Featured News Headlines

Altcoin Season 2.0: Institutional Capital Surge Sparks a New Kind of Altseason

A classic altcoin season, marked by rising prices in tokens other than Bitcoin (BTC), is anticipated by cryptocurrency enthusiasts. But according to an expert, this phenomenon is already happening. This time, though, it’s in publicly traded businesses connected to the cryptocurrency ecosystem rather than digital assets. This change is a result of increased institutional interest sparked by improved accessibility and regulatory permissions. It presents cryptocurrency stocks as the main recipients of new investment inflows. As investors rotate capital, significant rallies in Bitcoin have typically been followed by rises in other cryptocurrencies.

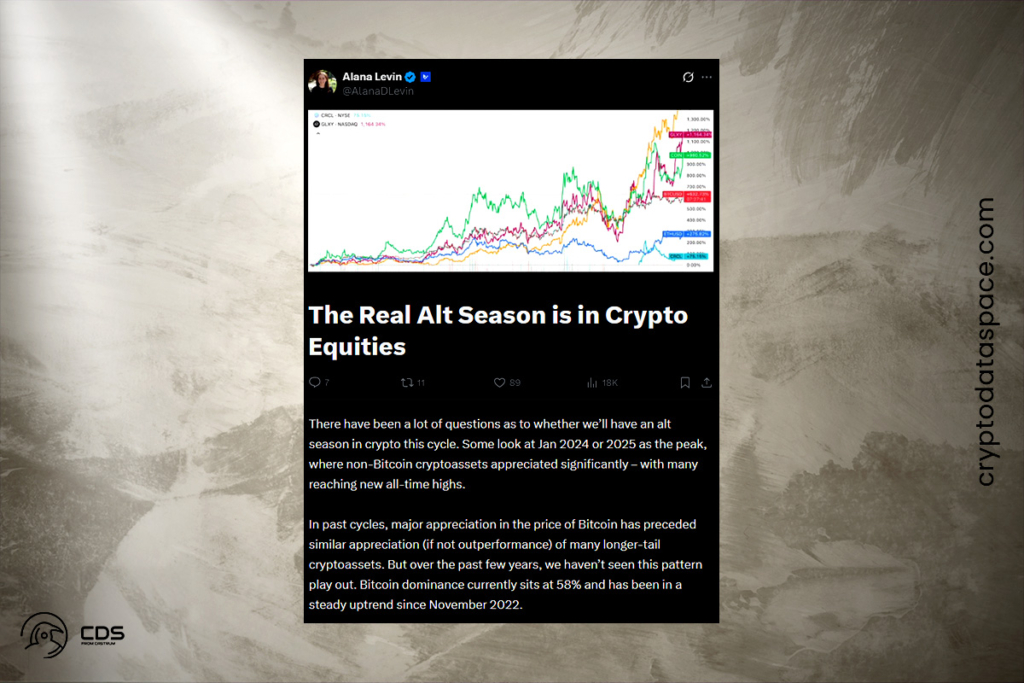

Over the past few years, we haven’t seen this pattern play out. Bitcoin dominance currently sits at 58% and has been in a steady uptrend since November 2022. So, is this cycle going to skip alt season? Is it just that alt season isn’t here yet? Or maybe… is alt season already happening in a different market entirely, and just no one is looking?

Alana Levin, an Investment partner at Variant

Forget Altcoins: The Real Crypto Rally Is in Publicly Traded Blockchain Firms

In a thorough analysis, Levin clarified that institutional investors are now the primary source of new capital rather than capital shifting from Bitcoin into altcoins. These investors are putting their money into stocks linked to cryptocurrencies. The “real” alt season is taking place in traditional markets rather than cryptocurrency tokens, as Bitcoin dominates the market and institutions prefer regulated exposure.

There’s certainly new capital looking to get exposure to crypto. But much of this is institutional, not retail. Retail tends to be fast adopters, while institutions are slower and often wait for external legitimization. Well, that’s happening now,

Levin

Levin outlined several significant advancements that are contributing to this change. These include the Nasdaq CEO’s support for tokenizing stocks and the SEC‘s approval of spot Bitcoin and Ethereum ETFs. Additionally, there is a more positive climate for cryptocurrencies, as demonstrated by programs like the SEC’s “Project Crypto.” Because equities have well-established operational frameworks for custody, compliance, and trading, these milestones have legitimized crypto exposure for institutions that want it.

Crypto Stocks Outperform Coins: Coinbase, Robinhood, and Circle Soar in 2025

The argument is further supported by performance data. Levin highlighted the noteworthy 2025 gains of several cryptocurrency-related stocks:

- Coinbase Global Inc. (COIN) has increased 53% so far this year.

- Robinhood Markets Inc. (HOOD) has had a remarkable 299% increase.

- With a 100% rise, Galaxy Digital Holdings Ltd. (GLXY) has doubled.

- Since its June IPO, Circle Internet Financial Ltd. (CRCL) has increased by 368%.

In comparison, Solana has increased by 21%, Ethereum by 35%, and Bitcoin by just 31%. A comparable pattern of outperformance by these stocks can be seen if the timeline is extended to December 17, 2022, the bottom of the Bitcoin market.

Is Alt Season Already Here? Levin Says Wall Street Is Leading the Charge

Levin also noted that there are a number of similarities between this equity boom and past alt seasons. She pointed out that, similar to early crypto cycles when fewer than 100 tokens reigned, only a small number of profitable crypto-related stocks are drawing capital. In conclusion, the present market dynamics indicate that the alt season is already here—it has just shifted to Wall Street—even though the next real cryptocurrency bounce may still be a ways off.

Last cycle, a number of crypto-native lending desks collapsed. We haven’t seen many rebuild. Equity allocators do have access to leverage, though, which means the booms can get bigger (and the busts can really bust),

Levin

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.