Featured News Headlines

- 1 Binance USDe De-Peg Causes Massive Market Shakeup

- 2 Market Overview: BTC Dominance Stable Amid Historic Liquidations

- 3 USDe’s Structural Risks Highlighted by OKX Founder Star Xu

- 4 Technical Analysis: Indicators Reflect Market Volatility and Caution

- 5 Outlook: Risk Management and Market Vigilance Remain Crucial

Binance USDe De-Peg Causes Massive Market Shakeup

The recent de-pegging of Ethena’s USDe stablecoin has reignited concerns over systemic risks in the crypto market, culminating in a historic $19 billion liquidation event. OKX founder Star Xu has urged the industry to reconsider how USDe and similar tokens are classified and managed to prevent future contagions.

Market Overview: BTC Dominance Stable Amid Historic Liquidations

Bitcoin dominance currently stands at approximately 46.8%, with the total crypto market capitalization around $2.25 trillion. Despite Bitcoin’s relative stability, the market experienced a massive shakeup last Friday when USDe briefly lost its peg, dropping 35% on Binance before regaining stability. This triggered forced liquidations worth $19 billion, the largest in crypto history, surpassing even the FTX collapse and pandemic-related sell-offs.

Altcoins bore the brunt of the fallout, with many tokens dropping over 90%. Compounding the chaos, intermittent access issues on Binance prevented market makers from injecting liquidity to stabilize USDe’s price, intensifying the market-wide sell-off.

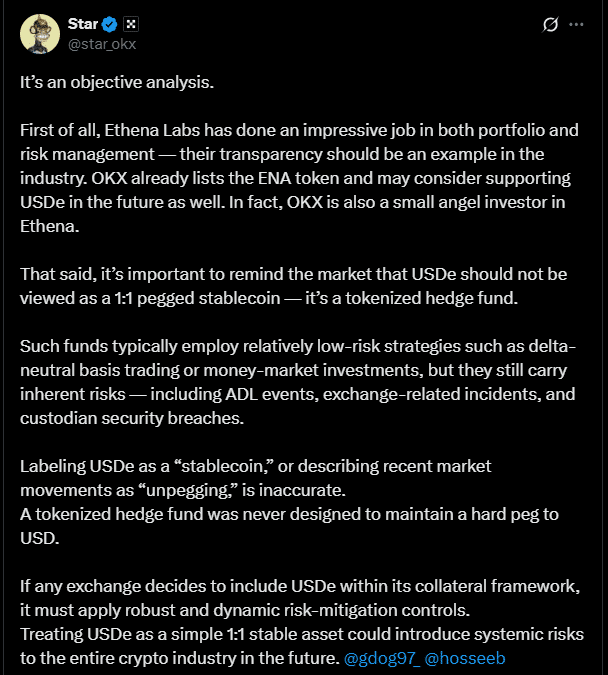

USDe’s Structural Risks Highlighted by OKX Founder Star Xu

In a statement addressing the recent turmoil, OKX founder Star Xu emphasized that USDe should be regarded not as a traditional stablecoin but rather a “tokenized hedge fund” with inherent de-pegging risks. Xu cautioned that treating USDe as a 1:1 USD stablecoin could introduce systemic vulnerabilities to the entire crypto ecosystem.

“USDe is not designed to maintain a hard peg to the U.S. dollar,” Xu said. “Robust risk controls are essential; without them, the entire market could face rapid collapse.”

This perspective responds directly to Ethena founder Guy Young’s claim that last Friday’s price drop was an isolated Binance event and “not a true de-peg.” However, the market consequences suggest broader implications.

Haseeb Qureshi, Partner at VC Dragonfly, likened the incident to a wildfire exacerbated by blocked firefighting efforts. “It’s like a fire broke out on Binance, but all of the roads were blocked and firefighters couldn’t make their way in,” he explained.

Technical Analysis: Indicators Reflect Market Volatility and Caution

Bitcoin’s technicals remain mixed amid the fallout. The Relative Strength Index (RSI) hovers around 50, signaling neutral momentum, while the Moving Average Convergence Divergence (MACD) shows flattening trends after recent volatility. Directional Movement Index (DMI) lines indicate slight bearish pressure, with the -DI marginally above +DI.

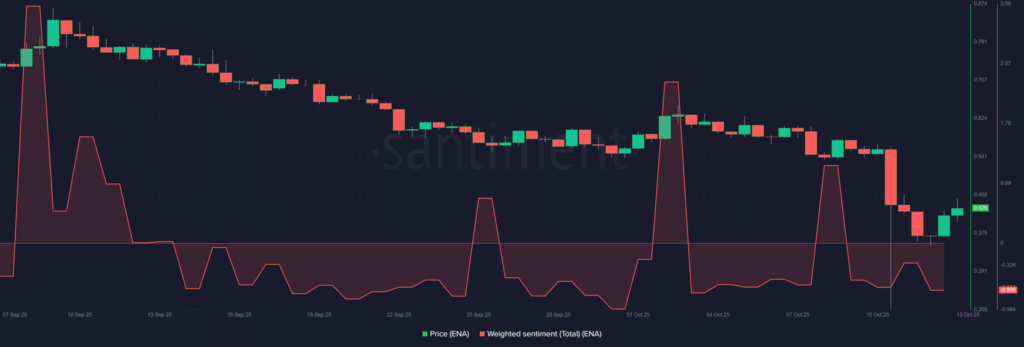

Meanwhile, ENA token — Ethena’s native asset — rebounded over 10% following the de-peg event, paralleling a modest market-wide recovery. However, overall market sentiment remains cautious, reflected in subdued trading volumes and ongoing volatility.

Outlook: Risk Management and Market Vigilance Remain Crucial

The USDe de-pegging and resulting liquidations serve as a stark reminder of the fragile nature of certain stablecoins and tokenized assets within the crypto space. Market participants and regulators alike will be watching closely for enhanced risk frameworks and clearer token classifications.

While Bitcoin continues to hold support, altcoins face an uphill battle in regaining investor confidence. As liquidity providers and market makers navigate ongoing challenges, the next weeks will be critical in determining whether this episode marks a temporary shock or signals deeper systemic vulnerabilities.

Traders should monitor on-chain data, technical indicators, and exchange liquidity closely to navigate potential volatility in the coming sessions.

Comments are closed.