Featured News Headlines

Whale Selling at a Loss Triggers Alarm Bells

Chainlink (LINK) is under significant bearish pressure after failing to hold the $23.1 resistance. At the time of writing, LINK was trading at $22.1, down 3.74% in the last 24 hours, marking its fourth consecutive day of losses.

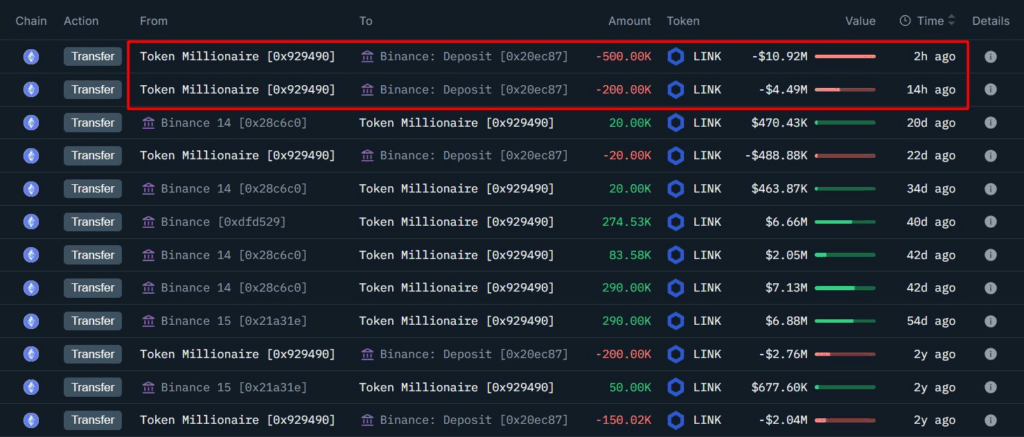

Investor sentiment appears to have shifted, particularly among large holders. On-chain data from On-chain Lens shows that a whale recently deposited 700,000 LINK (valued at $15.52 million) into Binance — realizing a loss of approximately $2.76 million. As analysts often note, such sell-offs from whales at a loss typically reflect a lack of market confidence, reinforcing bearish expectations.

Retail Traders Follow Suit

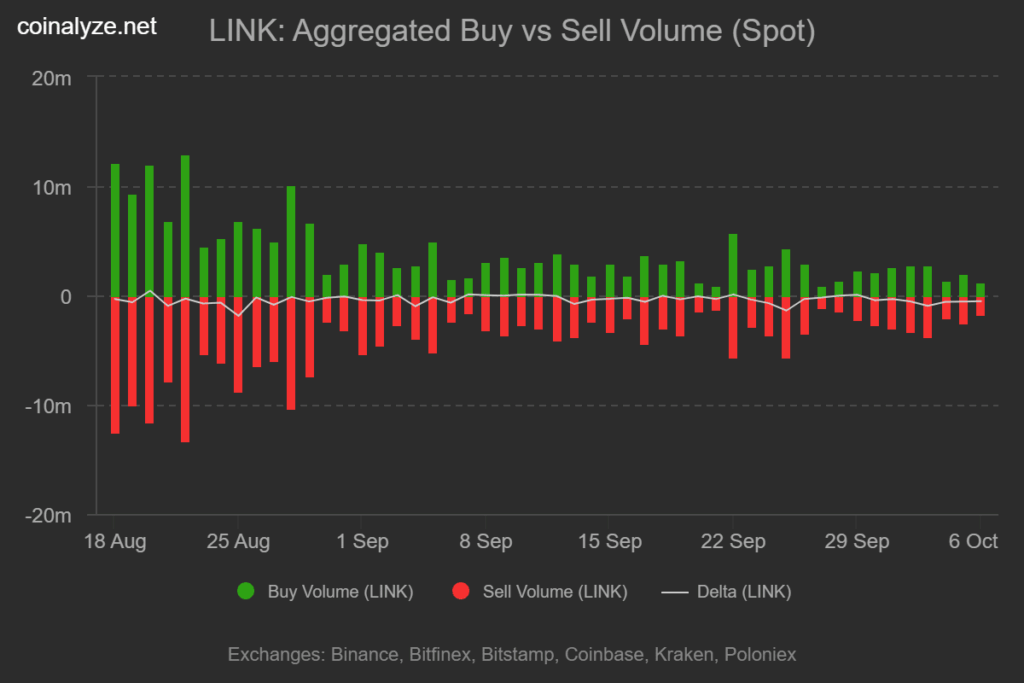

The selling pressure is not isolated to whales. Retail investors have also been offloading their holdings. According to Coinalyze, Chainlink has recorded seven straight days of negative Buy/Sell Delta, indicating more aggressive selling than buying.

On October 6, LINK’s sell volume hit 1.77 million, while buy volume remained lower at 1.25 million, resulting in a -523.7k Delta — further evidence of a retail-driven downturn.

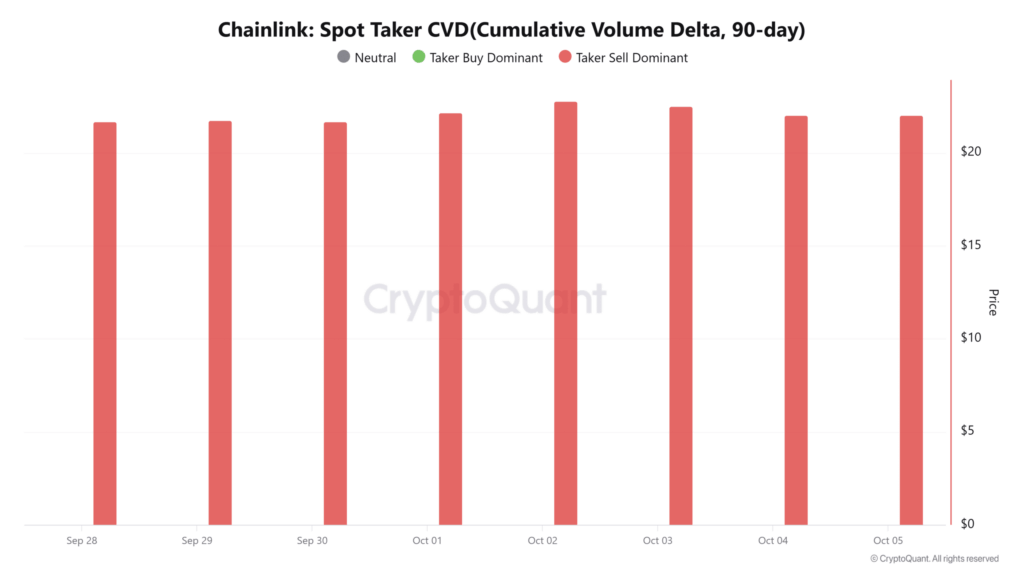

Supporting this trend, CryptoQuant data revealed a positive Exchange Netflow for two consecutive days. At last check, 136,000 LINK tokens had been moved into exchanges, suggesting more users are preparing to sell than to hold.

On-Chain Activity Cools

Adding to the concerns, LINK’s on-chain usage is weakening. Active addresses have declined to a weekly low of 6,000, according to CryptoQuant. A drop in active addresses often points to waning interest in the network and less interaction with smart contracts — a key indicator of declining organic demand.

Can Chainlink Hold $22?

If current trends continue, LINK may soon test the $20.3 support level, particularly if sell pressure intensifies and on-chain engagement remains low. However, a shift in sentiment, driven by reduced selling or renewed buying interest, could allow Chainlink to bounce back toward $23.1 and potentially $24.9.

Comments are closed.