Featured News Headlines

XRP Price Weakens Despite Breakout Setup

XRP’s recent attempt to break through resistance levels failed as the market faced a sudden wave of selling pressure. The sharp pullback has been largely attributed to profit-taking activity, particularly from long-term holders, raising concerns over XRP’s near-term price direction.

Heavy Selling Dampens Momentum

Despite briefly testing upper resistance zones, XRP couldn’t sustain upward momentum. The altcoin encountered aggressive selling pressure, forcing a retracement and triggering broader bearish sentiment. Analysts point to profit-taking as the primary reason behind this move.

A recent shift in market behavior suggests that investors are opting to secure quick gains rather than holding out for higher valuations. While this strategy may benefit short-term traders, it tends to undermine overall market stability and hinders sustainable price recoveries.

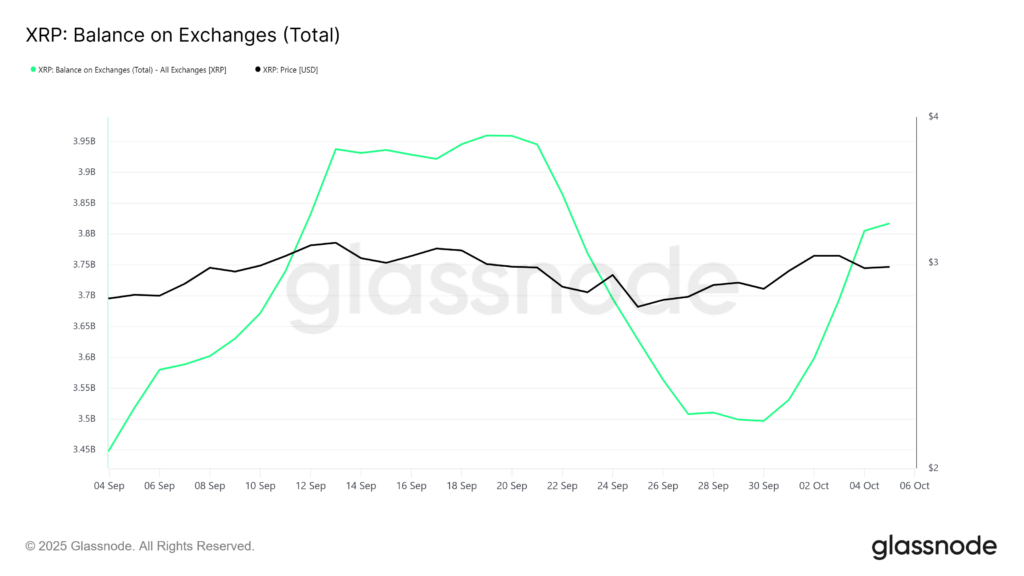

Exchange Inflows Signal Strong Sell-Off

On-chain data supports the ongoing selling trend. Over the past seven days, approximately 320 million XRP — valued at nearly $950 million — have been transferred to centralized exchanges. This substantial movement signals increased liquidation from investors, likely to capitalize on earlier price gains.

This surge in exchange inflows reflects a bearish shift in sentiment. When tokens are moved to exchanges in large volumes, it typically suggests upcoming sell-offs. In XRP’s case, the magnitude of this movement amplifies concerns about continued downward pressure.

