Featured News Headlines

Is ZEC Rally Over? Traders Brace for High Volatility

Zcash (ZEC), the privacy-centric cryptocurrency, is facing a sharp cooldown after last week’s explosive price rally. The asset fell by 10% in the last 24 hours, as traders began to lock in profits and reassess the sustainability of recent gains.

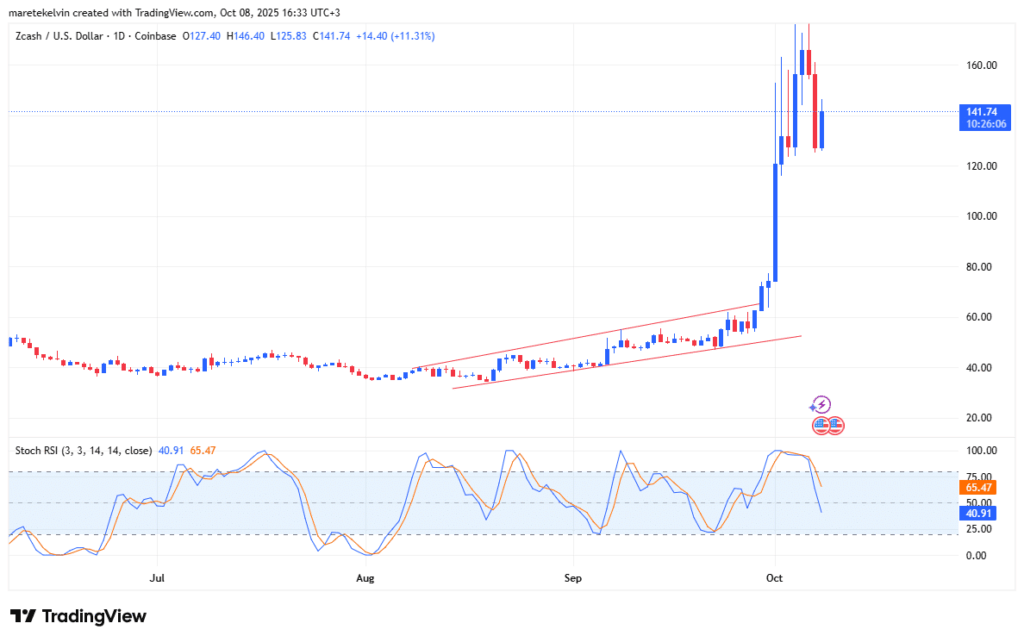

Overbought Indicators Signal Caution

Technical signals are flashing warning signs. At press time, the Stochastic RSI remained in overbought territory, hinting at the possibility of a deeper correction. Market imbalance near the $120 level could act as a magnet, according to analysts monitoring short-term price action.

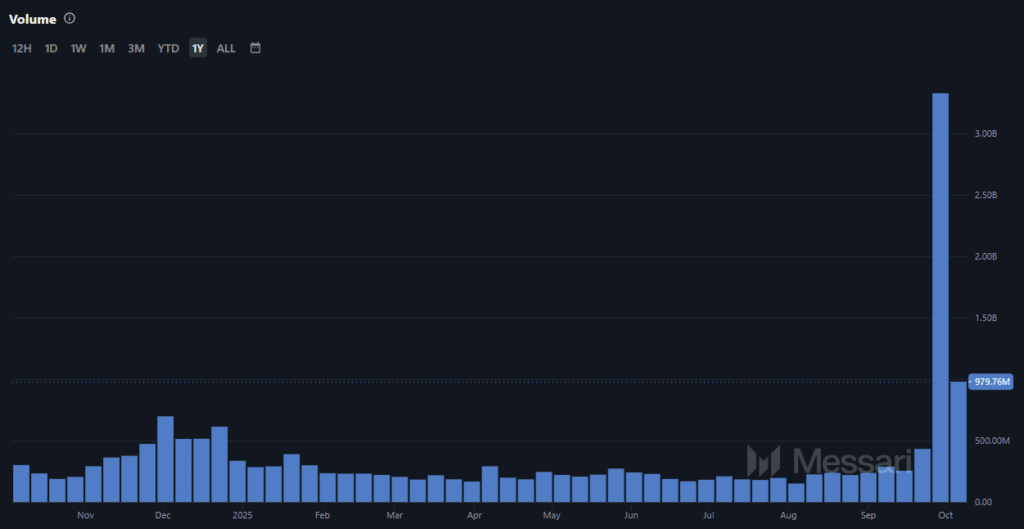

Volume Surge Adds to Volatility

ZEC’s price drop comes alongside a dramatic surge in trading volume. Data from Messari shows that daily volume jumped from around $500 million to over $4 billion within 24 hours. This spike suggests a combination of speculative interest and profit-taking.

