Featured News Headlines

As the total altcoin market capitalization (TOTAL2) hit a new all-time high of $1.19 trillion, veteran trader Peter Brandt, known for his four decades of market experience, has shared a cautious yet notable prediction for XRP — one of the most closely watched altcoins in the crypto space.

On-chain metrics and sentiment data now appear to support a possible correction scenario for XRP in October, offering investors a mix of signals to weigh.

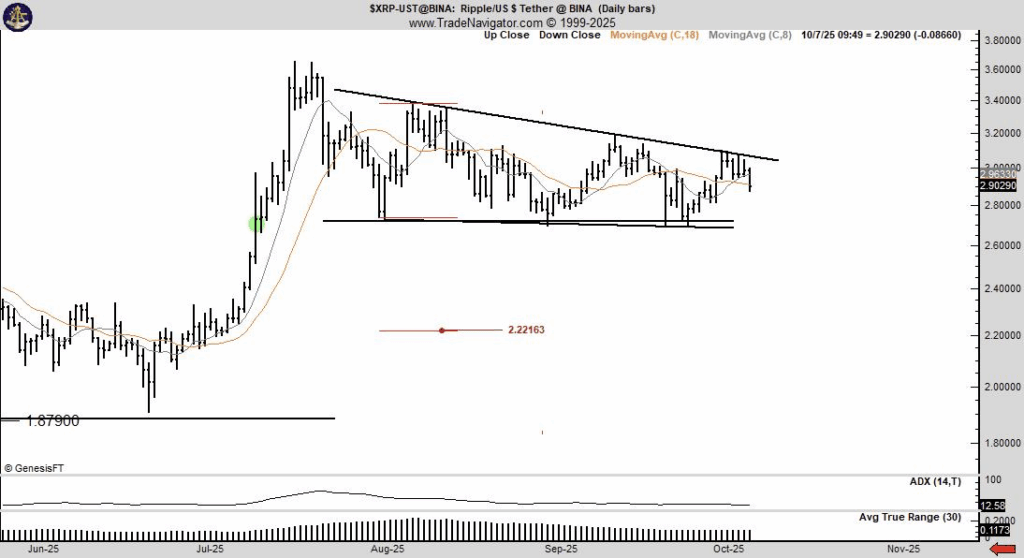

Brandt Warns of Descending Triangle Breakdown

In a recent post, Brandt pointed to a technical formation on the XRP chart:

“On the right is a developing descending triangle. ONLY IF it closes below 2.68743 (then I’ll be a hater), then it should drop to 2.22163.”

At the time of writing, XRP trades around $2.85, which places it just 6% above the key breakdown level. If the price falls below this level, Brandt suggests a drop of over 20% could follow, targeting the $2.22 zone.

Sentiment Hits a Six-Month Low

Brandt’s warning comes as the broader market sends mixed signals. According to Santiment, negative sentiment around XRP is at its highest in six months. While this typically reflects investor concern, the platform noted that extreme negativity has historically preceded price rebounds — a classic contrarian signal.

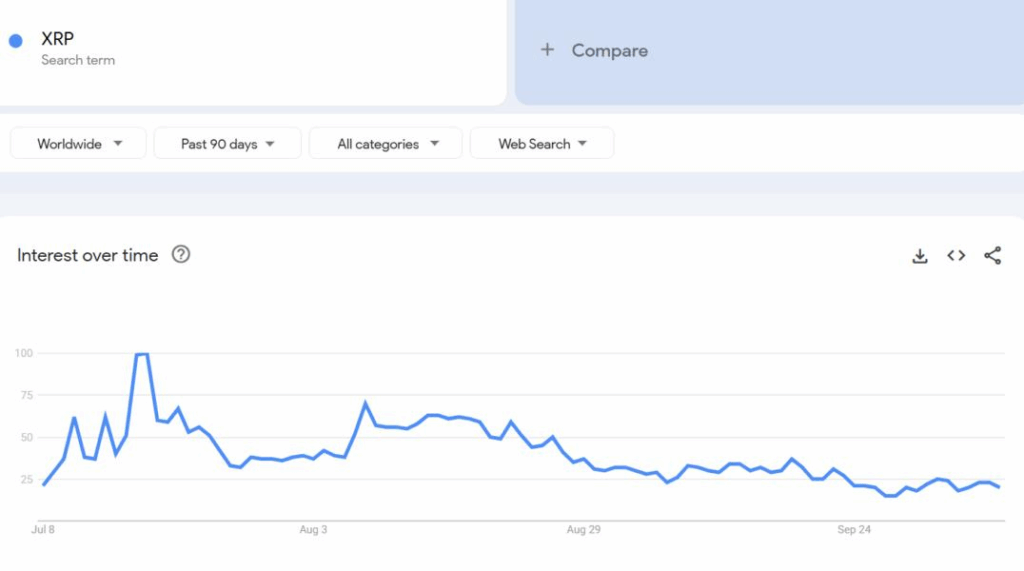

However, supporting the bearish case is declining search interest. Google Trends data shows that searches for “XRP” fell to a three-month low in late September and currently remain below 25 points — a sign of fading retail attention.

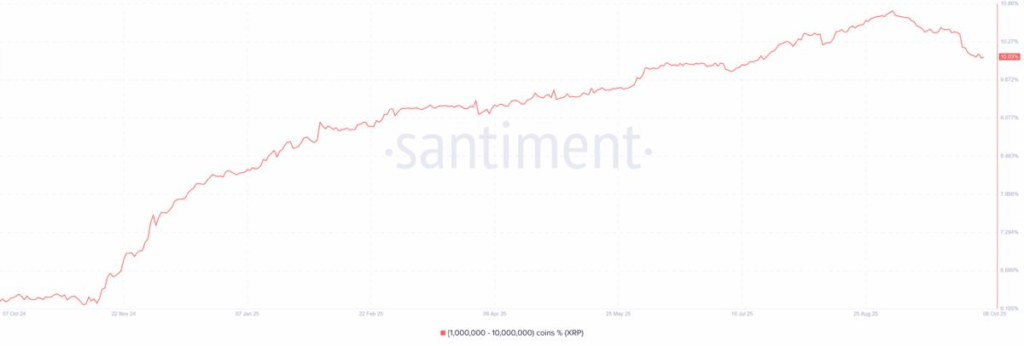

Mid-Level Wallets Begin Selling

Perhaps the most telling indicator is coming from wallet behavior. According to Santiment’s on-chain data, wallets holding 1 million to 10 million XRP — commonly mid-tier investors — have started selling after nearly a year of steady accumulation.

Their share of circulating supply rose from 6% in October 2024 to 10.76% in September 2025, but dropped back to 10% in early October. This reversal could be a sign of profit-taking or shaken confidence, both of which often precede broader selling pressure.

Since this group controls a large portion of XRP’s liquid supply, their actions can meaningfully impact market direction.

Comments are closed.