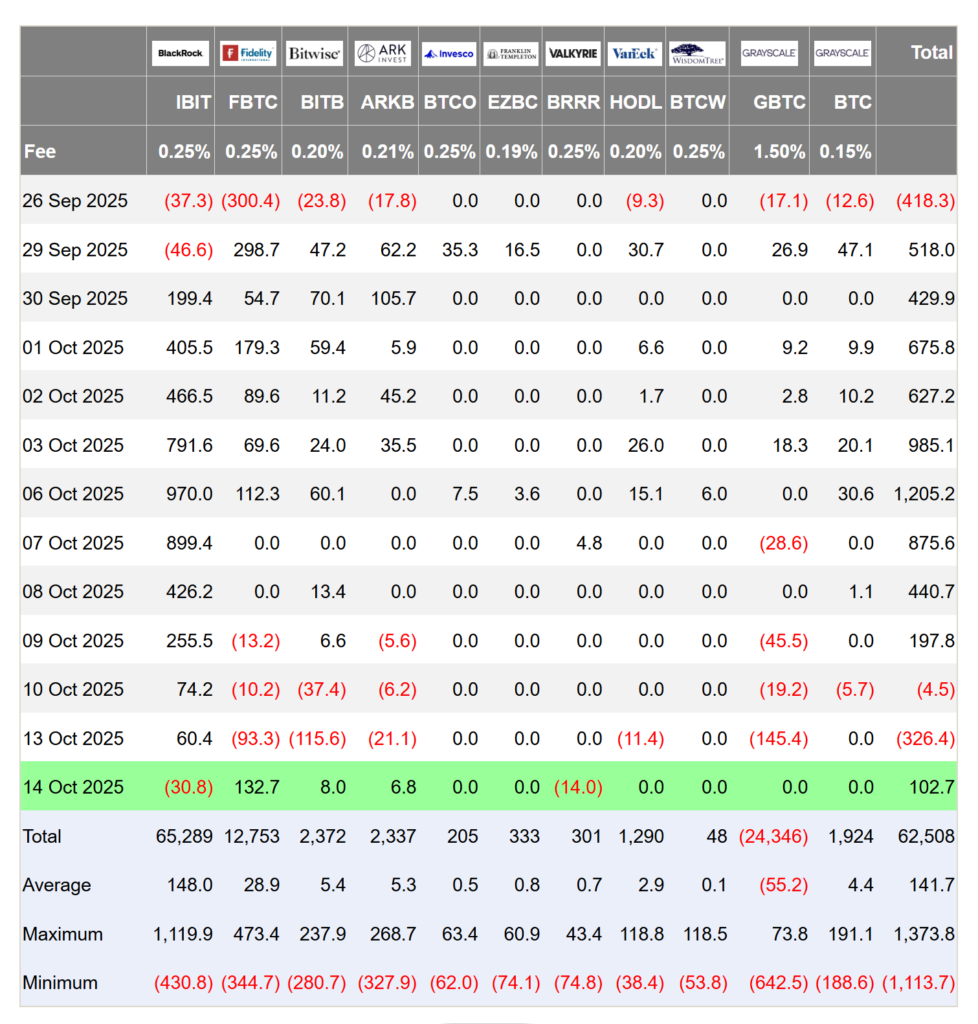

After a major outflow on Monday, spot Bitcoin ETFs saw a net inflow of $102.58 million, according to SoSoValue. Leading the pack was Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $132.67 million in inflows, while BlackRock’s iShares Bitcoin Trust (IBIT) posted a $30.79 million outflow.

Total net assets across all spot Bitcoin ETFs climbed to $153.55 billion, accounting for 6.82% of Bitcoin’s total market cap. Cumulative inflows now stand at $62.55 billion, highlighting sustained investor interest.

Ethereum ETFs Join the Rally

Ether ETFs followed suit, recording $236.22 million in net inflows after a steep $428 million outflow just a day prior. Fidelity’s Ethereum Fund (FETH) led with $154.62 million, followed by Grayscale’s Ethereum Fund with $34.78 million, and Bitwise’s Ethereum ETF with $13.27 million.

Powell Teases End of Tightening, Markets React

Speaking at the National Association for Business Economics conference, Powell noted the Fed may be nearing the end of its quantitative tightening program, with reserves now “somewhat above” adequate liquidity levels. He also acknowledged growing signs of a weakening labor market.

According to Vincent Liu, CIO at Kronos Research, “An October rate cut will have markets taking flight, with crypto and ETFs seeing liquidity flow and sharper moves.”

Crypto Resilience Amid Market Turmoil

Despite recent volatility, crypto investment products remained resilient, pulling in $3.17 billion in inflows last week—even as $20 billion in positions were liquidated due to renewed US-China tariff tensions, per CoinShares.

So far in 2025, total inflows have reached $48.7 billion, already surpassing last year’s total. Liu added that easing geopolitical tensions and inflation hedges are “fueling fresh demand for digital assets.”

Comments are closed.