Such elevated turnover typically precedes high volatility, and recent sessions have already shown sharp intraday price swings. These conditions often lead to unpredictable moves, both upward and downward.

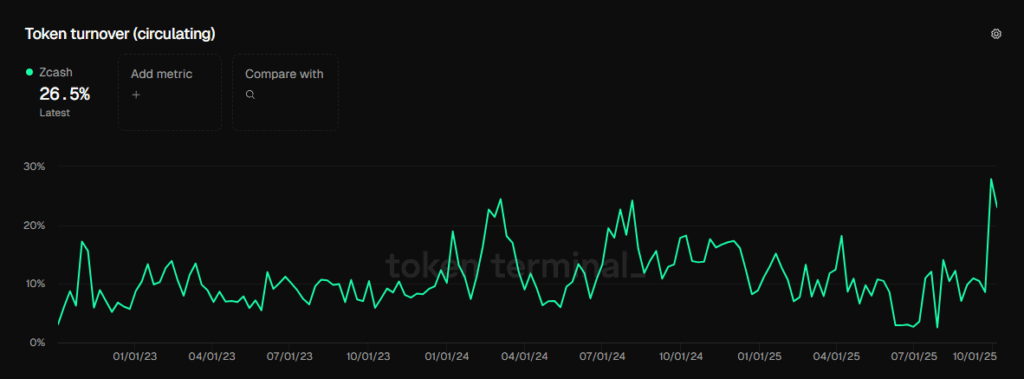

Limited Circulating Supply May Magnify Moves

According to Token Terminal, only about 30% of ZEC’s total market cap is currently in active circulation. This low float can heighten price sensitivity, especially during intense trading periods, as small shifts in demand or supply may cause outsized price reactions.

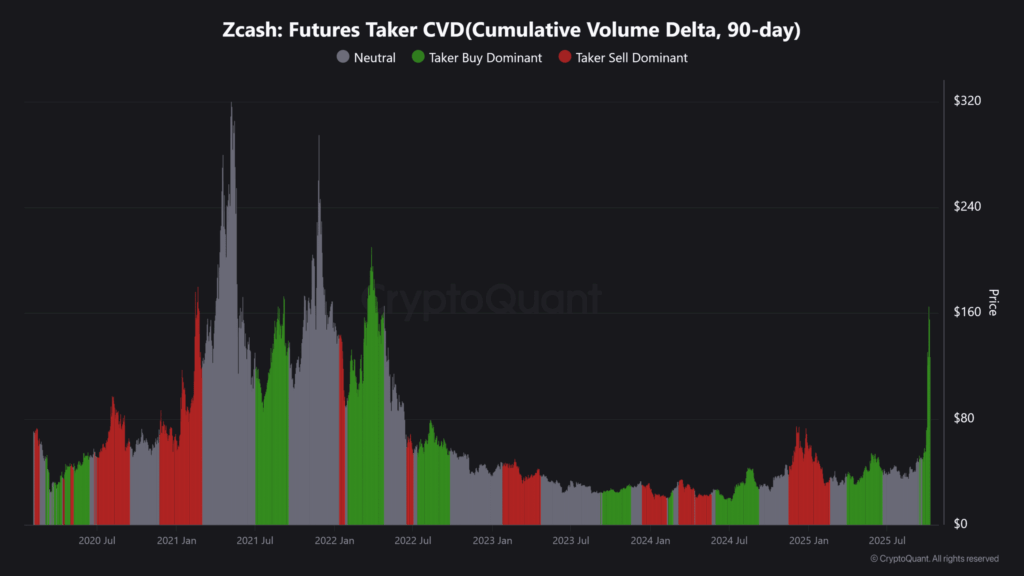

Futures Market Offers Temporary Support

There are signs of increased long positioning in the ZEC futures market. If spot prices remain stable, futures demand could help establish temporary support. However, overleveraged positions risk liquidation if bearish momentum persists.

Comments are closed.