TRX Set for Breakout: Key Technical Levels to Watch

Since early October, TRON (TRX) has experienced a noticeable decline in trading volumes, a pattern often preceding significant market recoveries. Historically, such volume cooling periods have signaled accumulation phases, during which institutional investors position themselves ahead of price surges.

Similar trends observed in July 2021 and October 2024 were followed by rallies exceeding 100%. The current environment mirrors these past phases, suggesting that TRX may be entering a bullish reaccumulation stage. The overall positive market trend, combined with reduced volatility and volume compression, indicates a calm before a possible breakout.

Technical Patterns Support Upcoming Momentum

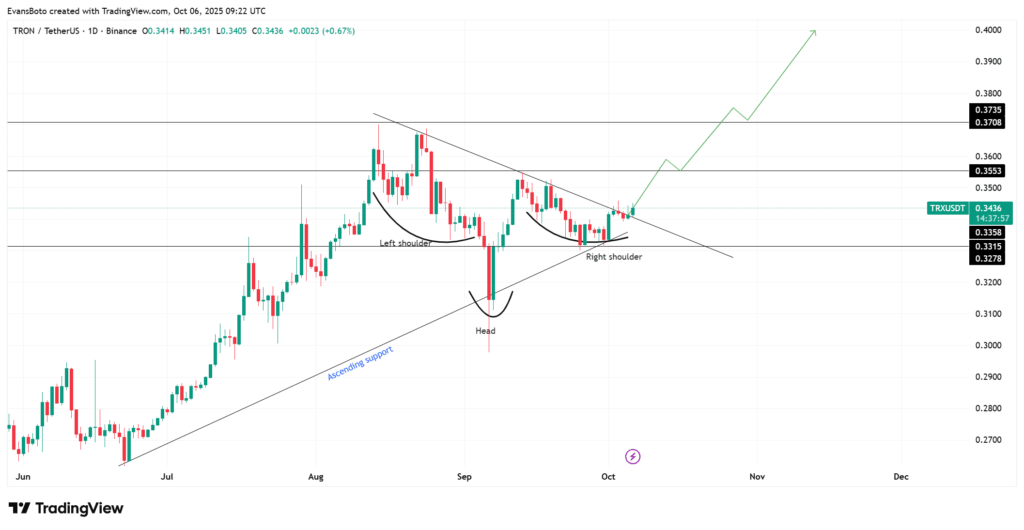

On the daily chart, TRX is developing a clear inverse head-and-shoulders formation, supported by an ascending trendline that has been in place since mid-August. The critical neckline resistance is near $0.355. A decisive break above this level could pave the way for gains toward $0.373 and $0.40.

At present, TRX trades around $0.343, maintaining stability above short-term support levels at $0.331 and $0.335. This pattern suggests consistent buying interest, with dips attracting renewed demand. A confirmed breakout over $0.355 may mark the start of a stronger upward movement in the coming weeks.

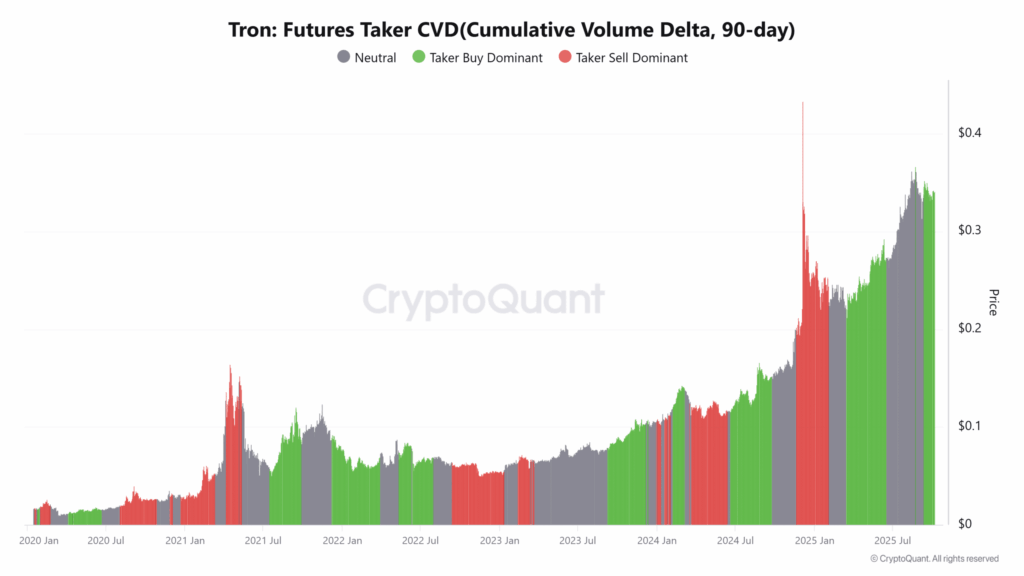

Futures taker cumulative volume delta (CVD) readings reveal dominant buying pressure within the derivatives market, indicating increasing confidence among leveraged traders. This activity signals that aggressive buyers are actively accumulating positions, supporting the notion of a bullish reversal.

The combination of decreasing spot volumes alongside rising futures buy-side momentum points to an impending impulse wave forming amid low volatility. Historically, when these signals align, they often precede robust price breakouts.

Social Engagement Adds to Positive Sentiment

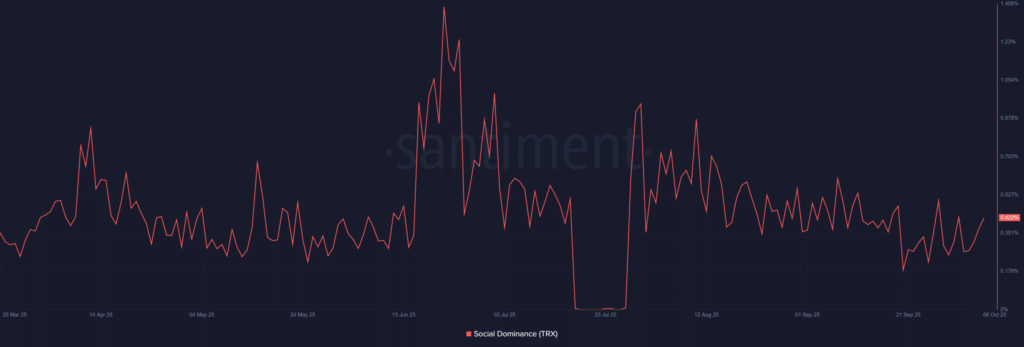

Data from Santiment highlights a gradual resurgence in TRX-related social discussions, with social dominance recovering to 0.422%. This uptick in community interest often foreshadows speculative momentum, as retail traders respond to growing market narratives.

When increased social buzz converges with favorable technical and on-chain signals, it typically amplifies both volatility and trading volume. The renewed attention on TRON’s ecosystem suggests that market sentiment is shifting toward optimism.

Comments are closed.