Featured News Headlines

Bitcoin Dips After ATH, Analysts Call It a Healthy Pullback

Bitcoin’s recent price dip is being interpreted by market analysts as a healthy correction, rather than a sign of weakening momentum. Despite a slight decline from its record high, on-chain data and long-term metrics suggest that investor sentiment remains strong.

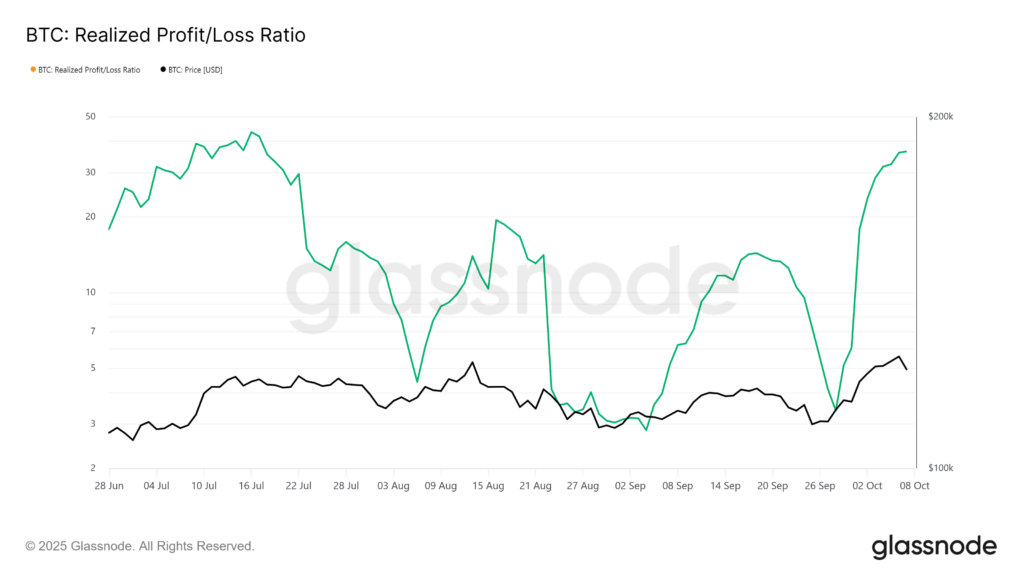

Investors Take Profits After Bullish Rally

According to on-chain metrics, Bitcoin investors have started realizing profits following its rapid price surge earlier this month. The Realized Profit/Loss ratio recently hit a three-month high, indicating increased selling activity as traders capitalize on gains.

This type of profit-taking is common after extended rallies and doesn’t necessarily signal a bearish shift. As analysts note, “The pullback appears healthy, suggesting continued investor confidence in the long-term outlook.”

Short-term corrections like these often help markets cool down and reset support levels, laying the groundwork for potential upward movement.

Long-Term Metrics Remain Bullish

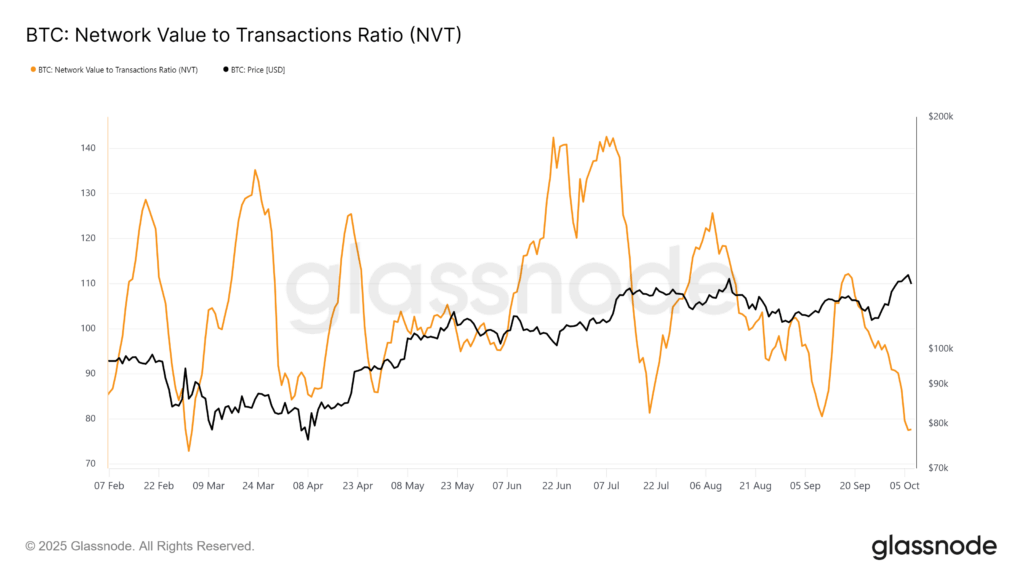

From a broader perspective, Bitcoin’s macro trend still looks positive. The Network Value to Transactions (NVT) Ratio, which compares market cap to transaction volume, has dropped to a seven-month low. This suggests that Bitcoin’s transaction activity is growing faster than its market cap, a dynamic often interpreted as bullish.

Strong network usage—especially when paired with moderate price movement—points to increasing adoption and user engagement, including among institutional participants.

Price Holds Above Key Support Level

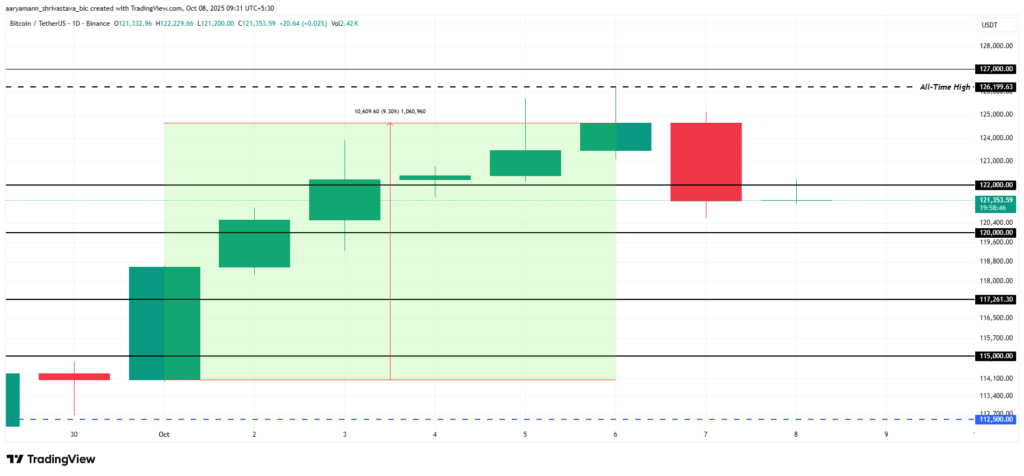

At the time of writing, Bitcoin is trading at $121,353, holding above the $120,000 support level. The asset remains just below the $122,000 resistance, which traders are watching closely as a potential breakout point.

The recent retracement follows Bitcoin’s new all-time high of $126,199. With on-chain fundamentals still intact, BTC may attempt to reclaim the $122,000 mark and stabilize before making a renewed push higher.

However, if selling pressure builds further, Bitcoin could briefly dip below $120,000, potentially revisiting support near $117,261. Such a move would not necessarily invalidate the overall bullish outlook but could signal a deeper short-term correction.

Comments are closed.