Featured News Headlines

Ethereum Price Eyes $6,000 After Falling Wedge Breakout

Ethereum (ETH), the leading altcoin, has been steadily leaving major exchanges like Binance, indicating that traders are holding rather than selling. With prices stable above $4,400 and a continued drop in exchange balances, the market appears poised for a potential supply squeeze.

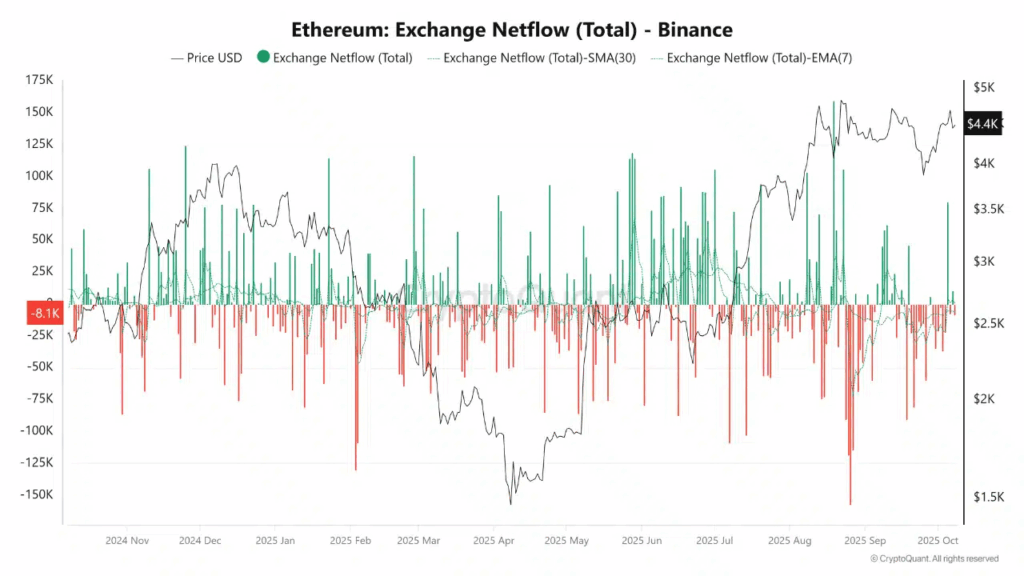

Exchange Outflows Signal Strong Holding

According to a CryptoQuant report by PelinayPA, Ethereum’s netflows on Binance have remained mostly negative from July through October 2025. This suggests more ETH tokens have been withdrawn than deposited, reflecting holders’ reluctance to sell amid rising prices.

During this period, ETH climbed from around $3,000 to $4,400, supported by shrinking supply on exchanges. The 30-day simple moving average (SMA) of netflows stays below zero, confirming a medium-term contraction in available supply. Although short-term outflows have slightly slowed, the trend indicates fewer tokens available for immediate sale.

Potential for a Supply Squeeze

With less ETH available on exchanges, a supply squeeze could emerge if demand continues to grow from staking, decentralized finance (DeFi), or exchange-traded fund (ETF) inflows. This dynamic often precedes significant price moves.

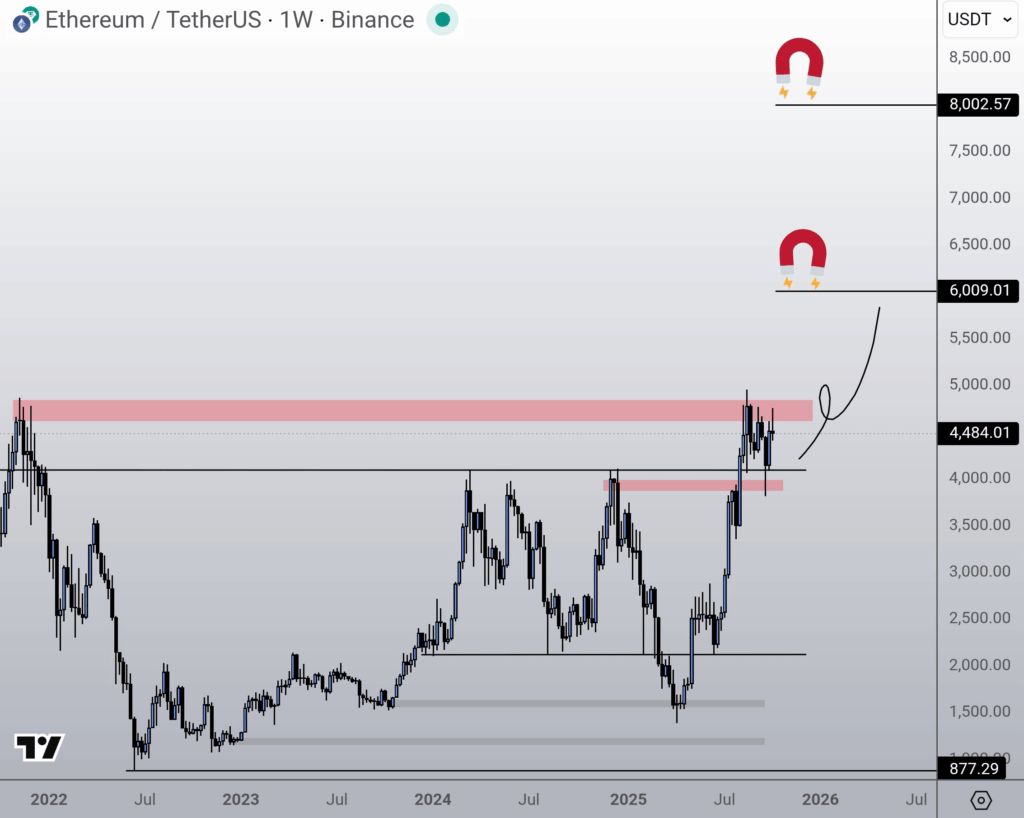

Watching the All-Time High at $4,952

ETH recently broke out from a falling wedge pattern, a bullish technical setup typically signaling upward momentum. The crucial level to watch is the previous all-time high near $4,952, now acting as key resistance.

While ETH briefly surpassed this level two months ago, it did not sustain the breakout. Currently, the price is consolidating just below this resistance. A confirmed move above $4,952 could open the door to new highs, with analysts eyeing potential targets of $6,000 and even $8,000.

Comments are closed.