Trump Escalates Trade Tensions: Rare Earth Restrictions Lead to Stock Sell-Offs

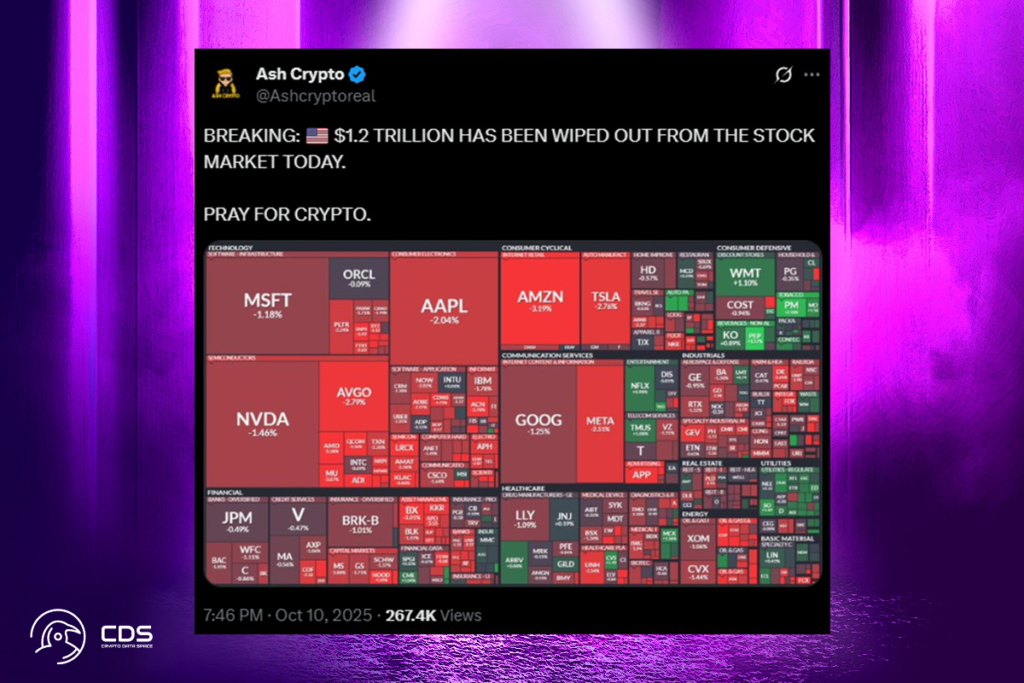

Donald Trump declared that, as of November 1, he would levy an additional 100% tariff on goods originating from China. China’s decision to limit shipments of rare earth minerals necessary for high-tech production has prompted this forceful response. As investor risk appetite waned, the news caused broad volatility in global equities, which resulted in sharp drops in stocks tied to cryptocurrency.

Crypto Stocks Tumble as US-China Trade Tensions Trigger Market Sell-Off

Crypto-related stocks were immediately impacted by the widespread market sell-off that was triggered by the re-escalating trade tensions between the US and China. Leading digital asset businesses witnessed steep drops overall as of Friday’s New York market close. Coinbase (COIN), a global cryptocurrency exchange, finished at $357.01, a 7.75% decrease from its previous close of $387. As a result of investors’ increasing risk aversion, the stock began at $387.66 and dropped as low as $351.63 during the day.

- Bullish (BLSH), a cryptocurrency financial services company, also reported sharp losses, falling 9.42% to $60.37 from the previous close of $66.65.

- Metaplanet, a Bitcoin treasury firm based in Japan, closed at $3.48, down 2.25% from the previous closing of $3.56.

- MARA Holdings, Inc. (MARA), a bitcoin mining company, saw one of the biggest drops, closing at $18.65, down 7.67%.

MSTR Faces Pressure as mNAV Falls, Sparking Investor Apprehension

The sell-off also severely impacted Strategy (MSTR), a prominent Bitcoin treasury company. On the same day, the stock finished at $304.79, down 4.84% from $320.29 the day before. It saw considerable volatility throughout the session, ranging from a high of $323.43 to a low of $303.57. More significantly, the emphasis is now on the growing apprehension regarding the company’s basic value measures rather than the short-term stock decrease. Almost two years and nineteen months have passed since the company’s multiple-to-net asset value (mNAV) fell below 1.180, according to analysts.

Standard Chartered’s Head of Digital Assets Research, Geoffrey Kendrick, cautioned that in order for digital-asset treasury (DAT) firms to increase their holdings, they must keep their mNAV over 1.0. According to him, values below that cutoff point lead to weaker balance sheets and increased industry-wide consolidation pressure.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.