Featured News Headlines

$5.6B in BTC and ETH Options Set to Expire

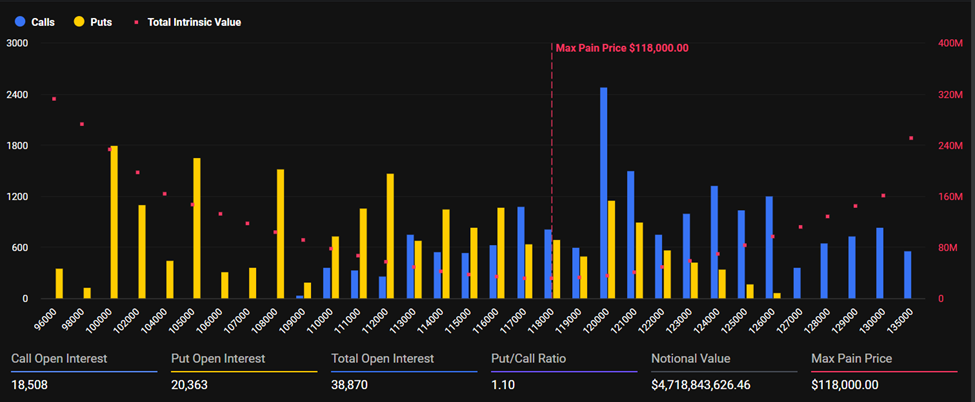

The crypto market faces heightened uncertainty as over $5.6 billion in Bitcoin and Ethereum options are set to expire today, according to data from Deribit. This event is being closely watched by both retail and institutional investors, as it could influence short-term market direction.

Bitcoin dominates the expiry volume with a notional value of $4.7 billion, while Ethereum follows with $944.5 million. The max pain price for BTC sits at $118,000, suggesting a potential battleground for price action. Open interest for BTC options stands at 38,870 contracts, with traders split between $110K puts and $120K calls—a clear indication of market indecision.

“BTC traders are split between $110K puts and $120K calls, while ETH flows are more bullish,” Deribit analysts noted.

Bullish Tilt for Ethereum Ahead of Expiry

Ethereum’s options market is showing more bullish sentiment, with a put-to-call ratio of 0.90 compared to Bitcoin’s 1.10, which leans toward downside protection. The max pain price for ETH is identified at $4,400, with open interest nearing 217,000 contracts.

Today’s expiry represents a notable increase in exposure compared to the previous week’s $4.3 billion event, amplifying expectations of volatility heading into the weekend.

Liquidity Risks and Short-Term Volatility

Periods of major expiries often precede sharp price swings, especially under conditions of lower liquidity. As such, today’s event could lead to misleading market signals, especially in crowded derivatives positioning.

Bitcoin Nears Overheated Territory

According to Glassnode, Bitcoin continues to trade above its Short-Term Holder (STH) Cost Basis, which generally supports a bullish outlook. However, the rally remains close to what analysts call the “Heated zone” — a potential warning for short-term correction.

“The rally remains below the Heated zone (+1 STD), suggesting momentum is high but approaching short-term risk conditions,” said Glassnode in a post.

Comments are closed.