Long-Term Holders Are Exiting Positions

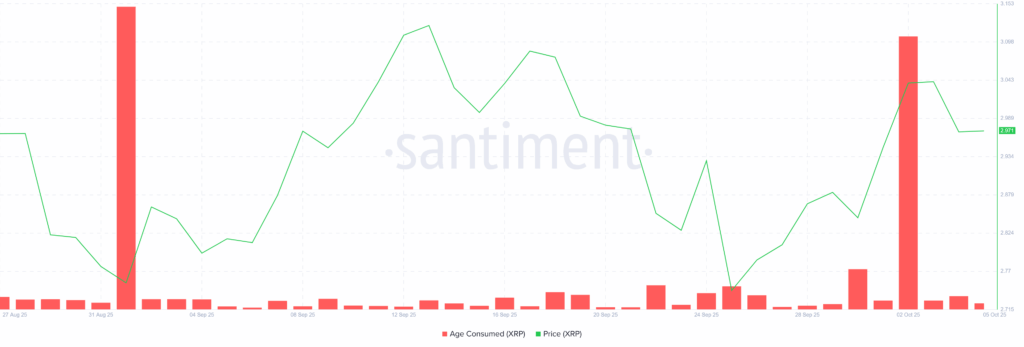

Further reinforcing this trend is the Age Consumed metric, which measures the activity of dormant coins. A significant spike was recorded recently, implying that long-term holders (LTHs) are actively liquidating their holdings.

Historically, LTH activity is viewed as a key market signal. These investors typically form the foundation of market sentiment and liquidity. When they exit positions en masse, it suggests a decline in confidence — a worrying sign for XRP’s price stability.

“Selling by long-term holders is particularly damaging, as it reduces liquidity and discourages new capital inflow,” analysts have noted.

With LTHs offloading their XRP, bearish momentum continues to build. This not only dampens buying interest from newer investors but also limits the chances of a strong rebound in the short term.

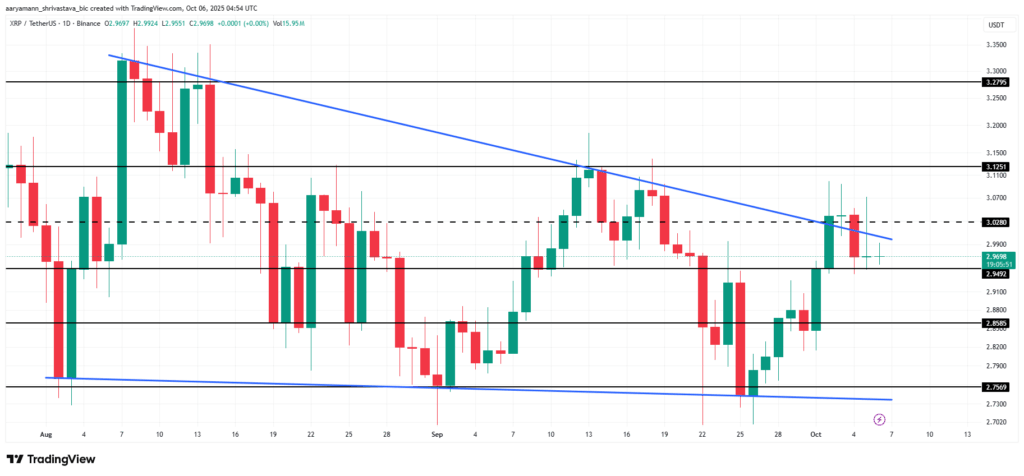

XRP Price Tests Key Support After Failed Breakout

At the time of writing, XRP is trading at $2.96, holding just above the key support level at $2.94. Earlier attempts to break out of a descending wedge pattern failed, indicating weakness in buying pressure and signaling the potential for further downside.

If the current selling trend remains intact, XRP could fall further — potentially testing $2.85, and if that level breaks, even $2.75. This lower level marks the bottom boundary of the wedge pattern. A fall to this zone would validate a bearish breakout and reinforce the downward trend.

What Needs to Happen for a Recovery?

If investors step back in and halt the ongoing sell-off, XRP has the potential to bounce. A decisive rebound above the $3.02 level could mark the beginning of a recovery phase. Clearing this resistance would open the door to higher targets such as $3.12, potentially invalidating the bearish outlook.

Still, for this scenario to unfold, investor sentiment must improve. Reduced selling pressure, positive market catalysts, or broader crypto market strength could be necessary triggers for a bullish reversal.

Until then, XRP remains vulnerable to further downside as long-term holders continue to offload and short-term traders dominate the landscape.

Comments are closed.