Featured News Headlines

Binance Under Fire as Record Crypto Liquidations Hit

A sudden and violent market correction on Friday triggered the largest liquidation event in crypto history, wiping out billions in open interest and sending shockwaves through both centralized and decentralized trading platforms.

Historic Liquidation and Volatility Spike

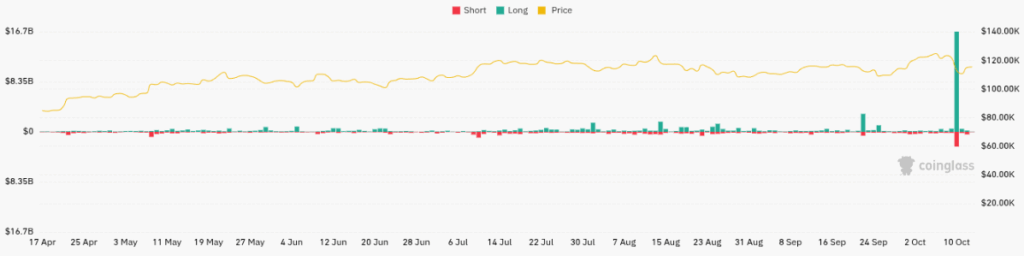

According to data from CoinGlass, the total crypto market capitalization plunged from over $2.03 trillion to $1.82 trillion within hours on Friday, driven by $19.1 billion in forced liquidations — including $16.7 billion in long positions and $2.45 billion in shorts. Bitcoin (BTC) briefly nosedived from $114,400 to $102,000, while Ethereum (ETH) slumped from $4,108 to $3,500. Solana (SOL) also dropped below the $140 mark after trading near $193 earlier in the day.

Bitcoin dominance climbed to 52.9% as capital fled altcoins, and the Crypto Fear & Greed Index fell to 31, its lowest since March, signaling elevated risk aversion.

Underreported Liquidations Raise Transparency Concerns

As market participants attempt to assess the full extent of the damage, questions are mounting about the accuracy of liquidation data reported by centralized exchanges. Hyperliquid CEO Jeff Yan highlighted a critical limitation in Binance’s reporting structure. In a Monday post on X, Yan pointed to Binance’s liquidation snapshot stream documentation, which only logs the last liquidation per trading pair each second — potentially masking high-frequency bursts of liquidations during extreme volatility.

“Because liquidations happen in bursts, this could easily be 100x under-reporting under some conditions,” Yan warned, echoing a similar concern raised by CoinGlass over the weekend.

The fallout was evident: more than 6,300 wallets saw a combined $1.23 billion in losses, and over 1,000 Hyperliquid wallets were fully liquidated during the crash. Some users on Binance reported UI malfunctions during the sell-off, with order buttons freezing and stop orders failing to trigger. While Binance later attributed the issue to a display error caused by decimal point adjustments, traders remain skeptical.

Decentralized Platforms Show Resilience

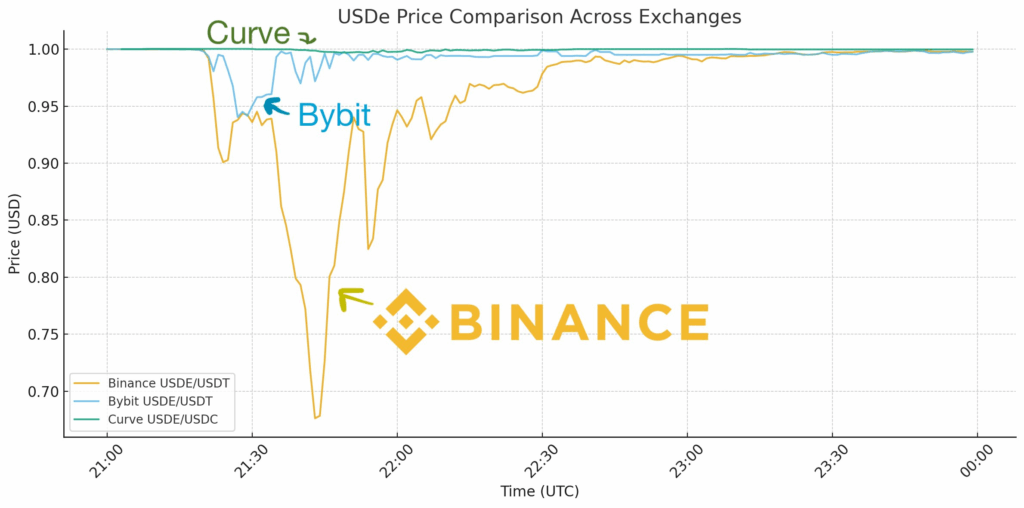

In contrast, decentralized protocols showed surprising stability. Ethena Labs’ synthetic stablecoin USDe maintained its peg on Curve even as it fell to $0.70 on Binance and $0.95 on Bybit. Ethena CEO Guy Young reported that $2 billion in redemptions were processed without disruption across Curve, Fluid, and Uniswap.

“The core minting and redemption mechanics functioned exactly as designed, even during extreme volatility,” Young stated. The smooth operation of DeFi liquidity protocols during the crash has reignited debate over the fragility of centralized finance in moments of market stress.

Technical Analysis: Indicators Suggest Oversold Conditions

Bitcoin’s Relative Strength Index (RSI) has dropped sharply to 28 on the daily chart, indicating deeply oversold conditions. The Moving Average Convergence Divergence (MACD) is signaling strong bearish momentum, with the MACD line extending below the signal line. Directional Movement Index (DMI) readings also confirm the dominance of sellers, as the -DI surged above 35 while +DI fell under 15.

However, volume indicators are starting to taper off, suggesting capitulation may be nearing exhaustion. Key support now lies at $100,000 for BTC, while ETH must hold above the $3,500 level to avoid further downside.

Volatility Persists as Traders Eye Reentry

With leveraged positions flushed and technical indicators pointing toward oversold conditions, short-term relief rallies are plausible. However, with macro uncertainties — including U.S.-China tariff escalations — weighing on risk appetite, analysts caution that volatility will likely remain elevated.

Investors are now watching whether decentralized protocols can continue to offer a more stable trading environment during future shocks — and whether centralized platforms will address data transparency and order execution reliability under extreme pressure.

Comments are closed.