XRP Price Sinks, $2.50 Turns Resistance After $8.13M Liquidation

XRP traders faced a brutal start to the week as a wave of liquidations wiped out millions in long positions within a mere four-hour window, marking one of the heaviest long/short imbalances seen in recent times.

Longs Take a Beating

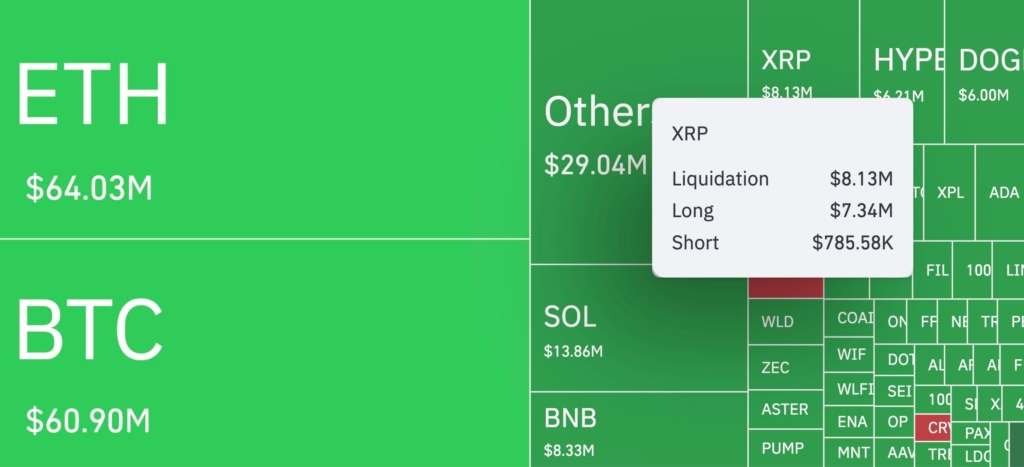

According to CoinGlass, a staggering $8.13 million in XRP positions were liquidated, with long traders bearing the brunt—$7.34 million in longs erased compared to just $785,000 in shorts. That’s a 935% imbalance, a striking signal of how aggressively bulls were positioned versus bears.

Unlike a single sharp move, the XRP price dropped gradually from above $2.60 to a low of $2.41, before stabilizing around $2.44. This slow bleed forced wave after wave of long traders to exit, fueling the liquidation counter with each leg down. Meanwhile, short positions remained mostly untouched, suggesting sellers were able to maintain pressure without needing heavy leverage.

Market-Wide Liquidations Top $240M

The pain wasn’t limited to XRP. Across the crypto market, $241.6 million in total liquidations occurred during the same four-hour stretch. Ethereum (ETH) saw $64 million wiped, followed by Bitcoin (BTC) with $60.9 million, Solana (SOL) at $13.8 million, and Binance Coin (BNB) with $8.3 million.

Still, XRP’s positioning stood out for its vulnerability. The now-lost $2.50 level, once key support, has flipped into resistance. Unless bulls reclaim that zone, the chart risks further downside toward $2.40 and below. With leverage still tilted against long traders, any bullish momentum could once again face swift rejection.

For now, traders eyeing relief may look to Bitcoin dominance for clues—but with such a lopsided imbalance, XRP bulls have little room left for error.

Comments are closed.