Featured News Headlines

Crypto Whale Shorts $163M in Bitcoin After $192M Profit

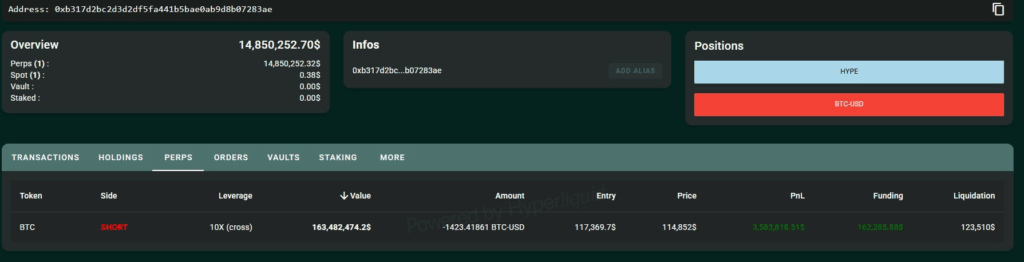

A high-profile crypto trader known for a remarkably timed $192 million short bet has returned with yet another massive leveraged position against Bitcoin. The anonymous trader, identified by wallet address 0xb317, placed a new $163 million short position on Bitcoin through the decentralized derivatives exchange Hyperliquid on Sunday.

Whale Profits Again as Bitcoin Slips

This new 10x leveraged perpetual short is already in the green, reportedly up $3.5 million in unrealized profits. However, the position is set to be liquidated if Bitcoin (BTC) surpasses $125,500.

The same wallet shocked the crypto community last Friday by opening a massive short just 30 minutes before former U.S. President Donald Trump’s new tariff announcement, which triggered a steep market decline. That move resulted in a staggering $192 million profit.

Market Manipulation Concerns Surface

Observers speculate the trader may have helped trigger a broader market cascade. An analyst known as “MLM”commented:

“The crazy part is that he shorted another nine figures worth of BTC and ETH minutes before the cascade happened… And this was just publicly on Hyperliquid, imagine what he did on CEXs or elsewhere.”

Since the crash, over 250 wallets reportedly lost millionaire status on Hyperliquid, according to HyperTracker.

Binance Denies Role in Crash

Amid speculation, Binance was accused of contributing to the meltdown due to failed stop-losses and order book issues. However, the exchange responded, saying there was no crash but rather a “display issue.” Binance also confirmed its systems remained operational and offered $283 million in compensation for affected users.

Community Reaction

Janis Kluge, a researcher at SWP Berlin, reflected on the event:

“Crypto people are realizing today what it means to have unregulated markets: Insider trading, corruption, crime, and zero accountability.”

Comments are closed.