October BTC Sell-Off: Short-Term Panic or Buy-the-Dip Opportunity?

Bitcoin (BTC) plunged by 17% shortly after former President Donald Trump’s post on Truth Social, but the drop may not have been coincidental. On-chain data suggests that large investors, or “whales,” placed multi-billion dollar short positions on BTC and Ethereum (ETH) just two days before the announcement.

Was the Crash Manipulated?

Although it’s unclear whether the trades came from the same entity, the timing has raised eyebrows across the crypto community. The short position doubled hours before the public announcement, leading to over $20 billion in liquidations as BTC crashed from $122,000.

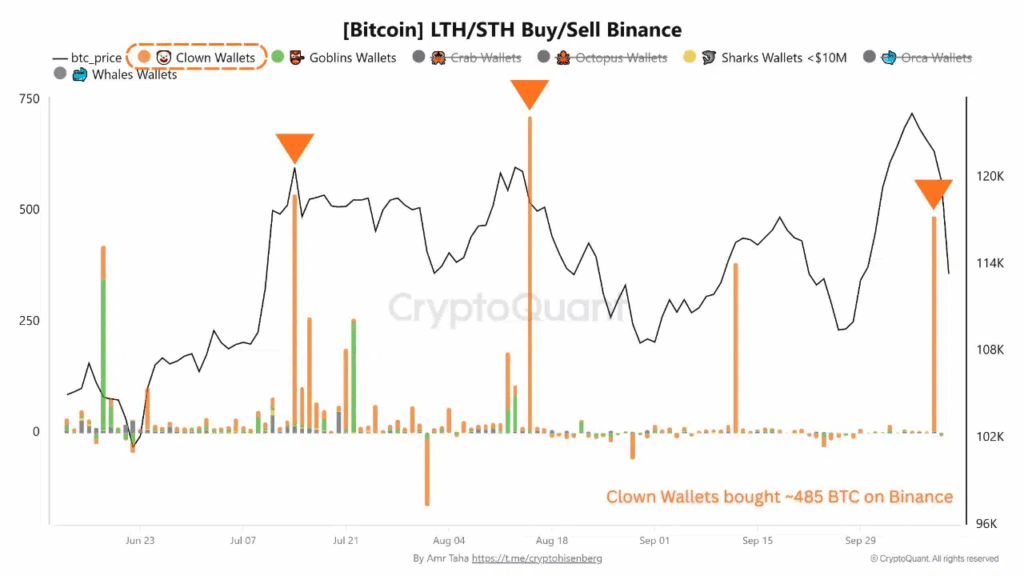

Short-term holders (STHs) were hit hardest, having purchased nearly 500 BTC at local highs. This marks the fourth time in recent months that retail traders bought heavily at market tops, only to face abrupt sell-offs.

Meanwhile, long-term holders (LTHs) remained unfazed. Exchange reserves continued to decline, signaling ongoing accumulation despite market volatility.

Historical Patterns Hint at Recovery

While the sell-off caused concern, historical data offers a potential silver lining. According to economist Timothy Peterson, Bitcoin has experienced October pullbacks of 5% or more only four times in the last decade—in 2017, 2018, 2019, and 2021. Each time, the market rebounded within a week, sometimes with gains exceeding 20%.

As October 2025 unfolds, some analysts suggest we may be witnessing a familiar pattern: panic-driven selling followed by a sharp recovery.

“Retail investors react emotionally to news shocks, but long-term trends often resume shortly after,” Peterson noted.

While market sentiment remains fragile, the historical resilience of Bitcoin during October may hint that the current dip is a setup, not a selloff.

Comments are closed.