Bitcoin Treasury Firms and ETFs: What’s Driving Record Rally?

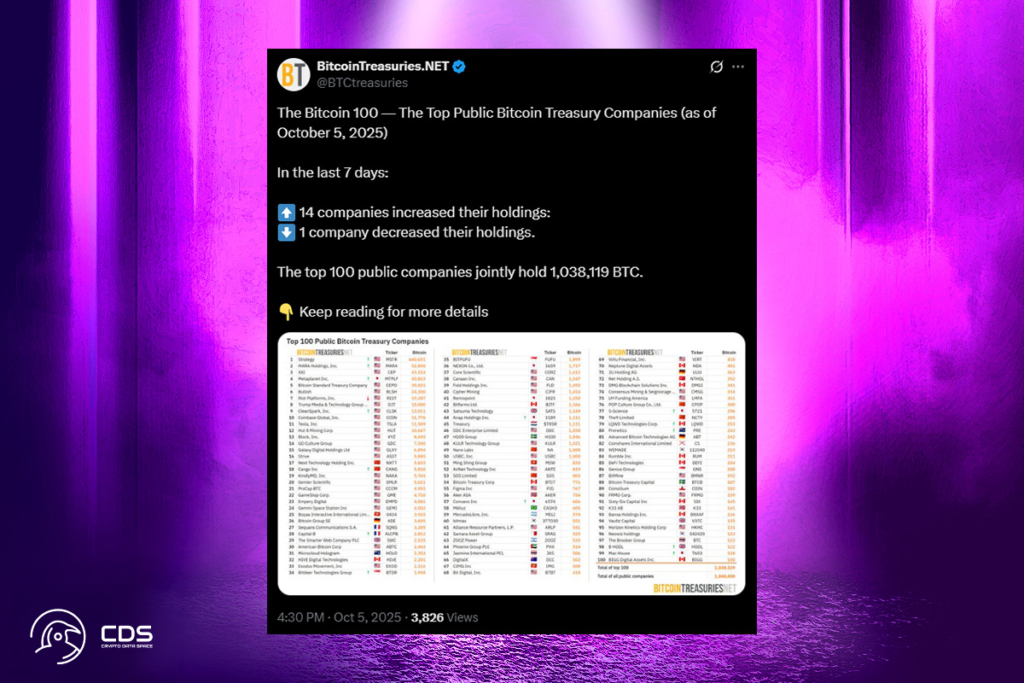

Last week, Bitcoin treasury businesses amassed $1.2 billion in BTC. However, observers believe that another reason contributed to the cryptocurrency’s new all-time high. Inflows into exchange-traded funds for Bitcoin were probably the primary source. Japanese investment business Metaplanet contributed 5,258 Bitcoin on Wednesday, leading a week-long total of over 6,702 purchases by Bitcoin treasury corporations. With a net inflow of $3.24 billion last week, spot Bitcoin ETFs almost exactly matched their peak week in November 2024.

This year, more Bitcoin has been seized by institutions than miners can produce. Miners typically produce about 900 Bitcoin every day. Businesses purchased 1,755 Bitcoin per day in 2025, while ETFs purchased 1,430 Bitcoin per day on average, according to a September report from financial services firm River.

Bitcoin’s Momentum: Regulatory Progress and Institutional Demand Driving Growth

The market is increasingly focusing on blue-chip assets like Bitcoin, according to Matt Poblocki, general manager of Binance’s operations in Australia and New Zealand. This pattern, he said, points to a shift in the direction of long-term stability.

Bitcoin reaching another all-time high this year is a strong signal of the asset’s enduring momentum and growing maturity. This rally reflects a structural shift in the market that extends well beyond short-term speculation. Crucially, global regulatory progress and the massive inflows from institutional investors, notably through products like the US spot Bitcoin ETFs, are cementing its place in the mainstream financial system.

Poblocki

Analysts from the Bitfinex crypto exchange predicted in August that new crypto ETF approvals could spark a fresh altcoin season or rally. They noted that these ETFs would give investors exposure to altcoins with less risk.

Bitcoin Q4 Outlook: ETF Inflows, Institutional Adoption, and Supply Trends Driving Gains

Inflows into Bitcoin ETFs will probably serve as a spur for additional gains as the year draws to a close. Institutional adoption, declining supply, and macro tailwinds will influence Bitcoin’s fourth-quarter forecast, according to Vincent Liu, chief investment officer of Kronos Research. Further support will come from Bitcoin’s function as a fiat devaluation hedge, he continued.

Thinner liquidity and ETF inflows will fuel rallies and volatility. Future Bitcoin gains will likely swing on institutional adoption, regulatory clarity, tightening supply as exchange balances hit a six-year low, and a supportive macro environment with prolonged low interest rates.

Liu

Michael Saylor, a Bitcoin bull and strategy executive chairman, forecast in September that the cryptocurrency will begin to pick up steam once more before the end of the year. He predicted that rising institutional and corporate interest would cause this.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.