Featured News Headlines

Are Altcoins Headed for a Shakeout? Liquidation Levels to Watch This Week

Altcoin – The total crypto market capitalization has soared past $4 trillion this October, setting a new milestone and drawing heavy liquidity into Bitcoin and top altcoins. But with this influx of capital comes heightened risk, particularly for short-term leveraged traders. Several major altcoins are flashing warning signals that could trigger mass liquidations in the second week of October.

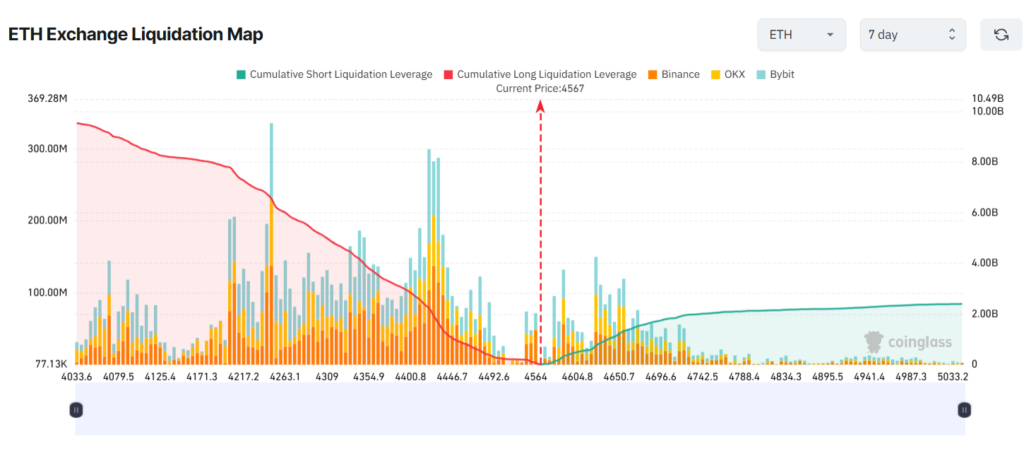

Ethereum (ETH): Bulls Confident, But Is a Reversal Looming?

According to Messari, institutional investors now hold a larger portion of ETH’s supply than even Bitcoin — a clear sign of strong accumulation demand. Growing interest in ETH ETFs, combined with expanding global liquidity and staking products, has led many to believe ETH is primed for another leg up.

However, as optimism rises, so does leverage. Coinglass data shows that if ETH drops to $4,030, over $9 billion in long positions could be liquidated. In contrast, a breakout above $5,000 may liquidate around $2 billion in shorts.

But ETH bulls may be ignoring key red flags:

- 97% of ETH addresses are in profit — historically a sign of market tops and imminent profit-taking.

- Large whales are starting to offload ETH onto exchanges. On October 5, Trend Research moved 77,491 ETH (worth $354.5 million) to Binance, while other dormant whales have resurfaced to sell.

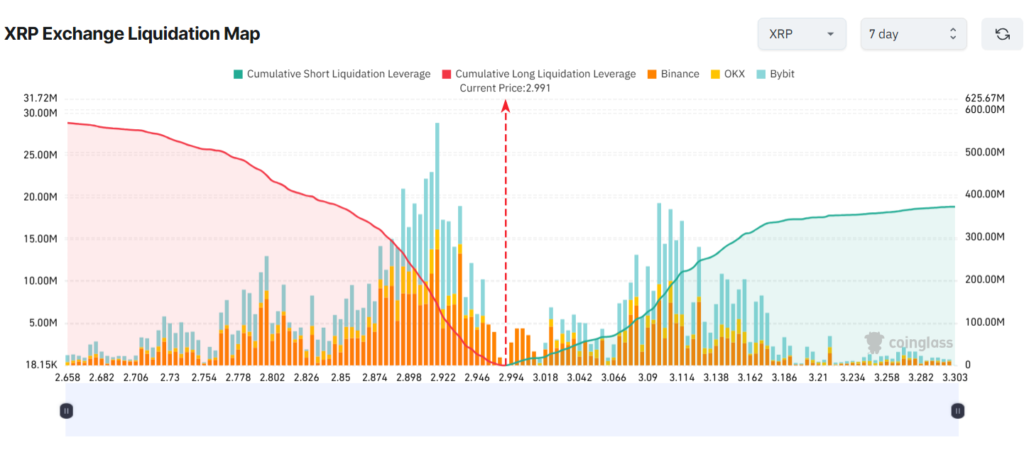

XRP: ETF Buzz Fuels Overconfidence

This month, the SEC is reviewing several high-profile XRP ETF applications, including from Grayscale, ProShare, and Franklin Templeton, with fund sizes ranging from $200 million to $1.5 trillion.

This wave of institutional interest has driven up bullish sentiment. However, liquidation heatmaps reveal an imbalance, with long positions heavily dominating. A dip to $2.65 could wipe out $560 million in longs, while a rise to $3.30 threatens $370 million in shorts.

Still, risks are rising:

- Over 320 million XRP have been deposited to exchanges in early October.

- Whale holdings are at their lowest level in nearly three years, signaling potential profit-taking.

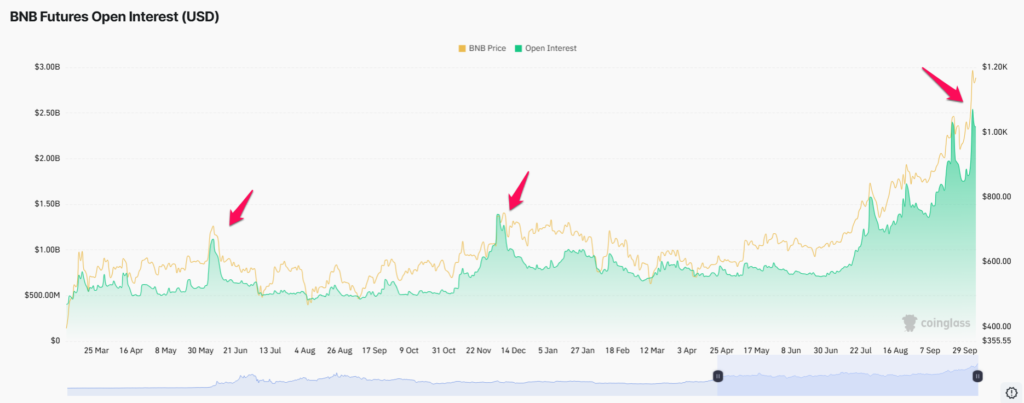

BNB: Record Open Interest Raises Red Flags

BNB continues to ride a strong rally, trading above $1,200, as traders chase gains in what looks like a classic FOMO-driven surge. But the current open interest (OI) has hit a record $2.5 billion — a level that has historically preceded sharp corrections.

- If BNB drops to $1,034, over $300 million in longs could be liquidated.

- A rise to $1,340 may result in $80 million in short liquidations.

With leveraged bets piling up, BNB traders face increasing exposure to sudden reversals, especially without solid risk management strategies.

As crypto markets heat up, overleveraged positions on leading altcoins like ETH, XRP, and BNB are becoming increasingly fragile. While bullish narratives dominate, on-chain data and exchange activity suggest that liquidation risks are growing — and traders may need to proceed with caution as the week unfolds.

Comments are closed.