Featured News Headlines

Warren Buffett’s Favorite Index vs Bitcoin: Who’s Winning Since 2020?

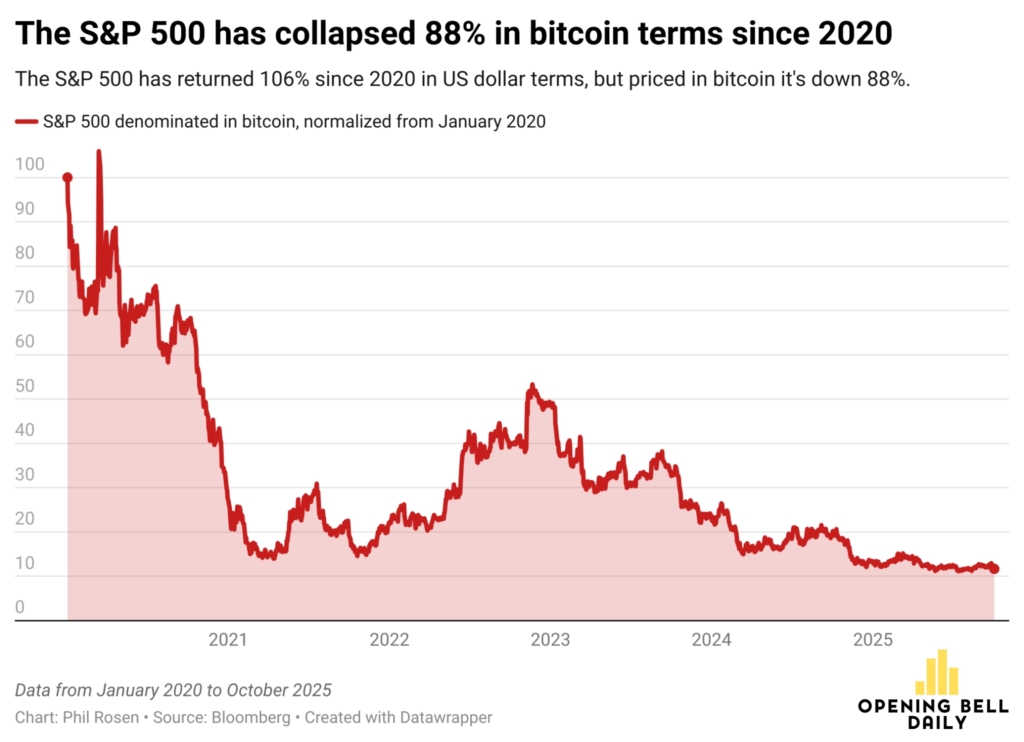

S&P 500 vs Bitcoin – While legendary investor Warren Buffett continues to advocate for the S&P 500 as the go-to investment for the average American, recent data shows that Bitcoin has dramatically outperformed the stock index — by nearly 88% — since 2020.

Bitcoin vs. S&P 500: A Shifting Investment Landscape

According to an Oct. 5 post by Phil Rosen, co-founder of the Opening Bell Daily newsletter, the S&P 500 has surged 106% in USD terms since 2020. But when measured against Bitcoin, the index has effectively “collapsed,” highlighting the massive growth Bitcoin has seen in recent years.

Despite its record-breaking rally in 2025 — with the S&P 500 currently trading at $6,715.79, up 14.43% year-to-date — it pales in comparison to Bitcoin’s 32% gain this year. On Saturday, Bitcoin hit a new all-time high of $125,000, further widening the performance gap.

The $100 Investment Comparison: Bitcoin’s Explosive Return

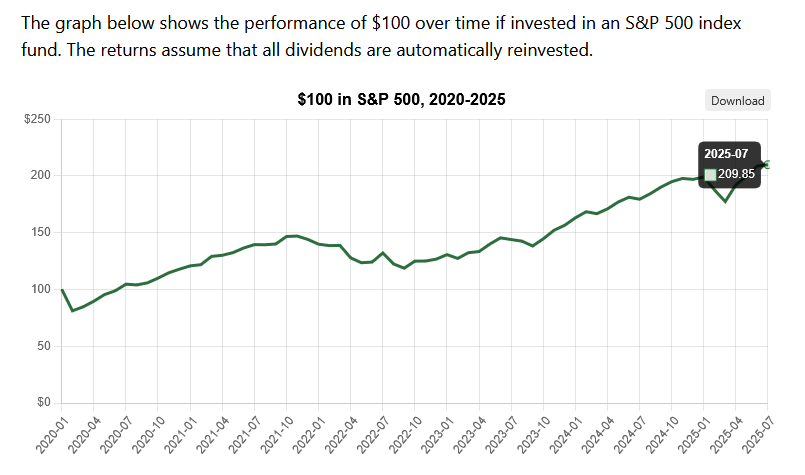

Looking at real-world returns, the numbers speak volumes. According to OfficialData.org, a $100 investment in the S&P 500 at the start of 2020 would be worth about $209.85 as of July 2025. In contrast, the same $100 in Bitcoin would now be worth $1,473.87 — a staggering 7x increase.

Why the Comparison Isn’t So Simple

While these figures might make Bitcoin look like the undisputed winner, it’s important to note that comparing Bitcoin and the S&P 500 isn’t exactly apples to apples.

The S&P 500 is a broad, diversified index tracking the 500 largest publicly traded companies in the U.S. It’s considered lower risk, regularly rebalanced, and designed to reflect the overall health of the U.S. economy. Since its inception in 1957, it has delivered a respectable 6.68% annual return after adjusting for inflation.

Warren Buffett, one of the most respected voices in finance, has famously promoted a 90/10 investment strategy — placing 90% of capital into the S&P 500 and 10% in short-term U.S. Treasury bonds — as an ideal long-term approach.

Bitcoin, on the other hand, is a volatile and relatively new digital asset that functions on an entirely different narrative. Its appeal lies in its scarcity, decentralization, and deflationary design. Bitcoin’s market cap stands at $2.47 trillion, significantly smaller than the S&P 500’s $56.7 trillion, making it more prone to volatility but also higher growth potential.

Comments are closed.