Ethereum Recovers Slightly: Is a Reversal Coming?

After a significant drop that saw its price drop below $4,000, Ethereum is now seeing a little comeback. Following recent volatility, investors are reevaluating their positions, although the market as a whole is still cautious. The increasing tendency may reverse as a result of this circumstance.

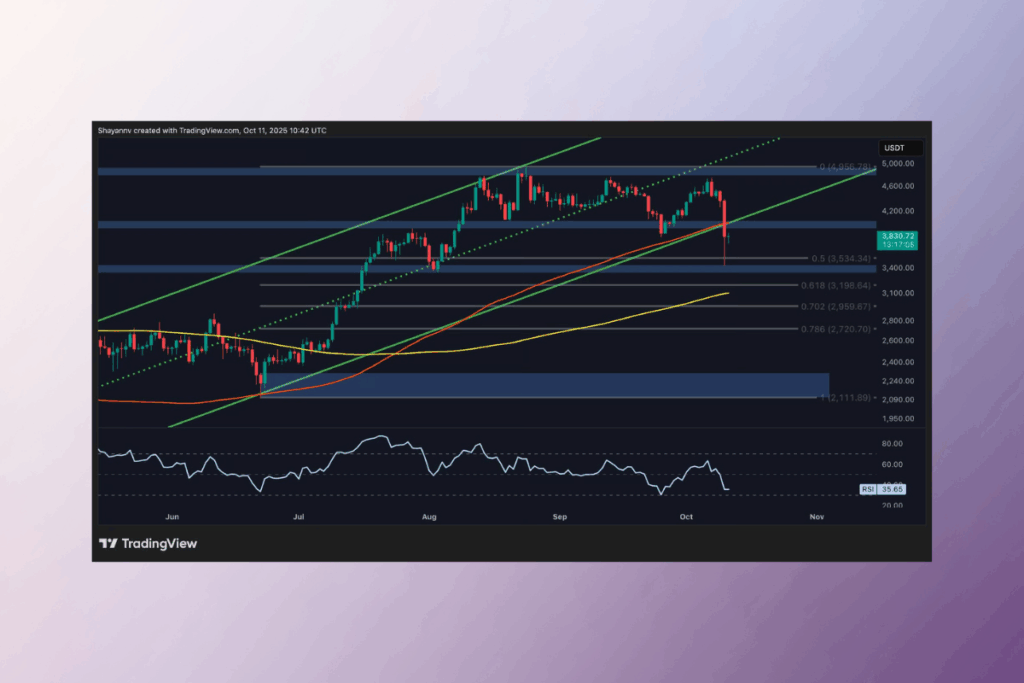

Ethereum Struggles to Stay Afloat After Breaking Key Technical Levels

Daily, ETH just fell below both the 100-day moving average and the midpoint of its rising channel. The 0.5 Fibonacci retracement level, which is situated in the $3,400–$3,500 region, was then touched. When this zone aligns with the prior structure support, a bounce toward $3,800 is initiated. The RSI is still below 40, though, indicating a lackluster momentum. Failure to regain the channel would probably drop ETH below the $3,000 range, which would signal the conclusion of the bull market. However, a daily close back above $4,000 could signal a short-term recovery.

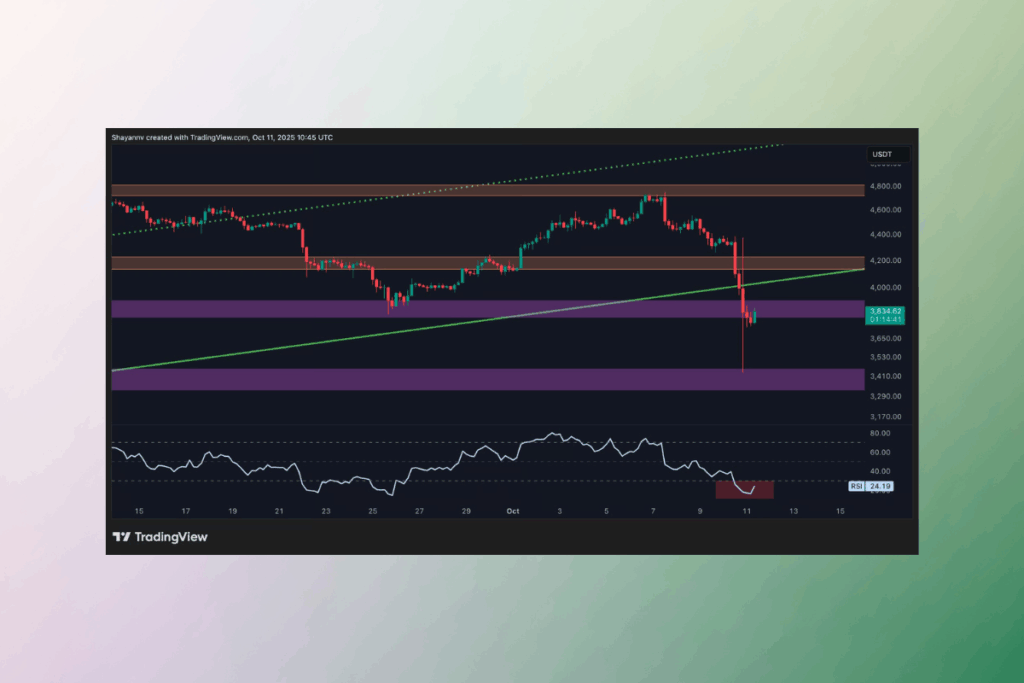

ETH Enters Oversold Zone: Can Bulls Push Price Back Toward $4,200?

According to the 4-hour chart, Ethereum experienced a steep loss before finding brief support in the $3,400 demand zone. Right now, the RSI is sitting around 24 after entering the oversold zone. A possible short-term reversal is indicated by this. The $3,800 resistance level is still crucial, though. A retest of $3,400 might result from a rejection at this level. But a distinct break might reopen the way to $4,200.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.